The sentiment today calls for more of the same Dollar selling

Outlook: We get a surfeit of new data today, including retail sales, industrial production, import/export prices, the April University of Michigan consumer sentiment, and inventories. Probably the single most important item will be retail sales, since the consumer runs the show. In March, sales surprised a bit to the downside, down 0.4%, although ex-autos, sales were down 0.1% and ex-gas and autos, sales were flat. Trading Economics reminds us that “On the other hand, the so-called core retail sales which exclude automobiles, gasoline, building materials and food services and relate more with the consumer spending component of GDP, increased 0.5%. Retail sales aren’t adjusted for inflation.”

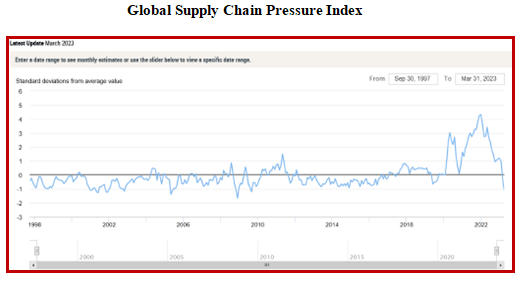

We have gone from dire recession to soft landing in just a few days. See the NY Fed “Global Supply Chain Pressure Index (GSCPI).” Getting some credit, in addition to supply chain detangling, is the drop in commodity prices. The CRB index has risen in the past six weeks, but that’s a good thing, due to China re-opening and central banks nearing the end of the hiking surge. Oil is up on supply concerns, but Trading Economics reports “Agriculture commodities moved away from their February records as concerns about supply shortages eased. In the industrial sector, copper, considered a barometer for the world's economy, was trading around $4.1/Lbs, up more than 30% from a multi-year bottom of $3.1 in July 2022.”

A key outcome is the US-Germany two -year bond yield premium at the lowest since late 2021, hence the dollar weakness. The Reuters chart is pretty good. We are now in a weird state of affairs where the probability of the May 3 rate hike is about 70% but then Fed funds futures traders expect the rate by year-end at 4.33%.

Analysts are naming Singapore’s pause in the hiking cycle as evidence of a trend, without having named Singapore for years. The better candidates are Canada and Australia. Then we see the market is waiting for Sweden on April 26. Granted, the Riksbank is a better model. Some are naming Mexico, whose next policy meeting in May 18 (after the Fed). The point is that once a narrative starts gaining traction, everyone jumps on the bandwagon. It’s wise to see a bandwagon for what it is and not fall prey to it.

Forecast: We have a “die is cast” moment that says the inflation crisis is nearing an end and central banks can start to think about a pause and then rate cuts. “Higher for longer” is off the table, if we believe this narrative. We suspect prices will be stickier than expected and inflation can easily be more variable, with a jump or two itself, so it’s not written in stone the Fed (or BoA and ECB) have bought the story just yet. This is especially the case in the UK and Europe where inflation is falling but still running at 7-9% and central banks are still talking about staying the course (and maybe 50 bp next time for the ECB).

All the same, the sentiment today calls for more of the same dollar selling. We might want to worry about some squaring up on a Friday.

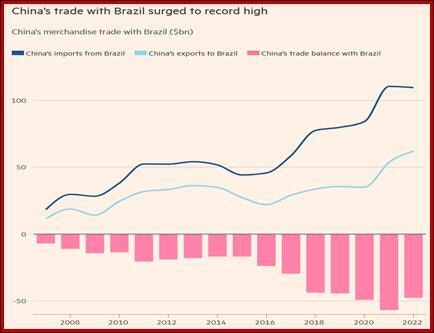

Tidbit: Brazilian Pres Lula tried to curry some favor with China by asking who decided that the dollar was the reserve currency after the gold standard. Oh, dear. According to the FT, on his state visit to China, he said “Every night I ask myself why all countries have to base their trade on the dollar. Why can’t we do trade based on our own currencies? Who was it that decided that the dollar was the currency after the disappearance of the gold standard?”

This is nice for China’s efforts to get the yuan at the front of the line, and it’s certainly true that Brazil, rich in natural resources, is an ideal trade partner for China. See the chart. But the answer to Lula’s question is really very easy. When countries have a fixed or government-set exchange rate, merchants fear a politically driven rate, and China got a dirty float only in 2005. Or, when countries like Brazil have wild corruption and even wilder inflation, their currencies reflect that. As noted earlier this week, the dollar is the top trade numeraire for the very good and sufficient reason that merchants prefer it as the least untrustworthy and most liquid of them all.

It's amazing that Lula doesn’t know that, and also that the FT doesn’t even try to refute his remarks that only make him look ignorant and foolish.

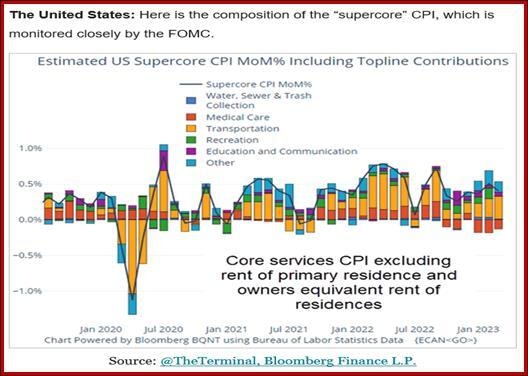

Inflation Tidbit: See the chart from Bloomberg showing “supercore” inflation—core excluding shelter, which has only just begun to fall and only in some places. We hate this kind of chart. As we showed earlier this week, shelter is continuing to rise (8.0% y/y as of March) and is not a good measure anyway, although the BLS discloses everything and it looks pretty fancy.

But one component is what homeowners guess their house would rent for if they were to rent it. Is that a credible number? Other data is real, like actual rents and sales, but some of it is guesses. We can’t blame the BLS—it’s a big country and we really don’t have Uncle Sam looking over our shoulders all the time.

Anyway, as also noted earlier this week, on this measure—less than 1%--the Fed could be cutting rates at any moment, which is certainly not what they are talking about. And it would be out of character for the Fed to use core ex-shelter as the decisive number on which to hang its hat without alerting us beforehand.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat