The Fed doesn’t obey CPI, but still, CPI sets the tone

Outlook: The big news this week will be US CPI on Wednesday and the ECB policy meeting the next day. In the US, we also get PPI, retail sales and the usual jobless claims. CPI was 3.2% in July after 3.0% in June, which upset some apple carts. Reuters report more of the same might be our fate this time, too, with CPI rising to as much as 3.6%.

The Fed doesn’t obey CPI, preferring the PCE, but still, CPI sets the tone. And the tone is very likely to be hawkish, even the members are in the blackout period ahead of the Sept 19-20 policy meeting.

Some folks will try to make out of the monthly core CPI, which was stable last time at the same 0.2% m/m. This can easily be put into question by the magic word “oil.” Unless we get a decent-sized drop in any or all of the various methods of measuring CPI inflation, the narrative is almost surely going to head in a hawkish direction, and that’s true even if the Fed decides on a pause in Sept.

As most analysts have been opining for some time, pause in Sept, hike in Nov. CPI will not change that. Where it might have an effect is the guess about the first rate cut in 2024, already moved out from March to June with some outliers sticking resolutely to later in the autumn of 2024, if then. We believe Mr. Powell when he says “higher for longer.” Note that the word “pivot” seems to have vanished from the pundit landscape.

As for the ECB decision, we get dizzy reading the demanding calls by various members for more strictness or less. It’s like watching tennis. The consensus seems to be a pause, but with hard-line-seeming rhetoric about more hikes later on, or even (perhaps) something like a 12.5% rate hike as a compromise.

Tidbit: The G20 meeting in India was a bust, with a wishy-washing communique. Russia and China’s Xi did not attend and host Modi, while sometimes sounding impressive on some subjects sometimes, continue to believe he can be friends with Russia and China and the West all at the same time. He calls it multilateralism, as though refusing to choose sides is a good thing. On the sidelines, some G20 countries agreed to a competitor to the Belt and Road Initiative with new projects joining India to the Middle East and Europe and other projects in Africa. Considering that China is losing its shirt on the Belt and Road projects, this is fairly silly, if good news for India if it works to any extent. Oh, yes, India got a giant contract to host and repair US Navy ships.

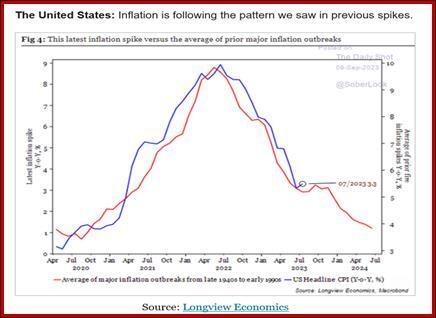

Tidbit: To take the long view on inflation, things are okay. See the chart from the Daily Shot. We don’t know (nor does anyone else) whether this is a valid way of looking at the numbers, but it sure is reassuring. Note that the apparent target today is about 3-4%--not the Fed’s 2%.

Tidbit: The New York Fed has suspended its GDP Nowcast during the pandemic because factors were too squirrelly (so much for purportedly “dynamic” modelling) but last week brought it back. A major virtue: various probabilities for various ranges. This is the right way to do it. If you can stomach the details. A point to notice—growth in Q3 will be somewhere near 2.25%. It could be as high as 3.73%. These numbers are well under the Atlanta Fed’s 5.6%. You have to wonder if they talk to one another.

Forecast: As we suspected last week, the dollar gained an awful lot for a fairly long time without a meaningful correction, and it’s time for one of those. This week will be data-driven, though, and that can upend trend work. If US inflation really does come in at 3.6% as the Reuters poll suggests, all the betting on the Sept pause and the later hike will get changed to maybe a hike in Sept and then another in November, with the “pivot” pushed way out. The Fed can talk all it wants about PCE, not CPI, but markets don’t care.

Then there’s the ECB, expected to pause but you never know. A hike by 12.5% would presumably favor the euro, unless it’s seems as chickening out.

Unless you believe you can trade the news on a minute-by-minute basis—and hardly anyone can—it’s time to pare back--way back.

Tidbit: Today is the anniversary of the 9/11 attack by religious fanatics on the Twin Towers in New York City and the Pentagon in Washington, DC. Today we have the additional shocker of the Jan 6 attack by religious fanatics on the Capitol, if we consider Trumpism a cult akin to religion. (Wasn’t there a Twilight Zone episode about religion having been banned?)

9/11 had heroes. Every year we replay this video about 9/11 heroes, narrated by Tom Hanks. About a half a million citizens were evacuated by boat, including ferries, a spontaneous surge of heroism. It was the American Dunkirk.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat