Market Overview

With the US taking a day off yesterday, suddenly the glass has gone from being half full to being half empty this morning. Looking around, the dark clouds have gathered and trading outlook has taken on an increased edge of risk aversion. Ratings agency Moody’s has cut the outlook for Hong Kong, whilst the IMF has cut its forecast for global economic growth which it sees as remaining “sluggish”. Add in the coronavirus that is spreading through China that is being talked of in the same breath as the SARS outbreak of 2002 and we have a risk outlook in retreat this morning. This is driving bond yields lower (US 10 year yield off almost -5 basis points from Friday’s close), whilst the starkest move to reflect risk aversion has been a sharp move higher on the Dollar/Yuan rate above 6.9000 again. Add in a stronger yen, a mini breakout on gold and equities dropping back and there is pretty much the full set. Quite how far traders take this is another matter though. Reaction to the Moody’s downgrade and IMF forecast is more likely to be knee jerk and short term. This seems to be a fly in the ointment rather than a broader malaise setting in this morning. The potential fallout for China of the coronavirus though is as yet unknown. Back in Europe, eyes on the German ZEW this morning for the outlook of the Eurozone’s major economy.

Wall Street was shut for Martin Luther King Day yesterday but futures have resumed around -0.4% lower today. This has dragged Asian markets lower, with Nikkei -0.9% and Shanghai Composite -1.4%. In Europe, the reaction is equally negative, following US futures, with FTSE futures -0.4% and DAX futures -0.6%. In forex, the main mover is JPY recovering lower ground, with the commodity currencies (AUD, NZD and CAD) underperforming by around -0.2%. In commodities, gold looked to be breaking higher, but is just paring those earlier gains, whilst oil is approaching -1.0% lower.

There is a European focus to the announcements on the economic calendar today. The UK Unemployment numbers for November are out at 0930GMT and are expected to show the headline rate sticking again at 3.8% (3.8% in October). UK Average Weekly Earnings are expected to slip slightly to +3.1% (from +3.2% in October). The German ZEW Economic Sentiment for January is at 1000GMT and is expected to show an improvement to +15.0 (from +10.7 in December), which would be the highest since March 2018. Furthermore, the whilst the German ZEW Current Conditions component is expected to improve to -13.5 (from -19.9 in December) which would be a third consecutive month of improvement and the first time this has happened since the end of 2017.

