The market believes the central banks can get away with rate hikes without triggering a recession

Outlook: The world is inundated with too much news in too short a time. This is the worst kind of information overload—a burst of grim geopolitical news plus a pandemic surge plus economic catastrophe plus central banks doing the opposite of what the catastrophe calls for. In addition, there are charges of war crimes. Usually that takes years, even decades, to get to court and by then the global public has stopped paying attention. Not this time, not with a stunning and unprecedented outpouring of solidarity for Ukraine.

It's interesting that commodity prices are continuing to fall, especially oil. Normally we expect a recession to follow a giant oil jump, as we had in 1973. When recession is expected, bond yields fall, but this time, bond yields are on the rise and not just in the US—see the Bund. This implies the market believes the central banks can thread the eye of the needle and get away with rate hikes without triggering a recession, even if the hikes are nowhere near what they should be to constitute a genuine anti-inflationary statement.

This is the argument Paul Krugman makes the in NYT today, and the argument has a lot going for it. Krugman notes that the 2010-11 oil price shock did not derail the recovery at all, unlike 1973, and the difference was then Fed chairman Bernanke’s academic work on inflation—do not hike rates, despite calls for drastic ones.

“What does that experience tell us about the current situation? If U.S. inflation were low, the right policy would be obvious: don’t raise interest rates. Unfortunately, we’ve come into the Putin shock with uncomfortably high inflation. And while I’m usually a dove on such matters, I do believe that the Fed should be taking its foot off the gas pedal. That is, it should be gradually raising interest rates to cool off an economy that looks somewhat overheated. What the Fed should not do, however, is allow itself to be bullied into slamming on the brakes, drastically raising interest rates the way it did in the 1970s.”

Besides, near-term inflation expectations are high but longer term, they are not. The inflationary shock from oil prices can easily be a one-off affair. The Fed can hike tomorrow but say out load that’s it for the foreseeable future, for example.

Somewhat weirdly, the financial world is starting to accept that the oil crisis is going to add about 2% to inflation, or 10% in the US, while subtracting 1.5-2% from GDP globally. How much of that hits the US economy might depend to some extent on how well or badly the government and businesses handle the inflation and supply side issues. For example, some states and even the feds are contemplating cutting or dropping the gas tax to help out the consumer.

The kicker is Covid in China, which on past experience can shut down whole cities and all their goods production—without the US and the rest of the world even remotely prepared to offer substitutes for Chinese goods. If so, add what? Another 2% to inflation. This is surely one of the scenarios the Fed is considering and is why it doesn’t dare be too weak in tomorrow’s statement (and forecasts), while not scaring anyone too much.

This is all pretty tricky and doesn’t help at all if the FX market gets a bee in its bonnet and the crowd goes mad for euros (or something). Pare some more.

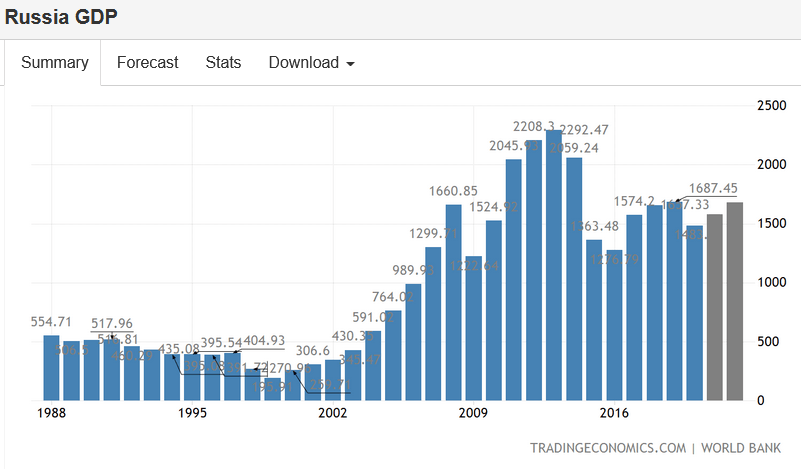

Russian Default: While doom and destruction are everywhere, we are not seeing enough expert opinion on how the world is going to react when Russia defaults again. The last time, in 1998, default was imposed in part from outside in the form of the Asian financial crisis. But Russia itself contributed, too—a vastly expensive war in Chechnya a few years earlier that Russia was still paying for, plus a collapse in the price in oil and a coal miners’ strike that closed down the Trans-Siberian Railway. Inflation reached 84% at the height of the crisis. We have no idea how to factor in Pres Yeltsin restructuring the government in March 1998 but we do know the central bank raised the key interest rate to about 21%. The ruble crashed. The IMF stepped in. The US and others were advising Russia directly. By year-end 1998, Russian GDP was down nearly 5% y/y.

Here’s a juicy bit from Wikipedia: “The inability of the Russian government to implement a coherent set of economic reforms led to a severe erosion in investor confidence and a chain reaction that can be likened to a run on the Central Bank. Investors fled the market by selling rubles and Russian assets (such as securities), which also put downward pressure on the ruble. This forced the Central Bank to spend its foreign reserves to defend Russia's currency, which in turn further eroded investor confidence and undermined the ruble. It is estimated that between 1 October 1997 and 17 August 1998, the Central Bank expended approximately $27 billion of its U.S. dollar reserves to maintain the floating peg.

It was later revealed that about $5 billion of the international loans provided by the World Bank and International Monetary Fund were stolen upon the funds' arrival in Russia on the eve of the meltdown.”

