We get the flash PMI today. The US PMI is important but not determinative, at least not to yields.

The missed eurozone PMI forecasts reinforce the idea of another ECB rate cut in December. It’s fascinating that FinMin Reeves in the UK suggested that borrowing could go up to finance infrastructure and the market believed her—and Gilts rose 6 points. The gain has been pared to 3 points but remains. The idea implies a slower BoE rate cut menu, too. Reuters reports “That pushed the premium investors demand to hold British 10-year debt over German to as high as 198 basis points on Thursday, just below a 14-month high of 201 bps touched earlier this month.”

About the yen: The dollar/yen reversed course to the downside, from the high yesterday at 153.18 to the low so far today at 151.77. This is why we have a Rule 4. The push came from having been overbought but also helped along by comments from the finance minister, who said the ministry officials "are watching exchange-rate moves with heightened vigilance.” This got hardly any press, meaning that as intervention threats go, it's a whisper, but traders certainly heard it.

BOJ Gov Ueda said overnight it was "still taking time" to achieve the 2% inflation target and rate hikes will get done "cautiously and gradually." As usual with central bankers, he also warned about the cost of moving too slowly, meaning (probably) an even weaker yen. The election is this weekend and the next BoJ meeting is Oct 31.

The Mizuho chief strategist told Reuters "The Ishiba administration would need to stop USD/JPY going higher with speed, but I don't think either MOF (Ministry of Finance) or the cabinet would want to actually intervene." He sees a test of 160 in short order.

Forecast

We are seeing a pullback in the dollar, especially against the yen and less so against the pound. This is (so far) a very minor move, although landslides can start with only a rock or two. We do not expect a landslide, even if the dollar is overbought, because we see no respite in firm yields until after the election. Keep the faith.

Tidbit: The FT’s front page has this story that illustrates the economic ignorance of the American voter: “The final monthly poll for the FT and the University of Michigan Ross School of Business found 44 per cent of registered voters said they trusted Trump more to handle the economy versus 43 per cent for Harris.

“The findings, which come less than two weeks before the election, mark the first time Trump has led Harris on the issue in the FT-Michigan Ross poll.

“The poll also found Trump with a wider lead among voters on the question of which candidate would leave them better off financially. Forty-five per cent picked the Republican former president — a five-point improvement from the previous month — compared with 37 per cent for Harris, the Democratic vice-president.”

A publication named Project Syndicate has some terrific and well-thought out and well-written opinion pieces, if usually quite wordy. They always have stunning headlines to catch your eye. This time it’s “The BRICS Still Don’t Matter.” Here is the subhead: “The annual BRICS summit is an ideal occasion for political leaders like Vladimir Putin to promote a vision of a world that the United States does not lead. But each year also brings further confirmation that the grouping serves no real purpose beyond generating symbolic gestures and lofty rhetoric.”

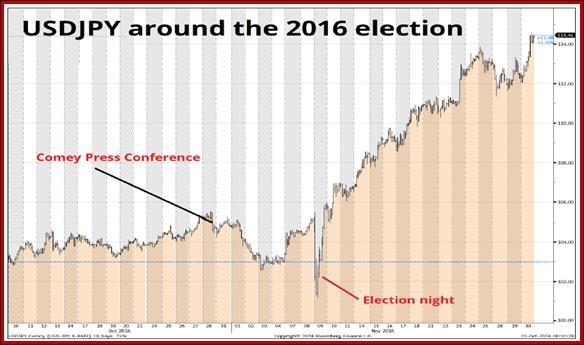

US Political: Brent Donnelly, author of The Art of Currency Trading, reprised the saga of the dollar when Trump won the 2016 election (https://www.spectramarkets.com/amfx/a-fun-story-from-2016/).

There’s a lesson here. Clinton was the leader in all the polls, despite the Comey setback. The dollar was on the rise. Then in the wee hours it became clear that Trump was winning the electoral count, state by state. The dollar crashed.

But then the next day, the dollar rallied on the new high-risk environment. This is what we call the often perverse reaction of the FX market to events that “should” take it other way. Rising risk, rising dollar, even if the rising risk is due to something in the US. See Donnelly’s chart. It’s a good bet the same thing happens again.

What happens if Harris wins? Considering the Harris plan has a lesser increase in the deficit, bond yields should dip—taking the dollar with them. This is a relief rally of sorts.

US Political 2: Pundit Carville has an op-ed in the NYT about why Harris will win, polls notwithstanding. First, Trump and the Republican Party are losers. They lost in 2018, 2020, and 2022. Second, Harris has tons more money, and money matters in US politics—it pays for TV ads, for one thing.

Third, plain old-fashioned hope that we don’t make the same mistake twice. Most people are good-hearted and reasonable, according to Carville. They see that Trump is malignant. They prefer hope and forward-looking over grievances and looking backward.

US Political 3: A site named Electoral Count has Harris ahead in the Electoral College by 271 vs. Trump with 246. Counting the swing states, Harris has MI, PA, WI, MN, and Nevada for 60 electoral votes. Trump has NC, GA and AZ for 43. It takes 270 to win, so Harris is ahead by one point. Note we are not so sure about Georgia for Trump, considering what happened in 2020. This might be worth watching over the next two weeks.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD regains traction and bounces off daily lows

After bottoming out near 1.0450, EUR/USD managed to regain some balance and revisit the 1.0470 zone on the back of alternating risk appetite trends in the FX world and amid investors' assessment of the German elections.

GBP/USD hovers around 1.2630 amid a vacillating Dollar

GBP/USD alternates gains with losses in the low-1.2600s in response to the lack of a clear direction in the global markets and a lacklustre price action surrounding the Greenback.

Gold extends consolidative phase near record highs

Prices of Gold glimmered higher on Monday, hitting an all-time high around $2,955 per ounce troy on the back of the US Dollar's inconclusive price action as investors are warming up for a key inflation report due toward the end of the week.

Bitcoin Price Forecast: BTC standoff continues

Bitcoin has been consolidating between $94,000 and $100,000 since early February. Amid this consolidation, investor sentiment remains indecisive, with US spot ETFs recording a $540 million net outflow last week, signaling institutional demand weakness.

Money market outlook 2025: Trends and dynamics in the Eurozone, US, and UK

We delve into the world of money market funds. Distinct dynamics are at play in the US, eurozone, and UK. In the US, repo rates are more attractive, and bills are expected to appreciate. It's also worth noting that the Fed might cut rates more than anticipated, similar to the UK. In the eurozone, unsecured rates remain elevated.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.