The Dollar’s giant gains cannot continue indefinitely

Yesterday’s NY Fed report on inflation, which is ridiculously hard to read for s simple subject, reversed some of the damage done by the Michigan inflation expectations report last week. The NY Fed has consumer inflation expectations steady as the same 3% for one year out.

The 3-year rose from 2.6% to 3% but the 5-year went the other way, from 2.9% to 2.7%.

Yesterday the CME Fed Watch tool had showed nobody betting on a rate cut this year. The CME FedWatch tool continues to shift around hour-by-hour., but as of 8 am today, the probability of a Jan meeting rate cut was effectively zero. By June, 52.8% expect one or more cuts. By December, 69.5% believe there will be one or more cuts. This flies in the face of current events and seems to be based solely on one of two factors, including the slight pullback in yields, so is a curiosity of the betting world.

Goldman Sachs has a good track record forecasting the dollar and now it has an update—an additional rally by 5% on “the realization of new tariffs and continued US outperformance.” The euro will fall to 0.97 within 6 months, last seen when Russia invaded Ukraine. In addition, sterling will go to 1.22 and the AUD to 0.62 (already surpassed).

Bloomberg shows that Investors including hedge funds are on board. See the chart. It’s from the CFTC Commitment of Traders report and shows the dollar positioning at the highest since Jan 2019.

Warning: When everybody and his brother has joined a crowd, who is left to keep up its momentum? We were early in declaring no recession, better--then worse--inflation, and the dollar’s gain from Trump irresponsibility. But now that the dollar’s ongoing gains are the consensus view and everyone has piled in to the trade and reached their institutional position limits, where will the ongoing bid come from?

Then there is the possibility that others fight back. This has tended to be ineffective in the past, from France removing its gold and excoriating the US for exorbitant privilege to the Brazilian FinMin complaining at G20 that the US was impoverishing emerging markets with a too-strong dollar. But this time the combination of seizing Greenland and the Panama Canal is a permission slip for China to invade Taiwan. Firing the Fed or gutting it with lackeys removes an institutional bedrock. Raising the debt scares investors—the example is right in front of us in the form of the UK.

Any or all of these acts cut deep into the reputation and credit-worthiness of the US. The top disapproval reaction is to dump dollars from sovereign reserves, sovereign wealth funds, and insurance company reserves. In the US, each state dictates how much insurance reserves must be kept in dollars—we can see states change their rules. As for various groups trying to create trade union currency exchanges to get away from the dollar, markets have jeered at their ineffectiveness. But they will have a chance now.

Bottom line, the dollar’s giant gains cannot continue indefinitely and when they stop, it could be a horrible crash. That’s off in the future, but it’s not never.

Forecast

The dollar’s gains might periodically reverse a little for a day or two, but the die is cast—the market wants to see parity against the euro. Now that 5% is in sight in the 10-year, the bond market is going to flirt with it for a longish time.

Today we are getting a respite in the crusade toward 5%, but we haven’t yet seen PPI today nor CPI tomorrow. Both are expected to disappoint on the upside. Reuters reports core PPI expected to rise from 3.4% to 3.8% and core CPI “stuck as high as 3.3% last month.”

We know that sentiment is formed by many factors other than mere data, and that includes a solid faith in “bad things ahead.”

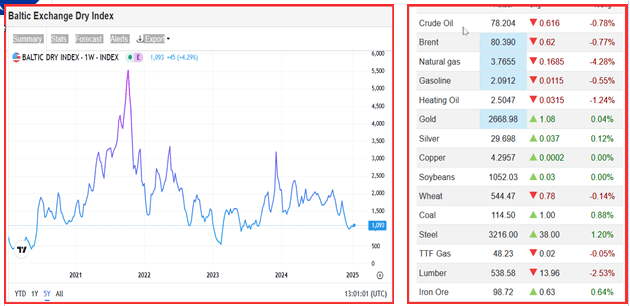

Tidbit: Whether tariffs come in increasingly bigger numbers, as seems likely under the extortionist-in-chief, or all at once, the cost of raw materials will be going up. This includes commodities from lumber and wheat to gas and iron ore. So far commodity prices are fairly tame, although aluminum, steel and copper are up from lows. See the chart of the Baltic Dry Index, which encompasses mostly commodity shipping.

Tidbit: The Special Counsel’s report was released and is the stunner we all knew it would be. Trump engaged in “"unprecedented criminal effort." The NYT put the whole thing on the front page. The Special Counsel said Trump would have been convicted if not shielded by Justice Dept rules. Various parties are requesting the full file lest Trump have it destroyed once he gets his hands on the Justice Dept.

By this time next week, sleazeball Trump will be in office and still selling vastly overpriced tacky junk online (boots, sneakers, watches, Bibles). You can fool some of the people all of the time. The transitional hand-off is the worst ever, riddled with incoherence and incompetence (two of three cabinet candidates can’t meet with the Congressional committee today because the transition team didn’t do the work).

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat