Outlook

Thoughtful essays abound about the drivers of the US yield advantage and how increasingly off-kilter are expectations of another 50 bp in rate cuts by the Fed. And while single-factor explanations can be wildly off, it’s likely that right now, it’s the election.

The Mexican peso is suffering from the idea of Trump tariffs. Europeans are scrambling to shore up NATO and tighten controls. The world is fearful of wildly higher US deficits if Trump wins. The FT and other others have long lists of causes and effects by varying players, but it all boils down to… the election.

If Trump wins, which we say is not going to happen, the Fed will hold off rate cuts, perhaps all of them, this year. Next year it could be re-constituted with Trump lackeys, and the Feds know it. The yield curve will invert again and this time the prospect of recession in 2025 has a 50%+ probability. And so on. No wonder the bond gang has nerves on fire. See the chart from the FT.

This is not to say other factors are not out there. Some thought the prospect of Gaza ceasefire talks was real, hence the short-lived dip in gold. Another big factor is the resilience of the US economy. We get another GDPNow from the Atlanta Fed today, last shown at a whopping 3.4% for Q3. Nobody else comes close. As noted before, this could stay the Fed’s hand, too.

We have a little over a week to go to the election on Nov 5. It will take 3-5 days for a decision, maybe longer. Trump is a sore loser so everyone expects court cases and other shenanigans. This time election officials have prepared long and hard to resist charges of fraud and incompetence, so maybe it won’t be a worst-case scenario—but Trump wants to say out of jail. If the electoral count is close, expect fireworks. It’s likely that over the next two weeks, the perception of risk rises to nearly unbearable levels, and that means higher yields and higher dollar. If and when Harris wins, the dollar can tank.

About the Yen: Japanese FinMin Kato and TreasSec Yellen met on the sidelines of IMF/G7 yesterday. The Vice Minister for International Affairs Mimura told the press "The two sides discussed exchange-rate moves, and confirmed the need for the United States and Japan to communicate closely." This could mean anything from winks and nods to a Deal.

He said "It's desirable for exchange rates to move in a way that reflects fundamentals. We will be increasingly vigilant to currency moves, including those driven by speculation." We don’t want to read too much into it, but it could be a warning to carry-traders—if not until after the election this weekend and the BoJ on Oct 31.

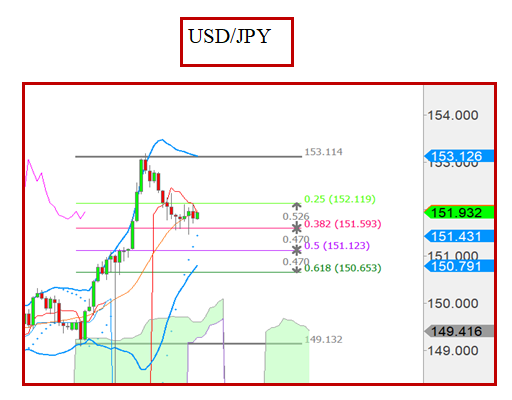

The drop in the USD/JPY that started on Wednesday (high 153.181) has gone a little over 38% down to a low of 151.45 overnight on the 240-minute chart. The Fib levels are set from the low on 10/20 at 149.08. The 50% retracement lies at 151.12. The last correction hit about the 50% number. That’s not guarantee it will do it again.

Forecast

We expect yields to stay steady and a little higher until after the election, taking the dollar with them. The seeming corrective tone yesterday and today is a blip and arises from the reaction to a seriously over-stretched move now some 20 days old.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0750, descending channel pattern

EUR/USD inches lower for the second successive day, trading around 1.0780 during the early Monday. A review of the daily chart shows that the pair tests the upper boundary to return to the descending channel pattern. which could reinforce a bearish bias for the pair.

GBP/USD: The bearish outlook remains in play below 1.2950

The GBP/USD pair extends the decline to around 1.2945 during the early European session on Monday. A bullish US Dollar on the back of bets for a less aggressive easing by the Federal Reserve drags the pair lower.

Gold buyers turn cautious, as a Big week kicks in

Gold price has lost its two-day recovery momentum, trading below $2,750 amid a quiet start to a big week on Monday. Gold buyers did find acceptance above the $2,740 static resistance on Friday but the further upside appears elusive on resurgent US Dollar demand.

Cardano Price Forecast: On-chain metrics and technical outlook signal bearish trend

Cardano is trading slightly down around $0.33 on Monday, struggling against resistance from its previously broken ascending trendline. Declining daily trading volume reinforces a bearish outlook, indicating reduced trader interest and liquidity in the ADA chain.

US elections: The race to the White House tightens

Trump closes in on Harris’s lead in the polls. Neck and neck race spurs market jitters. Outcome still hinges on battleground states.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.