Outlook

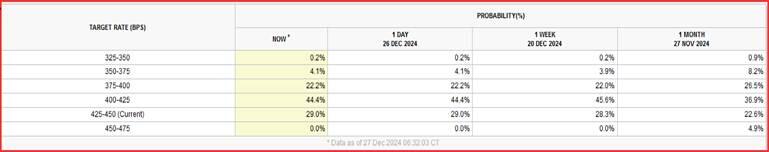

The idea that the Fed is reluctant to cut rates much further is starting to sink in to a reluctant market. See the CME FedWatch table for June 2025. A large percentage see no change at all by then, 29% (from 22.8% a month ago). Only 44.4% see one cut and only 22.2% see two cuts.

But before then, the Bank of England will have cut at least once, although some reports have it that the pound is getting some support from the idea that the BoE will go on hold because the Fed is going on hold. The ECB is expected to have cut by 50-100 bp, although today Bloomberg reports the rise in the Bund yield is traders paring rate cut bets now the Fed has said it will be cautious.

Even Australia is forecast to cut at least once, but the RBA is pretty savvy and might also join the club waiting for Trump. We suspect the new stimulus measures in China will have a beneficial effect on the Australian economy, so rising labor participation and other measures could offer an excuse for delay there, too.

It’s possible the Bank of Japan will have raised rates by June—March is now the favored timeframe—but maybe not, depending on what Trump does, as even Mr. Ueda admits.

Analysts are reluctant, so far, to forecast what Trump might do. It is not politically biassed to point out that he is impulsive rather than analytically rational. He doesn’t listen to experts unless they parrot his views, and he scorns the law, tradition and norms. As a real estate guy, he wants lower interest rates and may not accept that mortgage rates are more closely related to the 10-year than to Fed funds.

Bottom line, he may fire Mr. Powell (despite having said he would not), setting off a legal battle. Powell’s term can be interrupted only for cause and Trump wouldn’t have one. That hasn’t bothered Trump before. Maybe he doesn’t fire Powell but devises other interference with the Fed. In addition, maybe the plan for converting gold reserves to bitcoin goes somewhere (enriching his crypto bro pals).

Financial market deregulation is another risk. Libertarians think deregulation is a great idea but just wait until they get defrauded. Just as a conservative is a liberal who just got mugged, a libertarian is a free marketeer until he gets scammed out of everything. Consumer protections will be ripped away, too.

So far the focus is on those Trump tariffs, with a few diehards clinging to the idea it’s all just rhetoric. Bloomberg writes the world doesn’t agree. “Across the world, businesses aren’t waiting until US Inauguration Day on Jan. 20 to see which countries, products or tariff rates are announced in Trump’s widely telegraphed trade wars. The mere threat of his universal tariffs is sparking a scramble that’s leaving the global trading system prone to bottlenecks, saddled with higher costs and vulnerable to disruptions should an economic shock come along.

“’We’re still in the freakout period,’ said Robert Krieger, president of Los Angeles-based customs brokerage and logistics advisory firm Krieger Worldwide. ‘There’s about to be a king tide in the supply chain.’”

That’s the guy on the ground and he should know. Bloomberg even has a cute chart.” To get ahead of the game, some firms are frontloading orders. Others are seeking new suppliers or, if that’s not possible, renegotiating terms with existing ones. A common theme: The renewed stress comes with higher costs, in the form of bigger inventories, costlier expedited shipping, or taking a chance on untested partners. Profits will suffer and expenses will be reduced elsewhere, they said. Ultimately consumers will foot the bill.”

Here's some muscular proof: “China’s ports saw double-digit growth in container throughput in the two weeks around the election and that rose further to an almost 30% gain in the second week of December. International air freight flights have increased by at least a third each week since mid-October and economists expect that’ll continue as customers rush to frontload orders.”

Oxford Economics is cited by Bloomberg: companies are more worried about tariffs than about Russia-NATO or China-Taiwan conflicts. According to its “survey of 156 businesses in the two weeks to Dec. 10, 65% of respondents said a global trade war presents a very significant risk to the global economy over the next two years, compared with 38% for a Russia-NATO showdown and 14% for a China-Taiwan conflict.”

And as the new year starts, attention will turn again to that exorbitant privilege. Will the world’s savvy investors accept that the US deficit can go wildly over 100% of GDP without consequence?

Risk is rising. On the Friday before New Year’s Day, nobody wants to think about just how awful conditions can become if Trump does all the things he says he will do. When risk goes up, the dollar tends to follow, even when the source of the risk is America. As we have been pointing out since 2016, this is perverse but sentiment is not always logical. Will the financial world become logical? No, not as long as those juicy bond yields are available. All the same, gird thy loins.

Forecast: As expected, the euro/dollar is fairly flat but has some support that is probably from squaring of dollar positions ahead of the new year. Monday and Tuesday could be thin trading days ahead of the New Year holiday on Wednesday, so we can’t expect any serious action until next Thursday. The last time we had a bounce, it rose above the 20-day. This time the 20-day lies at 1.0470.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0400 in quiet trading

EUR/USD trades in positive territory above 1.0400 in the American session on Friday. The absence of fundamental drivers and thin trading conditions on the holiday-shortened week make it difficult for the pair to gather directional momentum.

GBP/USD recovers above 1.2550 following earlier decline

GBP/USD regains its traction and trades above 1.2550 after declining toward 1.2500 earlier in the day. Nevertheless, the cautious market mood limits the pair's upside as trading volumes remain low following the Christmas break.

Gold declines below $2,620, erases weekly gains

Gold edges lower in the second half of the day and trades below $2,620, looking to end the week marginally lower. Although the cautious market mood helps XAU/USD hold its ground, growing expectations for a less-dovish Fed policy outlook caps the pair's upside.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.