The inflation debate is not really all that tricky

Outlook

The inflation debate is not really all that tricky. On the m/m basis, inflation slid a bit. On the y/y basis, it went up. Which one you prefer is a function of your wishes and preconceptions. Supercore, or what Trading Economics names “core core” (ex not only food and energy but also used cars and shelter) went up to 2.4% from 2.3%. The Fed is, however, aware that shelter has a very long lag.

See the Bloomberg breakdown. Columnist Authers says the inflation report was the essence of boring. “US inflation has not completed its journey to the Federal Reserve’s target, but it is dull again, and that suggests that much of the Fed’s work is done.

“For the first time in a few years, Thursday’s announcement of September inflation made no discernible impact on markets. The S&P 500 dropped 0.2% for the day, while the 10-year Treasury yield shed one basis point. These are piffling examples compared to the convulsions that inflation reports have often caused over the last three years.”

As noted above with expectations of the Nov rate cut actually higher in the first hours after the release, the market voted right away—a Nov cut is still in the cards.

The probability lies with a 25 bp cut in November also because of the next PCE inflation reading, even if the Fed has left the door open to revising its data dependency. The Fed prefers PCE and we get one more of those releases (Oct 31) before the Nov meeting (Nov 7).

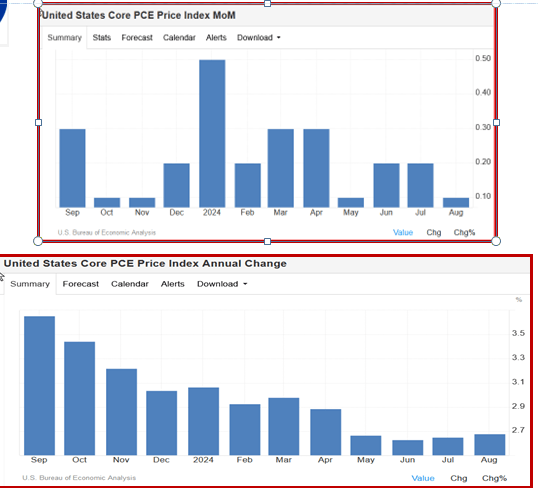

See the PCE charts from Trading Economics. They each support inflation nicely falling and another rate cut. It would take a terrible release on Halloween to put a halt to that. And don’t count on the Feds to tell us. One of them (Atlanta Fed Bostic) said skipping a cut (“pause” might be a good idea, but Chicago Fed Goolsbee (a dove) is not much concerned with the release a tad higher than expected.

The point is that ahead of the CPI, the Fed had set the stage for maybe yes, maybe no. We will likely hear one saying this and another saying that for the rest of the month. At least a little depends on the labor market, supposedly the new focus. There’s plenty of evidence that the labor market is cooling, but (consistent with one-time demographics and the pandemic aftermath), a labor shortage at the same time. Or rather a skilled labor shortage.

It’s not clear that another 25 bp rate cut would do much to create jobs, but never mind. It’s the psychology that counts—as long as the gloomsters don’t start up again that the labor market is pointing to recession.

Forecast

The markets are willing to accept that while the Fed may decide to skip/postpone the Nov rate cut, December is in the bag and so are additional cuts in 2025. The die is cast. It would take something very big to shove it off course. This narrative would normally be dollar-negative, but not this time, or at least not yet.

We don’t know whether the dollar’s persistent firmness arises from risk aversion from geopolitical conditions, yields hanging on to gains and making some renewed ones, or plain old economic growth. It’s not a dead-cert, either, but we can’t see anything to bring any of the others up, except maybe the yen resistance to 150.

Then there’s the US election less than a month away (Nov 5). Economists everywhere know that Trump would be an economic disaster and perversely, likely drive the dollar up on sheer risk aversion, as we saw the first time around. But for once the effect on the national debt could be heeded. The US has avoided this problem, despite many reviews and much discussion, presumably because of exorbitant privilege. A Trump win would/could bring it home for the first time with the power of a tornado. Then the question becomes whether the necessary higher yields are dollar supportive or the underlying cause, wild deficits and bad management, turns the dollar in a third world currency.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat