The USD/JPY pair continues to escalate, currently positioned at 160.88, nearing the 37-year peak of 161.27 achieved last Friday.

Early today, the yen temporarily strengthened following Japan’s Q2 Tankan survey results, which indicated a slight improvement in industrial sentiment to 13 points from 11. However, the services sector displayed mixed results, maintaining 27 points against predictions of an increase, with future expectations slightly downgraded.

Despite these data points, the predominant driver of the yen’s weakness remains the significant interest rate differential between the Bank of Japan (BoJ) and the US Federal Reserve.

The BoJ has no immediate plans to adjust interest rates but might alter its government bond purchases, hinting at potential monetary tightening. However, market sentiment remains sceptical about such changes, contributing to the yen’s downward pressure.

USD/JPY technical analysis

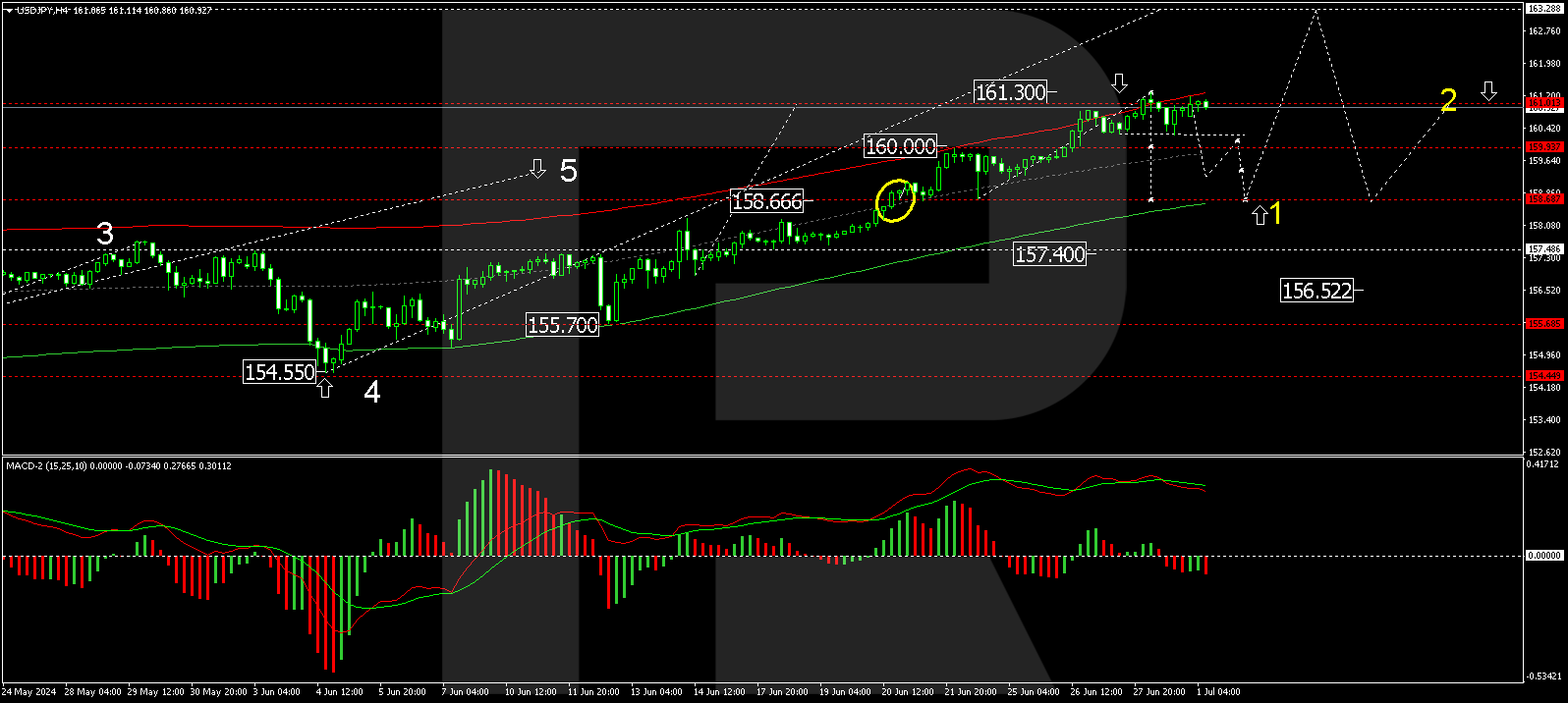

The USD/JPY is creating a consolidation range just below the 161.26 level. A brief surge to 161.33, considered a local peak within this upward trend, is possible. After this level, a corrective movement to 158.66 might initiate, potentially followed by another upward wave aiming for 163.30. This forecast is supported by the MACD indicator, with its signal line positioned above zero but pointing downwards, suggesting upcoming corrections.

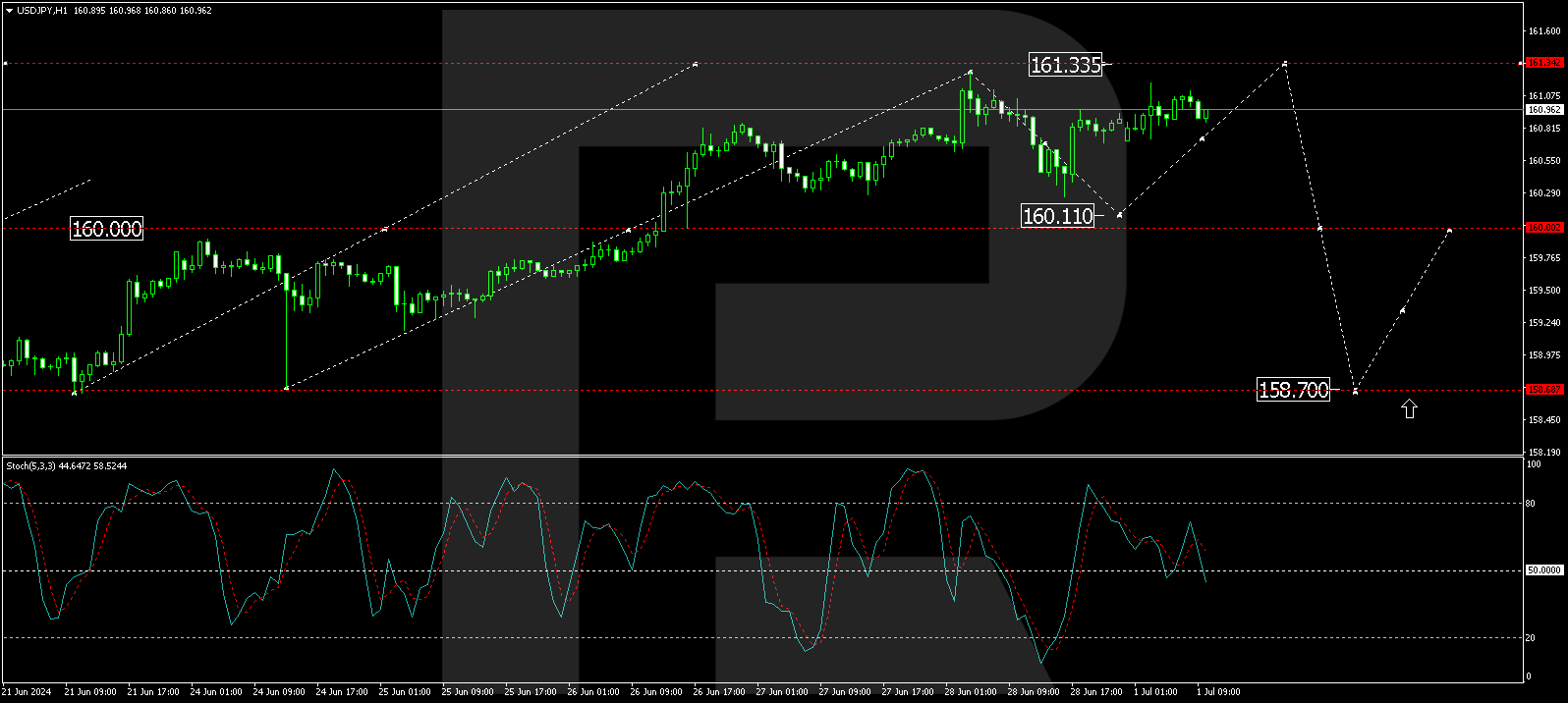

The pair completed an upward movement to 161.26, followed by a correction to 160.26. Currently, it has surged to 160.88, forming a consolidation range. Breaking above this range could lead to a rise towards 161.30. Conversely, a downward break might lead to a correction to at least 160.11 before another potential rise to 161.30. The Stochastic oscillator indicates that the signal line, currently above 50, is poised to drop to 20, reflecting potential short-term declines before further gains.

Market outlook

As investors navigate these fluctuations, the broader focus remains on global central bank policies, particularly any shifts by the BoJ or the Fed that could influence the USD/JPY trajectory. The upcoming economic releases and central bank updates will be crucial in shaping market dynamics and the yen’s valuation against the dollar.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains near 1.0750 after German inflation data

EUR/USD stays in positive territory at around 1.0750 in the second half of the day on Monday. The data from Germany showed that the annual CPI inflation declined to 2.2% in June, limiting the Euro's gains. Investors await US Manufacturing PMI data.

GBP/USD holds above 1.2650 ahead of US data

Following a bullish opening to the week, GBP/USD struggles to preserve its bullish momentum and trades in a tight range above 1.2650. The ISM Manufacturing PMI data for June will be featured in the US economic calendar on Monday.

Gold stabilizes above $2,330 as markets await US data

Gold clings to modest daily gains and fluctuates above $2,330 on the first trading day of the week. The benchmark 10-year US Treasury bond yield stays near 4.4% following last week's rally, limiting XAU/USD's upside ahead of US data.

Bitcoin is breaking above the falling wedge

Bitcoin breaking above the falling wedge pattern on Monday signals a bullish move, with Ethereum and Ripple poised to follow as they find support at key levels, paving the way for an upside rally in the days ahead.

Nine fundamentals for the week: Elections, Powell, and the build-up to Nonfarm Payrolls set the tone Premium

Will populists take over? In the UK, the answer is most likely no, but France poses risks to markets. Politics adds spice to an already busy kickoff of the second half of 2024. Here is the preview for this week’s major events.