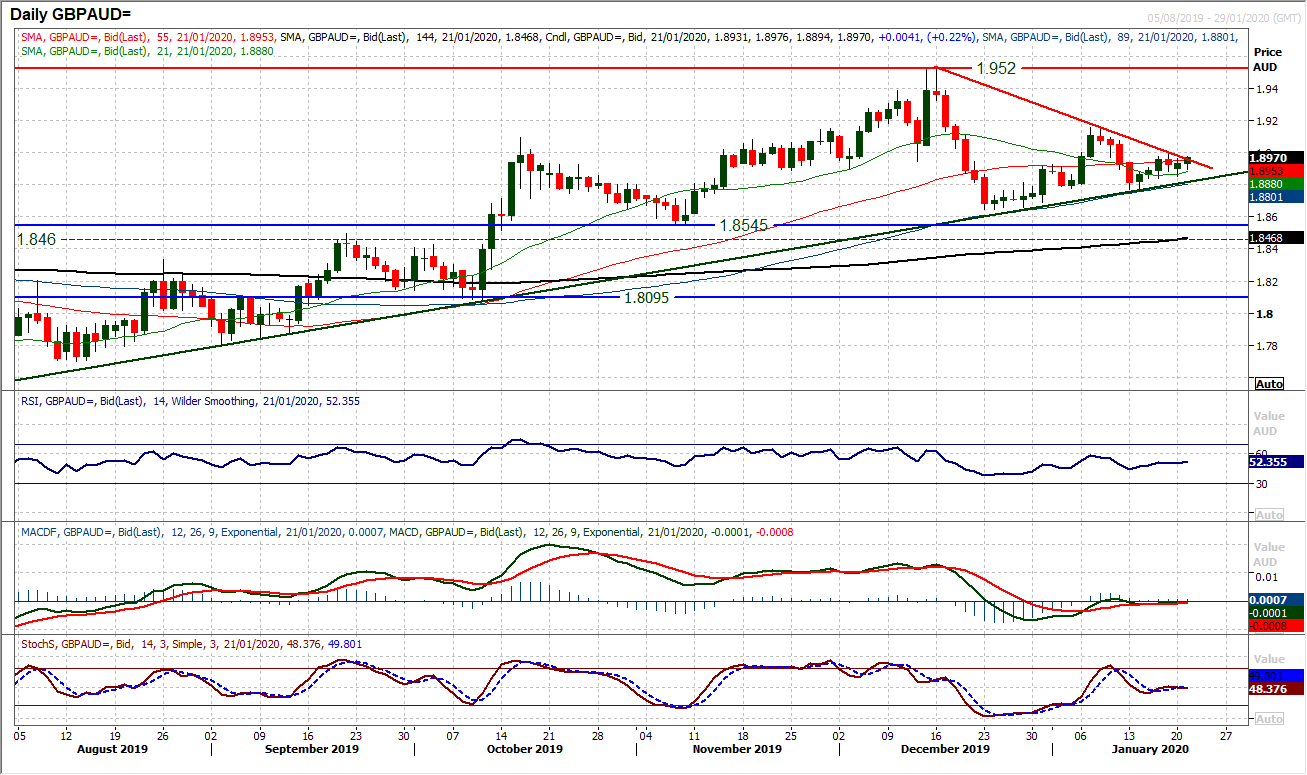

Chart of the Day – GBP/AUD

The latest drop back to $1.2900/$1.3000 on Cable has sterling bulls having their control questioned. However, that is not the only sterling cross which is at a key crossroads as Sterling/Aussie has also been at a key level in recent sessions. For the past six months, sterling has been building a very well-defined uptrend, which has been used on several occasions as a basis of support. In recent weeks, this trendline has again come back in as support for sterling weakness. However, now as a five week downtrend converges, this is a key moment. This is a key crossroads for GBP/AUD. Momentum indicators are taking on a more neutral configuration though which reflects the crossroads. The RSI has been around 40/60 over the past few weeks whilst MACD and Stochastics lines have moderated around neutral. The six month uptrend and 89 day moving average both sit around 1.8815 today and are supportive. The candlesticks have been slightly more positive in aggregate in the past week meaning that support at 1.8765 is initially key. A move above 1.9000 (last week’s rebound high) would suggest the bulls winning the battle (especially on a closing basis).

