The focus is on core PCE showing a cooling

Outlook

An autopsy on yesterday’s price action is useful. We got a hot mess in the news and on the charts yesterday. Minneapolis Fed Kashkari said the Fed has not ruled out additional rate hikes. Then we got a mixed but relatively upbeat consumer confidence survey that showed a willingness to keep spending and the expectation that rates will, indeed, go up. The 10-year yield rose 8 points to 4.54% after the 5-year auction went for 4.553%, over the pre-auction 4.540%. Trading Economics reports “An earlier offering of $69 billion in two-year notes also saw tepid demand.” It’s a little interesting that in early Australia trading that note also went up 8 points (New Zealand got 7).

Okay, which factor drove the dollar higher? Each report features a favorite factor, and none of them has anything to do directly with the impending PCE inflation except by inference. Yields rise for many reasons, including the market demanding more return when the US is peddling so much paper and has such a big deficit, despite some clever auction timing. We might add other negatives, like the coming presidential election and worsening conditions in the Middle East, that lead one to imagine a whiff of risk-off.

This left us with a significant rise in the dollar yesterday pretty much against all the majors, delivering dueling channels and depending on the timeframe of the chart, some outright buy signals. This makes some sense in the context of the ECB presumably hiking in June while the Fed sits on its hands for longer, but we do not see the dominant commentary saying the ECB is cutting, sell the euro. In fact, a bit of gloom is rising that the ECB will cut less than expected only a week ago and June may be the last cut for a long while.

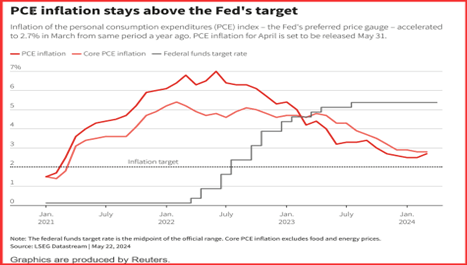

Not all forecasts are the same, but it looks like both the eurozone and the US are going to report inflation on Friday at about the same number, 2.7%, with core down a bit but headline the same or even up a bit. A difference of 0.1% in any of the numbers in either of the locations is not meaningful, although traders are so hot to make a tiny change meaningful that they can force it to happen.

Never mind, the focus is on core PCE showing a cooling. See the chart from Bloomberg. This hardly seems enough to drive a dollar rally.

As we have been seeing for many months, housing/shelter is the key driver preventing disinflation, and it forms a far bigger proportion of the PCE (over 50%) than of the CPI (28%). A few weeks ago, a big bank economist pointed out that if the US calculated inflation the way the Europeans do it, with a lower weight to shelter, inflation in the two locations would be about the same. We may be getting that outcome this time even without subtracting housing/shelter. And don’t forget that the cost of housing lags like crazy. Example: the price of a new lease on a house or apartment may go up mightily, but the proportion of renters getting a new lease is small compared to those who are still on their old leases.

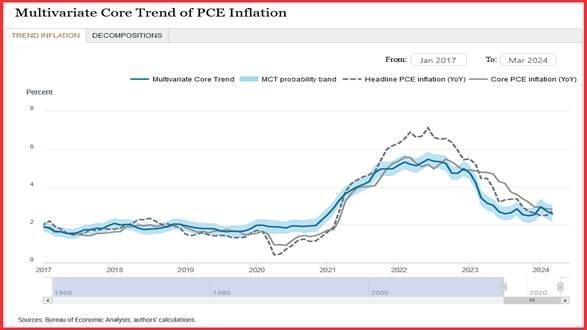

See the chart from Reuters... and then the NY Fed’s multivariate core trend. This is a useful chart because it removes most of the human interpretation and aims for “persistence” of the 17 components of core inflation. We will get a new version on Monday. You can sign up for the research.

Last time, the core trend was down to 2.6% in March from 2.7% in Feb (revised). The NY Fed reports the MCT inflation is 0.78% above the pre-pandemic average. Services ex housing account for 0.41% of this increase, while housing accounts for 0.37%. That’s why we have to look at non-housing services, too. See the Fed’s “sticky CPI prices less shelter.” As of May 15, the April number was 3.23%.

Bottom line, the NY Fed’s multivariate chart looks hopeful for a nice dip this time. But the Fed’s sticky prices less shelter is not improving.

As we keep pointing out, we have data overload, and that’s before considering three or six months annualized, which is different, statistically, from year-over-year. You can state that inflation is up or down or sideways depending on which measure you choose.

But those are facts, and traders make decisions on what they think the rest of the market will do—Keynes’ “pretty girl” analogy. If the consensus is that disinflation is back, they will sell the dollar, and then sell it some more on the idea that a preference for risk is embedded in the numbers.

If the consensus develops that inflation remains sticky and the Fed is on hold for longer, the dollar can gain, as it “should” on the relative economic growth rates, perhaps prodded along by yields rising for this and for other reasons, like overindebtedness.

Forecast

The consensus scenario got upended by the bond market. Whether we have a global bond sell-off remains to be seen. Can it be that the impending inflation data is taking a back seat to relative yields, which are themselves influenced by inflation data? Talk about circular.

Something else we don’t know is whether the Fed gives a fig for the consumer survey expectations, including the weird reading that a majority see the stock market going up along with job availability and their own big-ticket spending plans.

We are sticking to the big-picture narrative of the dollar regaining its moxie on the Fed sitting on its hands for longer than other central banks on the perfectly reasonable narrative of a high-growth economy that by definition feeds at least some inflation.

Tidbit: The NY Fed has a new paper on foreign ownership of the dollar as reserves, demonstrating that it’s a relatively small number of countries selling and in part on a renewed preference for gold.

Given the numerous “sky is falling” stories, this is a welcome contribution. The essay also says “Our findings add insights to the messages of the ECB’s 2023 report on the International Role of the Euro, wherein a careful survey of key announcements of country intent to shift the currency composition of their reserves was not accompanied by material changes in key indicators of international roles of the dollar. “

Reasons for the Fed to cut rates

Avoid embarrassment from getting inflation wrong twice.

Normalize the yield curve.

Head off any recessionary tendencies.

Help housing via mortgage rates.

Help banks rollover commercial property loans.

Help the stock market.

Synchronize with the ECB (and Riksbank and SNB).

Help the current White House and/or avoid accusations of political bias if delayed to after the Nov election.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat