The new week brings three central bank decisions

Outlook

The new week brings three central bank decisions, starting with the Fed on Wednesday (plus a new dot-plot), the BoE on Thursday and the BoJ on Friday. Before then, tomorrow we get US retail sales and CPI from Canada and the UK. Today in the US, it’s the Empire State, not a mover.

The BoE is expected to hold back, as is the BoJ, but the BoJ has some fresh reason to feel aggrieved—the dollar/yen fell back under 140 for the first time since July 2023. Various officials have been muttering about another small hike and we would not be surprised if they do it—maybe not at the official meeting but a few days later, inter-meeting, as a form of FX intervention on the grounds that too strong is as bad as too weak when it goes too fast (unstable).

The 50 bp saga resumes. By 10 am on Friday, according to Bloomberg, the FT/WSJ stories the day before on 50 bp had gotten a grip. “The likelihood of a 50-basis-point move climbed to 40% on Friday, up from as low as 4% earlier in the week. The repricing added to a rally in US government bonds, lifted small-cap US companies the most in three weeks and weighed on the US dollar.”

As of this morning around 7:45 am ET, the probability of a 50 bp cut had moved up to 63% (from 30% only a week ago), according to the CME FedWatch tool. Some reports have 80% and we don’t doubt it—the numbers change frequently and sometimes by a lot.

We saw in a few reports that it was Fed chief Powell himself who “planted” the story last week in the WSJ/FT that 50 bp is a real possibility.

We admit to not understanding betting, but it looks like the gain to be had from the 50 bp version, while under 50% probability, is so much better than the expected gain from the higher-probability option of 25 bp that it’s worth the loss if wrong. That’s what poker players like Annie Duke (Thinking in Bets) and Nate Silver might say. Bettors have a different mindset than economists.

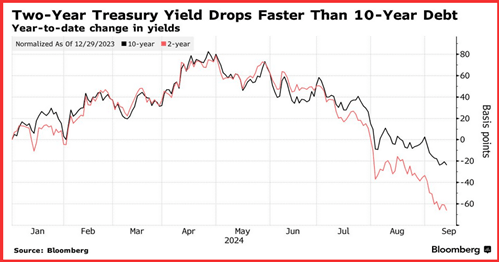

Despite the pushme/pullyou in this debate over the past month, something else has emerged and it’s less choppy—the drop in the 2-year yield is faster than in the 10-year. See the Bloomberg chart. Be careful to read the title and sub-title—this is not a straightforward yield comparison, but comparing the change year-to-date. We hardly ever see yields in this format and it sure is interesting. It means the Fed is getting one of its top wishes—de-inverting the yield curve.

Forecast

There is a case for the 50 bp thesis and the majority of daily FX charts show this is what traders are counting on.

We don’t buy it for all the reasons already given—a classic case of technical and fundamentals saying opposing things. Charts are not always correct, but generally win over “discretionary” views.

It’s very rare to have this much uncertainty over a central bank decision—but having said that, the last few years have seen rare and even unprecedented developments. As a Bloomberg editorial points out, history tells us it takes a crisis for the Fed to do 50 bp but history can mislead. The Fed is “safe” doing it this time because there is no crisis—the economy is fine, the stock market is fine.

We admit 50 bp is not out of the question. A 50 bp cut “should” tank the dollar, assuming the big players are not already positioned short. Weirdly, we could get relief rally once the news comes out.

The dollar can tank anyway if the cut is just 25 bp but the new dot-plot is wildly dovish. This is all too possible. The old days of fear of inflation resuming seem to be over, despite the fear of inflation resuming not nuts. And if not resuming, taking far longer to get to 2% than now imagined by drawing straight lines on a chart… that is, Lag. The drop in oil prices is helping tremendously there.

Bottom line—get out of Dodge.

Tidbit: China failed to get young women to have more babies, so now it has raised the retirement age. It’s the first hike since 1978. For men, the retirement age is 63 from 60. Women get 55 instead of 50 for ordinary workers, and 58 instead of 55 for managers. It will taker 15 years to implement. Golly, I’d go for 55. In the US, it’s 66 for both men and women (or 67 for the next gen).

Political tidbit: Fox persists in pretending Trump did well, against all the evidence. Repeated in the mainstream press are negative comments by former chief of staff Tillerson—he’s a “fucking moron.” General Kelly says he’s an idiot and unhinged. His chief economist called him “an idiot surrounded by clowns.”

For what it’s worth, the latest Silver bulleting has Harris with 48.6% and Trump, 46.4%.

Trump is not, of course, going to debate again. And again, debate outcomes are not voting outcomes and Clinton clearly won the first debate against Trump but failed at the voting booth, undone (apparently) by “deplorables.” Maybe Trump will get undone by “immigrants eating cats.” All the respectable news outlets refute the story but Trump and Vance refuse to give it up. Excellent political analyst and comedian Bill Maher says the cat-eating thing will be Trump’s Waterloo.

The latest assassination attempt was pathetic. Anyone with half a brain could have done the deed under the circumstances. It looks like assassins are not very bright or competent.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat