The FX market seems not frightened by tariffs, unlike the stock market and even the bond gang. For reasons no one can name, the dollar showed some firmness yesterday despite the additional bad news. We guess traders are confused rather than actually pro-dollar, or maybe the hedgers are getting done or the shorts are just fed up, so starting over. It’s hard to think FX traders do not see and respect the potential economic crises ahead. Maybe they think it’s already priced in.

A somewhat reasonable argument is that Europeans had bought $108 billion in US and now they are unloading some of it. Does this not mean a sale of the proceeds sometime soon? The FT likes to fear-monger and writes that the whole shebang might be up for disposal, and that’s $9 trillion. “Thr great European disentanglement from US stocks has only just started. A long rebalancing of investor portfolios is likely to be under way that could be painful for America”.

Interesting fact from the FT report: Europeans hold around 17% of the overall value of the US market and “not far off the market capitalisation of all the equities in Europe.” In the worst case, that could be a doubling of the European markets. Wow.

The US has been hard to avoid, in fact. By the end of last year, 10 stocks made up nearly a quarter of the global total of market capitalisation in public equities. Nine of them are from the US. The US makes up 64 per cent of the value of all global stocks, or nearly 73 per cent of developed markets. Any investor tracking a global stocks index such as the MSCI Global may think this is a neutral strategy — a nice, easy way to achieve diversification. It’s not — it’s a nice, easy way to run a massive positive bet on the US.

“We have argued over time that the merits of the US must be fully discounted,” Marsh said at the launch of his latest yearbook earlier this month. “It’s not that the US will stop being a dominant market or the US will stop being a hugely entrepreneurial country. It’s just that all has to be in the price at some point.”

Investors everywhere are hugely overexposed to the US. That was uncomfortable enough before Trump began his second presidency, and it feels rather more reckless now. It is hard for global investors to shake off more than a century of evidence that buying US assets is simply in the best financial interests of themselves or their clients, but lighter allocations to Trump’s America represent basic risk management at this point.

If FX traders don’t want to pay attention to tariffs, they should pay attention to the real macro data, like the Atlanta Fed’s forecast of GDP at -2.8% in Q1 and big banks calling for three rate cuts. Maybe some are thinking those rate cuts will goose the economy enough to offset inflation. Only if wages inflate, too, and/or the richer spenders stop being freaked out by their stock market losses.

Today we get the ISM and S&P Global manufacturing PMI’s, the Feb JOLTS report, Feb construction spending, the Dallas Fed service sector survey, and comments from Richmond Fed Pres Barkin.

The only big US macro data this week of real interest is the jobs report on Friday (well, maybe JOLTS today and ISM services PMI on Thursday). We dismiss the ISM manufacturing PMI because manufacturing is a minor piece of the economy. Jolts will be interesting because voluntary quits may fall back some more, disclosing high anxiety, but we still have a skilled labor shortage and it’s too early to see Trump effects in the labor statistics. This could give a false sense of “We’re all right, Jack.”

We’re not. The pseudo-macro is whatever chaotic, random outrage Trump comes up with next in order to stay in the spotlight. Analysts feel the most extreme stuff will get dialed down, and that may be true, but the process of dialing down will also be chaotic and haphazard. Hope of less uncertainty (surely the most used word in a long time) are wishful thinking. That’s the province of the stock market, by the way. We could even end the week on a higher note in the S&P, ridiculous as that seems.

Tariffs: The so-called Liberation Day is tomorrow. Again and as usual, Congress is asleep at the switch. As Blomberg points out, “Article 1 of the US Constitution is clear in giving the legislative branch the power ‘to lay and collect Taxes, Duties, Imposts and Excises’ and ‘to regulate commerce with foreign nations.’” This is buttressed by Smoot-Hawley having been a Congressional move, along with its removal.

As for using the Emergency Powers act, “… there’s a convincing argument out there that IEEPA doesn’t really grant presidents the power to impose tariffs and that Trump’s use of the statute violates the Constitution. Which matters because there’s a good chance IEEPA will feature again this week as a justification for Trump’s new tariffs. At some point someone is likely to challenge the constitutionality of that maneuver and ask US courts to decide. Which means eventually the Supreme Court may rule on Trump’s power to declare economic emergencies and levy tariffs.”

Trump says tariffs will raise $6 trillion, which is ridiculous. Total imports in 2024 were $4.1 trillion. QED.

But the consequences are dire. The FT reports a UK university study with a dandy chart that measures and adjusts various outcomes by country depending on what comes next. No matter how you slice and dice it, the big losers are the US, Mexico, Canada, China and Ireland. Ireland because it’s not diversified by country and specializes in exports to the US.

Takeaway: if the US imposes a universal 25% tariff and all affected countries retaliate with the same 25%, US inflation rises to 5.5%.

Forecast

It’s well-nigh impossible to forecast FX when price moves depend on the garbage spewing from the White House, and responses are inconsistent. Sometimes the dollar wins and sometimes it loses when the rhetoric gets ramped up. Those who think it will all be over tomorrow on the big day are mistaken—it’s going on, and on. Trump really needs that spotlight.

The dollar “should” fall on the absence of consistency and no drop in uncertainty. Yes, those are components of risk-off, which used to be dollar-supportive. We used to call it one of the perversities of FX that Trump I would do something stupid and the dollar would gain. We think those days are well and truly over.

Besides, now would be the ideal time for hostiles to make a move. The courts are ruling against Trump, the public is out in the streets (all the streets, everywhere) and Trump is on the defensive. China has been taunting Taiwan again. Trump is a bully and like all bullies, actually a coward. China could move meaningfully on Taiwan and Trump will say it doesn’t matter.

Tidbit: The NY Fed delivers the Feb inflation report at end-March… chances are it gets little attention now that we have PCE and the surveys. The NY Fed never heard of tariffs or at least finds no reason to consider future effects.

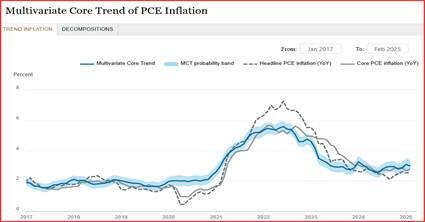

Still, it’s of some interest because it points out that its “Multivariate Core Trend (MCT)” is 3%, down from 3.1% in Jan. “The 68 percent probability band is (2.6, 3.4), meaning the top end is 3.4%. Seems low.

“Services ex-housing still accounted for the larger part (0.76 percentage point (ppt)) of the increase in the MCT estimate relative to its pre-pandemic average, and core goods’ contribution increased to 0.33 ppt. The housing contribution was much lower, at 0.09 ppt. Persistence is largely driven by the common and sector-specific components of services ex-housing inflation and the common component of goods.”

So, services today is something to watch.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.