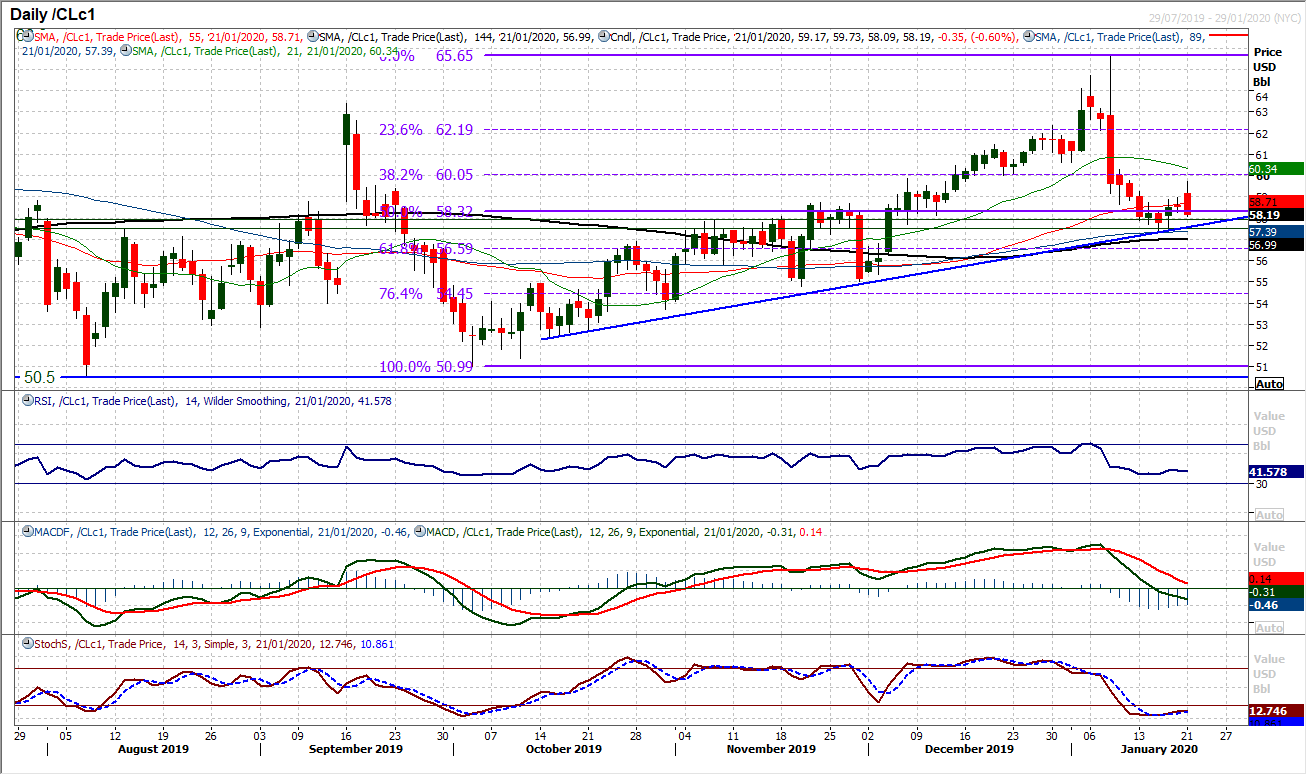

WTI Oil

Indicative intraday moves with US oil trading shut for Martin Luther King day means that the market has been volatile into early trading today. A sharp retracement lower brings the support of the key pivot of what is now $57.35/$57.85 back into prominence. Along with the support of a slightly shallower (but still three months) uptrend there is a confluence of support around the $57.50 area now. We still see RSI holding around this 40 area and this once more is a key moment for the medium term outlook. A close below $57.35 would be a significant bull disappointment now and would open $55.00 as the next support. Friday’s traded high of $59.00 is resistance.

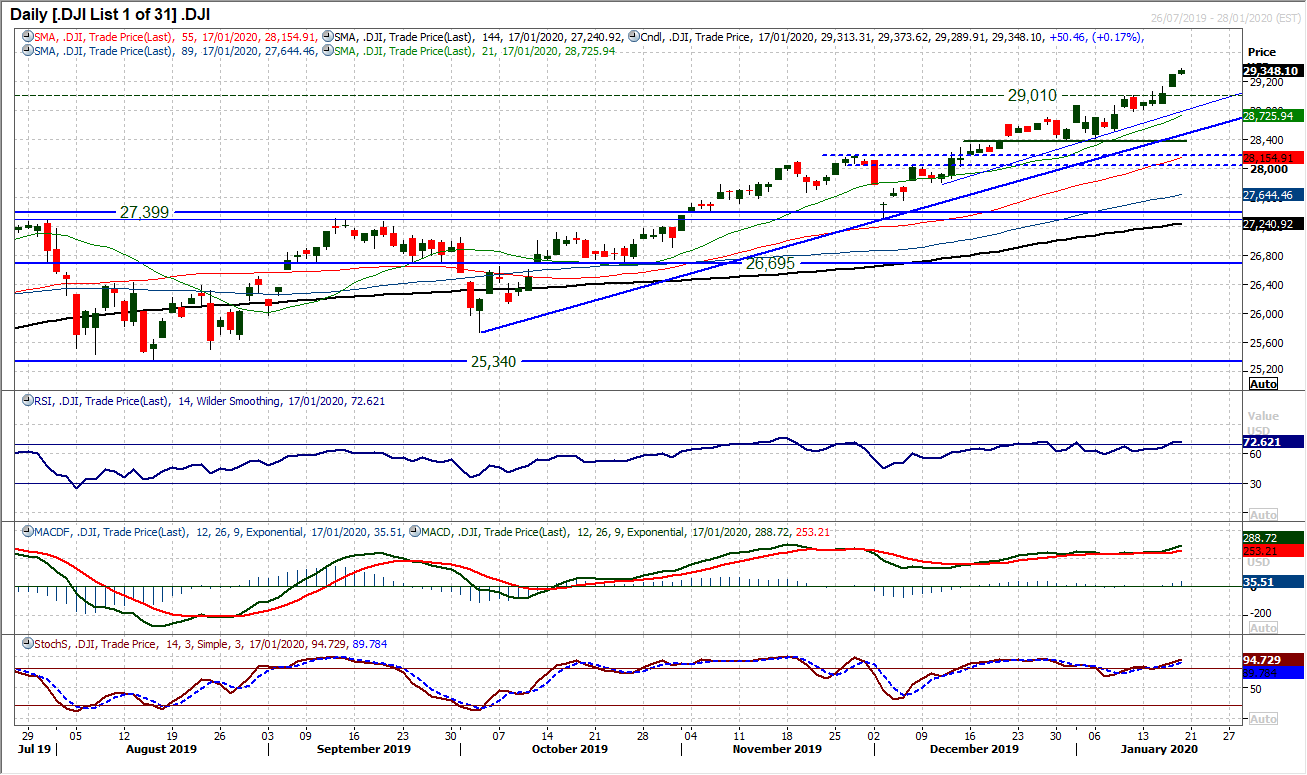

Dow Jones Industrial Average

Another positive candle on Friday and another close at an all-time high, before yesterday’s public holiday where the market was closed. Momentum with the run higher continues to build into strong configuration now. Although with marginally stretched momentum there will be a corrective move at some stage, and with the futures hinting at an early unwind today, an initial correction could be seen. There is still a gap open at 29,127 which ideally needs filling, whilst the first real support comes in at 29,010 and back around 28,873. Support of a five week uptrend comes in at 28,835 today too. We still see near term weakness as a chance to buy and with little real slowdown in momentum, Friday’s high at 29,374 is unlikely to be the ultimate all-time high of this bull phase.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0850 area as mood sours

EUR/USD stays under bearish pressure and trades deep in negative territory near 1.0850 on Tuesday. The US Dollar benefits from safe haven flows and weighs on the pair as investors adopt a cautious stance ahead of this week's key earnings reports and data releases.

GBP/USD closes in on 1.2900 on US Dollar recovery

GBP/USD is on the defensive toward 1.2900, struggling to find a foothold on Tuesday. The US Dollar holds steady following Monday's pullback amid a negative shift seen in risk sentiment, not allowing the pair to regain its traction.

Gold recovers above $2,400 as US yields retreat

Gold stages a rebound and trades above $2,400 on Tuesday after closing the fourth consecutive trading day in negative territory on Monday. The pullback seen in US Treasury bond yields help XAU/USD cling to modest daily gains despite the US Dollar's resilience.

Bitcoin price struggles around $67,000 as US Government transfers, Mt. Gox funds movement weigh

Bitcoin struggles around the $67,000 mark and declines by 1.7% at the time of writing on Tuesday at around $66,350. BTC spot ETFs saw significant inflows of $530.20 million on Monday.

Big tech rebound ahead of earnings, Oil slips

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

Tesla and Google are due to report earnings today after the bell, and their results could shift the wind in either direction. Despite almost doubling its stock price between April and July, Tesla sees appetite for its cars and its market share under pressure.