The effect of yesterday’s inflation data might get watered down by the flood of upcoming fresh data

Outlook: The effect of yesterday’s inflation data might get watered down by the flood of upcoming fresh data. We get retail sales, industrial production, the Philadelphia Fed, business inventories, and jobless claims. We could even get a stock market that reverses itself.

The shock that inflation is sticky, especially in housing, should not have been a shock at all. We already knew the last mile would likely be a slog. It’s nice that reality checking continues, but the overreaction was unwarranted. It’s a single month’s data. for heaven’s sake. For all we know, by the time we see data for Feb and March, the expected improvements will be visible.

As we keep pointing out, what would change the Fed’s mind toward a later rate cut is not headline or core CPI, but rather the PCE data, and we don’t get that until Feb 29. And even if that data were to show a failure of the trajectory to keep going in that last mile, it doesn’t necessarily mean the Fed will interpret the information as requiring a push of the first cut out to June. The core PCE would have to rise significantly, not fall by a lesser amount or remain flat, that that to happen. Or, for all we know, the Fed would interpret a flat line on the chart, i.e., no change, as suggesting sustainability.

A lot depends on the concept of sustainability. What kind of numbers say sustainability to the Fed? A sensible definition might be “two out of three” or a downward slope on the chart. Alas, other data surrounding the main release yesterday is not so cheery. The regional Fed work on sticky prices stands out. The Cleveland Fed trimmed mean went up, not down. In fact, it put in the biggest rise last month since early 2023. The overall year-on-year measure is barely below 4%.

Further, as Bloomberg’s Authers reports, the Atlanta Fed sticky price index has picked up over the last three months. Importantly, “the decrease in the year-on-year measure has stalled.” These are scary side stories but again we have to point out that while the Fed might be influenced by them and by CPI itself, it claims to prefer core PCE prices alone.

The one thing we should fear is that growth continues “too hot” and does pull yields higher on the assumption that growth means inflation by definition. We get a new Atlanta Fed forecast today. We had thought the 10-year would not return to 4.9% as we had in October, itself an overreaction, but also not rise back above 4.25%, either. We were wrong. We do expect inflation mania to subside but it may take a while, by which we mean more than a week.

Or not. The soft landing and Goldilocks economy are not news anymore. Reuters reports the total of rate cuts this year has shifted to 92 bp from 150 only a month ago. “The chances of a first move as soon as March have now been wiped to as little as 1-in-10. It's 50-50 for May and a quarter point cut is now not fully discounted until the Fed's June 12 meeting. An overreaction to one number that's not even the central bank's favored inflation gauge? Given the scale of the day's market reaction, you'd be forgiven for thinking U.S. inflation spiked higher again last month.” But headline did fall to 3.1% from 3.4%. Even given worries about sticky services, that is not a regression.

While the euro is the benchmark currency and the biggest component of the dollar index, two other currencies matter, too, and we might expect a change in sentiment in them.

First up is the yen, which broke 150 easily yesterday and inspired comments from the Ministry of Finance that the currency market moves contain an “undesirable speculative element.” This is a far cry from an outright intervention threat, but still. The move slowed to a crawl. A policy change has been long expected and the over-interpretation of every blessed word out of the BoE and MoF has been tiresome, but it’s also correct that Mr. Ueda more or less promised the end of zero rates and he is to be believed.

Then there is sterling, where today the inflation report was “good” and yesterday some labor market data was stronger than forecast and can be seen as pushing out the BoE intentions. Higher claims for unemployment benefits in Jan were offset by the absence of wage growth slowdown. Average weekly earnings on the 3-month/3-month basis slowed only to 5.8% instead of 5.6% forecast, if better than 6.7% (revised). See the 8-hour chart. It shows a choppy range since last November of 1.2506-1.2828. This is not all that wide a range. We need a breakout here, too.

Forecast: We wished for a breakout and got it, somewhat to our surprise. We expect a pushback, normal after breaching the 62% retracement level and likely short-lived.

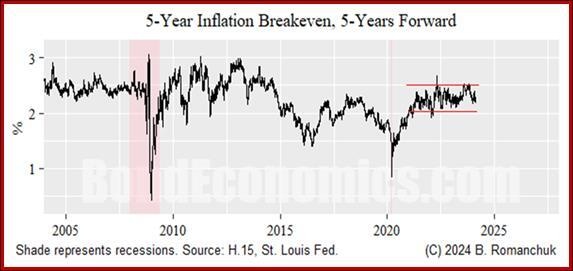

Tidbit: When it comes to yields, we are actually still within the recent range. Bond guru Romanchuk shows the 10-year and 5-year breakevens are stuck in “rather uneventful extended range trading dynamics.” This means that an inflation-linked bond and a conventional bonds are delivering close to the same total return.

The author is writing about TIPS and advising against hedging conventional bonds, but for our purposes, we note his deduction: “One way that this could be interpreted is that central bankers are doing a great job of anchoring inflation. Yay! Another theory is that modern economies have a lot more inflation inertia than they did during the peak of the welfare state and Old Keynesian business cycle management. Yet another theory is that the linker market is broken, and/or fixed income investors are delusional.”

This is a maverick point of view if ever there was one. We know the Fed waited too long to acknowledge rising inflation in 2022 and further, in years past, waited too long to cut rates. For anyone to say that today the Fed is good at anchoring inflation flies in the face of relentless criticism. Then there is the fair amount of greed-pricing, aka gouging, that we feel sure has been taking place. But then, this is Big Picture and the breakevens do tell a story.

For FX, the breakevens maybe tell a sad story. If it’s the change in relative yield differentials that drives currencies, we would need the same breakevens for the UK, eurozone, and Japan (maybe China, too). Some of these breakevens do exist, as in the UK, but the measurements differ and it would be a tough and perhaps fruitless slog to devise comparabilites. We are left with the rough-and-ready yield minus inflation today. There the UK stands out as the most likely to stay higher for longer, and yet we have had a wide trading range since the beginning of December.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat