Outlook: Ahead of no fewer than five central bank decisions this week, today we get US CPI, likely to show a nice little drop because of the falling price of oil, to 3.1%. Core CPI is forecasted by just about everybody to rise by 0.3% or 4% y/y, but it is now becoming customary to ditch the y/y concept and go for a q/q version or the 6-month annualized, which for core is 2.8%.

As noted before, CPI is not the version the Fed uses and in any case, it’s stuck with the presentation of the data the way the public gets it, and that’s mostly year/year. The NY Fed’s inflation expectation is cooperating—3.4% for the one-year outlook, the lowest in over two years. Later today we get the Cleveland Fed’s adjusted version.

The financial markets are keenly of the opinion that the data can be shown to be disinflationary and that should allow the Fed to keep the pause tomorrow and perhaps adopt a vaguely dovish tone or at least stop saying rates can still go up if data says so.

The FX market is eerily quiet and that’s not a good thing. It means the Bollinger bands are narrowing dramatically and this squeeze tends to lead to a breakout, even if a short-lived one. One conceivable reason for a more lasting breakout might be that yields are okay where they are and the CPI and Fed decision tomorrow won’t change that very much. In other words, the happy CPI and open-to-cuts Fed is already priced in.

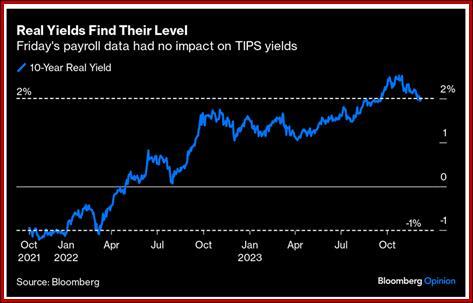

Look at the real rate of return another way—inflation adjusted T-notes, or TIPS. As the excellent Authers (Bloomberg) wrote yesterday, at about 2% (and not moving an inch on the payrolls story Friday), the real return is about right. That implies the yield curve can remain inverted, de-invert, or get more inverted, depending on which data point tickles the fancy. We tend not to like TIPS because participation is really very small (mostly because you need a PhD and the patience of Job to navigate the Treasury website to get your hands on some). But it’s a bellwether, too. This means the Fed can still be careful and cautious.

The last Fed meeting of the year is being viewed in a lop-sided manner—all good, no drawbacks. But this is never true in evaluating an economy and you can bet on two things—the central banks are phoning one another (perhaps even collaborating on vocabulary) and mindful of some of the awkward questions they will have to face.

First up is which inflation numbers? Not only CPI vs. PCE and m/m, q/q, annualized, and so on, but also should the central banks flag specific items that are badly designed or out of sync? In the US, that’s shelter and some other services, and see below for owners equivalent rent.

Then there’s QT. Remember when some Fed or another said QT is already doing the jobs well enough? The Fed is expected to keep up the QT plan without modification but there’s a fair amount of wiggle room in there. Some experts think they can smell liquidity issues.

Third is the “reasonable pace” itself. If the Fed raised rate starting late but then rushing the fences, should it adopt a more measured pace on the wayback down? And honestly, does it have a reasonable number in mind? The dot-plots were always fairly silly. Will they be more in keeping with the financial markets analysis this time?

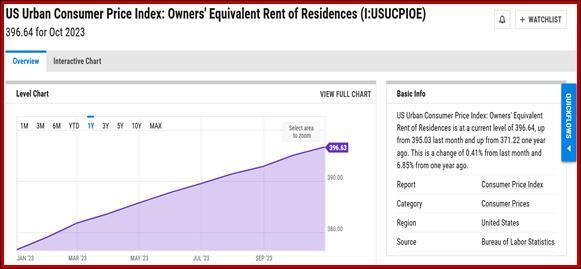

Tidbit: Some analysts are still riding the hobbyhorse of inflation actually under the Fed target if only “Owners equivalent rent” (OER) were properly measured. It makes up 30% of CPI and 40% of core and is unbearably stupid—it’s the hypothetical rent an owner estimates he could get if he rented out his house instead of living in it. It goes without saying that nobody actually pays OER and therefore it is not a true price (except maybe the price of homeowners’ imagination).

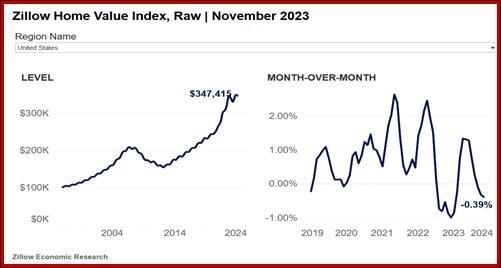

Comparisons with more realistic prices include the Case-Shiller (seriously lagged) and the Zillow Home Value Index (ZHVI)—and note that acronym does not include the word “price,” either. Zillow also has a forecast, a rent index, days-to-sale, condos and coops, and others, all by region. For November, whose CPI we await today, Zillow has a drop in the value index by 0.39%. Rents, as a stand-alone, are up a mere 3.3% y/y. Granted, critics of Zillow abound. It gets only one star of five on several review sites. But the economics team is not the same as the buy/sell/rent team, and as statisticians go, seem pretty good.

Meanwhile, the official government line is that OER was up 6.85% y/y, as shown in the Y-Charts chart.

So, the complaint is correct. Excluding owners equivalent rent or pricing it properly would deliver a more realistic picture of inflation in the US economy. If the Fed looked at things this way, the idea of a rate cut in March might not be so nuts.

Ah, but the Fed doesn’t look at things this way, nor does the public. The public sees an inflation rate of (say) 3.1%, and they do not do the arithmetic to adjust it downward. To the extent that the Fed believes inflation expectations are self-fulfilling, the Fed has to project inflation expectations on the basis of the numbers as reported, lousy or not.

This brings up the problem of who is the Fed’s audience? The Fed is supposed to be independent and deaf to politicians. It’s supposed to be deaf to big borrowers in the economy, whether manufacturers or service providers or real estate moguls. This subject has been the focus of more than one learned tome, and we can’t answer it—but we do know that the public’s inflation expectations are on the list of Fed constituents and maybe at the top of it.

A more serious question is how the Fed views the real rate of return. If it knows inflation is not as high as reports make it seem, whether headline CPI or its own core PCE, then the real rate must be higher than it looks on a simple nominal basis. Let’s say inflation really is 2%, or will be soon. Now Add to that the 1.5-2% that is the conventional real return the markets wants to demand in its heart of hearts. That brings us to 3.5-4%. Meanwhile, the 1-year note was yielding 5.17% yesterday at 10:15 am. This is an extra bonus for the investor/saver and more than it needs to be, so to speak.

Meanwhile, the 10-year was 4.262% at the same time (and is lower this morning). Should we not be expecting a de-inversion coming in the next few months? Inverted yield curves are not normal. Won’t it be a disruption and shock when this happens?

And what is the effect on the dollar when the yield curve becomes normal again? We thought it was headed that way in October, but instead it retreated. See the chart from the St. Louis Fed. Looking at the EUR/USD, the seeming end of inversion was sharply dollar-positive. This leads us to wonder if we don’t get a dollar recovery, and soon.

And yet that’s not what happened back when Fed Gov Waller let the cat out of the bag, as we put it at the time. He said (Nov 28), according to Reuters, "’I am increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%,’ he said, and also ‘reasonably confident’ of doing so without a sharp rise in the unemployment rate, now at 3.9%.

“’If the decline in inflation continues "for several more months ... three months, four months, five months ... we could start lowering the policy rate just because inflation is lower," he said. "It has nothing to do with trying to save the economy. It is consistent with every policy rule. There is no reason to say we will keep it really high.’"

Note that the next day, when the Waller remarks got widespread attention, the dollar started heading down. How to explain this divergence? Well, short-termism vs. long-termism, maybe. Some critics thought Waller was upstaging Fed chief Powell, who prefers to be less straightforward. That leaves us with two camps, equally valid in their own terms. In the long run, the US economy and the normalization of the yield curve should prevail. That’s if history repeats and doesn’t just rhyme. But beware! This is not going to happen overnight. It may take all next year and into 2025 for the curve to de-invert.

Forecast: The market has priced in far more cuts and sooner cuts than the Fed can possibly deliver tomorrow, even if it admits inflation is behaving better and any additional hike should not be expected. Analysts will parse every sentence for the absence of that “possible hike.” For what it’s worth, the S&P probably went too far, too, closing at the high of the year yesterday. Tears, or at least profit-taking, may follow. Despite an overly quiet day yesterday and so far today, it looks like the dollar is headed for a sell-off, even if it turns out to be short-lived.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains look likely in the near term

AUD/USD added to Wednesday’s gains and broke above the key 0.6200 barrier following the pronounced retracement in the US Dollar amid widespread concerns over the impact of Trump’s tariffs on the global trade.

EUR/USD: There is a minor resistance at 1.1300

EUR/USD gathered renewed steam and advanced north of 1.1200 the figure to clinch new highs, always on the back of intense tariff woes and the marked sell-off in the Greenback.

Gold flirts with record peaks near $3,175, Dollar tumbles

Gold continued its record-setting rally on fresh tariff-related headlines, surging past the $3,170 mark per troy ounce after the White House confirmed new tariffs, sparking another round of US Dollar selling.

Bitcoin miners scurry to import mining equipment following Trump's China tariffs

Bitcoin (BTC) miners are reportedly scrambling to import mining equipment into the United States (US) following rising tariff tensions in the US-China trade war, according to a Blockspace report on Wednesday.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.