The biggest outcome for international markets was the failure of Long-Term Capital in the US, offset by backdoor arm-twisting by the Fed to prevent market instability, and what came to be known as “contagion.” The whole thing started with Thailand and by the end, had spread to every emerging market. We don’t see the whole EM world upset this time, but you never know. It might be of interest that Putin joined the federal government that year and his initial title was First Deputy Chief of Presidential Staff for regions. He knows something about economic turmoil and disorderly markets. He must also know that it took Russia six years to recover.

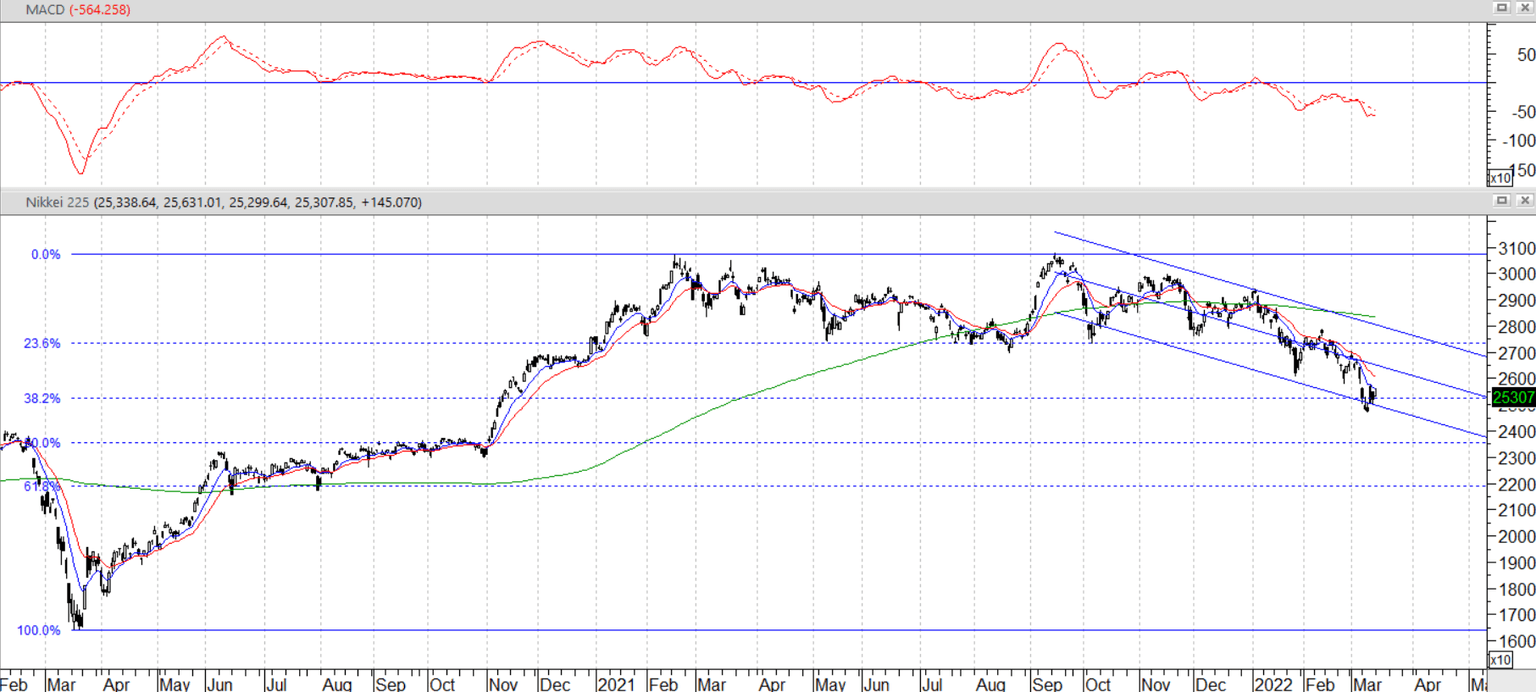

The Yen Mystery: A number of analysts note the yen is no longer a safe haven—it’s not going up on safe-haven flows headed home, missing in action this time. One idea is that the Japanese economy has been steady and stable, and still without enough inflation to write home about. Because returns are tiny at home, Japanese investment managers are happy to hang on to better-yielding assets abroad. If and when the US and European economies look like hitting real trouble—recession, stagflation—Japan is going to look even better. At least one Big Bank analyst (SocGen) proposes a giant rise in the yen—to 100 or so—if this scenario materializes. Bloomberg has a P/E for the Nikkei at 14.48 while the S&P is still elevated at 23.68 (if better than 44.63 a year ago).

We have been wrong about the Nikkei numerous times before so take the idea with a spoonful of salt. It’s currently below the 200-day moving average and near the first Fibonacci retracement level, having formed a double top and surpassed the neckline. We could be in for an upside corrective bounce, judging from the current price near the channel bottom.

Tidbit: Our Latin teacher, Mrs. Jewel, insisted the Ides of March was really on March 13, not March 15. That’s because in Shakespeare’s day, or maybe Julius Caesar’s, the ides fell on March 13. Ides refers to first full moon of the month. The Farmers’ Almanac says “The next full Moon will occur on Friday, March 18, 2022, at 3:18 AM ET, and is known as the Worm Moon.” Take that, Mrs. Jewell.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat