Outlook: We get the usual jobless claims today, plus Q3 GDP and the ECB rate decision.

We always assume central bankers talk to one another. What could BoC Gov Macklem have said to Mr. Powell recently? Canada went from being hyper-aggressive–the only country to do a full 1% hike–to the first to back off, with only 50 bp yesterday, despite inflation not obeying. One analyst suggests the retreat is an unspoken recognition of monetary policy operating at a well-known lag of 18-24 months. And the BoC forecast for inflation this year was pared to 6.9% from 7.2% and next year will see 4.1% from 4.6%.

The FT writes “Top officials at the US Federal Reserve have started to talk more openly about shifting to smaller rate rises, with economists forecasting a ‘downshift’ as soon as December.” Maybe that idea of only 50 in Dec is gaining more ground than we thought.

But probably not. Actual data is more important than what your neighbor is doing and this is not your neighbor’s economy. In fact, the US economy is not showing the signs of recession that the BoC detects up north. Yesterday the Atlanta Fed GDPNow for Q3 is 3.1%, higher than 2.9% last week. Granted, the main reason is a rise in government spending, but growth is growth. We get the first estimate today of the real thing, probably 2.3% (ESJ and Bloomberg), 2.4% consensus) or 2.5%, as Trading Economics forecasts. GDP had contracted in Q1 (-0.6%) and Q2 (-1.6%), so a positive number ought to set off fireworks.

We will also be getting personal income and spending tomorrow, with the PCE deflator to follow. Here we may want to consult another central bank leader, the RBA. Yesterday, Australian inflation surged in Q3 to 7.3%, throwing a monkey wrench into the expectation of only a 25 bp hike next week (Nov 1). That’s what the RBA did last time. Will the RBA respond to a single lousy number?

Unfortunately, as Q3 comes into focus, it’s still rear-view mirror and attention in now going to turn to Q4–we are already one-third into Q4–and next year. There the growth forecasts are pretty grim. The IMF sees US growth at 1.2%, while the Fed has 1.7% for the median from the range of 1.0–2.6%.

The worry here is that Q3 and Q4 are pretty good for growth but not so good for inflation, which might be falling but only a little and not enough to stay the Fed’s hand. Everyone pretty much agrees that the 2.3% forecast for PCE inflation in 2024 is overly optimistic.

In any case, say Q4 and Q1 growth are a real bummer, even a contraction, while inflation stays stubbornly high. Two outcomes: the Fed would look wrong if it did only 50 bp in Dec and would appear to have switched priorities from inflation to recession. This would not go over well. The other implication is that still-rising inflation is not controllable by the Fed–as suggested yesterday in the Rogoff essay from Foreign Affairs--resulting in the inflation mentality embedding itself more firmly into the public mind, loss of confidence in the Fed, and another hideous drop in the stock market.

About the forecast: we have been seeing an unusually powerful counter-trend corrective move that was starting to get a little scary and threatened our buy-dollar signals. But powerful or not, corrections tend to last only 3-5 days at first, then retreat, then resume for another week or even two. It seems like we are getting the first pullback from the pushback, if you can follow that. But a rising dollar today doesn’t mean the correction is over. We continue to advise much smaller positions.

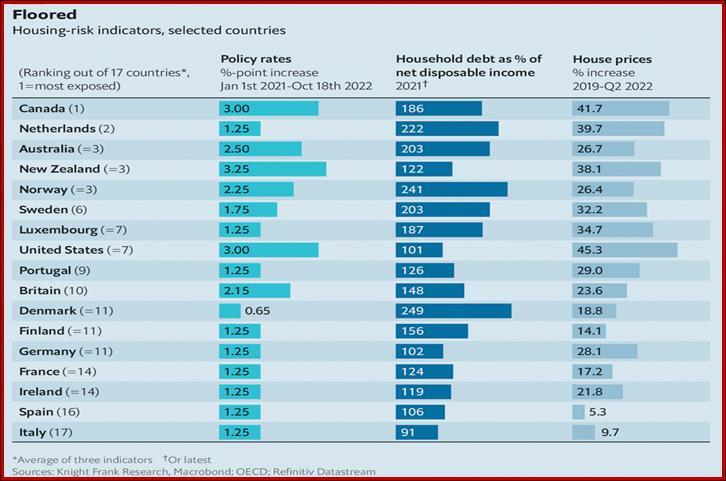

Global Housing Woes: We complain about US house prices, but others have it worse–see the chart from The Economist.

Mortgage debt as a percentage of household income, only a little out of date, is worse in the Netherlands, Denmark and Norway. The story notes that Oxford Economics reports prices are falling in nine of the 18 countries it follows, and are falling the fastest in the most overheated markets. A critical pain factor is the high percentage of floating rate mortgages in many countries (e.g., Australia) but not in the US, where most folks take 30-year fixed. If the housing cycle leads the business cycle–and a housing downturn precedes 8 of 10 recessions–we won’t be able to put off recession very much longer. But remember that in the US, experts predict house prices will fall by only about 3.5% because of the housing shortage.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD ticks lower after Australian CPI print; holds above 0.6200

AUD/USD turns lower following the release of Australian consumer inflation figures, which does little to temper expectations for multiple RBA rate cuts this year. This, along with US-China trade war fears, acts as a headwind for the Aussie amid a bullish USD, bolstered by the Fed's hawkish shift and the recent surge in the US bond yields.

USD/JPY stands firm near multi-month top; FOMC minutes awaited

USD/JPY holds steady above the 158.00 mark on Wednesday and remains close to a near six-month peak touched the previous day amid wavering BoJ rate hike expectations. Furthermore, the Fed's hawkish shift, the recent surge in the US bond yields and a bullish USD support the currency pair, though Trump trade uncertainty cap gains.

Gold consolidates amid mixed cues; looks to FOMC minutes for fresh impetus

Gold price stabilizes after the overnight pullback from the $2,665 barrier as concerns about Trump's tariff plans and geopolitical risks continue to support the safe-haven bullion. That said, diminishing odds for further Fed rate cuts, a further rise in the US Treasury bond yields and the underlying USD bullish tone act as a headwind for the XAU/USD.

Crypto market surged to $3.9 trillion record market cap as Solana's revenue plunged in December: Binance

In a report on Monday, Binance Research stated that the crypto market reached a market capitalization milestone of $3.9 trillion in December. The researchers suggest anticipation surrounding Donald Trump's upcoming pro-crypto administration could stretch the bullish momentum in the coming weeks.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.