The market is twitchy as risk sentiment ebbs and flows

Outlook: The market is twitchy as risk sentiment ebbs and flows—and a bit more frequently than usual. For a while we had the embrace of risk and a falling dollar, then a reversal as unhappy events developed or uncertainty went up—US yields, oil prices, the new BoJ governor.

Underlying it all is a grudging and belated acceptance of “higher for longer” by both equity and bond markets. Also, Bloomberg reports gloomsters have turned attention from the no longer inevitable recession to the underlying fiscal problem of the herd of retirees arriving pretty much everywhere and threatening central banks’ ability to cut rates.

Reuters writes “Both 10 and 30-year yields hit their highest levels in over a month early on Friday. As Federal Reserve officials continue to talk tough about keeping rates higher for longer, futures now price year-end policy rates at 4.86% - almost a quarter point above current levels and their highest level of the year so far.” At a guess, this is a classic overreaction and will fall back, bringing the dollar with it.

The news today is the University of Michigan consumer sentiment for Jan, plus two Fed govs speaking. Consumer sentiment can be a real market-mover, although we say it’s vastly overrated and almost always wrong. Last time the Jan reading was a revised 64.9 in Jan, the highest since April. The consensus forecast is for 65, or a tiny gain. But consider the inflation expectations last time. For the year, expectations fell from 4% to 3.9% and the 5-year fell from 3% to 2.9%. If economists and experienced market watchers can’t forecast inflation, why should we pay attention to the mostly know-nothing public? This adds unwarranted weight to the idea of self-fulfilling prophecies.

It's possible that “higher for longer” is finally entering the previously thick skulls of the majority of market players. If so, yields need to rise and equities need to re-calibrate. Underlying the Fed’s stance is the idea that inflation will be persistent and take longer to fix, well into 2024, with the possibility of inflation falling but then surging again as lagged factors come out of the shrubbery. Mexico is one example of inflation falling but then coming back, hence the deliberate shock of the 50 bp hike.

The important point is that while “higher for longer” might be in the process of being accepted, the inflation outlook is deeply, darkly muddy. It’s important that actuals are likely to deviate substantially from the current thinking of a “normal” looking downmove in inflation. As we know to our dismay, actual vs. expected can generates fireworks. It’s why Citibank devised the surprise index. For example, we now have layoffs all over the place in the tech sector, with Yahoo! Finance the latest to shed jobs. Most analysts expect those workers to find new jobs more or less immediately, but the numbers are starting to get scary—over 100,000 and still counting. What if they don’t find jobs? The fallout could be stunning and affect everything from low-paid service sector wages to home prices, all feeding the inflation numbers. This is why the upcoming PCE inflation data is all but worthless.

We expect US inflation to be persistent and the data to be inconsistent going forward, and that’s without any shocks from oil or other big factors. Fed chief Powell hints at this in his references to watching data. Weird inflation data feeding uncertainty about Fed conduct adds to risk and “should” provide support to the dollar. But we shall see. We can’t call a reversal just yet—we need confirmation.

Tidbit: Reuters has a story on how China reacts to the idea that Texas and Florida, with perhaps some other states, are thinking about legislating bans on Chinese citizens buying real estate. This is a violation of the principles of a market economy and international trade rules! How ironic (and hypocritical) that China objects to a state controlling property rights of citizens… Funnier, the spokesman is named Mao.

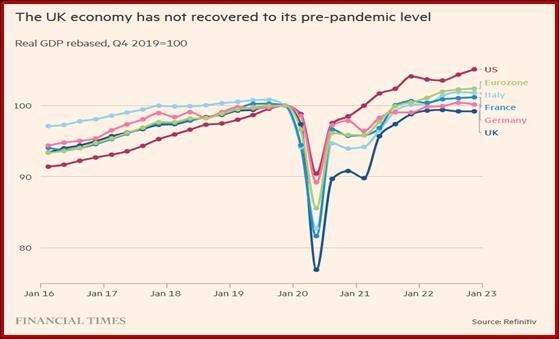

Tidbit 2: In the FT story about UK Q4 GDP, one point is that the UK alone among the majors has failed to restore growth to pre-pandemic levels. The US has done the most, followed by the eurozone, led by Italy. Germany is just making it. We seldom see such a clear picture of the underlying robustness of economies.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat

-638116348354896356.jpg&w=1536&q=95)