Retail Sales were only okay, but lower than forecast and considered a likely harbinger of things to come

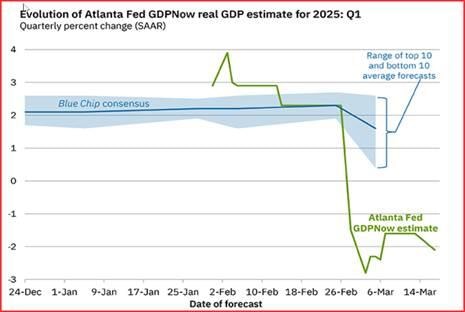

Retail sales were only okay, but lower than forecast and considered a likely harbinger of things to come. The Atlanta Fed GDPNow, which admittedly usually overshoots (although not last year) has Q1 GDP at -2.1%, worse than -1.6% on March 7. The reason is largely in retail sales that pushed real personal consumption expenditures growth from 1.1% to 0.4%.

Two things: the Blue Chip forecast, slow as molasses and not terribly useful at the best of times, has moved its GDP forecast to 1.5%. Blue Chip: A camel is a horse designed by a committee. Also, note that the Atlanta Fed admits the previous forecast that counted imports did include massive amounts of gold from London and that distorted the overall picture. It gets fixed later this month as a factor in the GDPNow forecast.

We have three central banks contemplating conditions, the Swiss National Bank, the Bank of Japan and the Bank of England. All are expected to sit on their hands this time around, although the BoE may decide to go rogue, even ahead of the budget next week. Reuters’ Dolan points out that “While Reeves may be anxious about meeting her own fiscal targets given the likely sputtering of government revenues, an additional squeeze on government spending now seems self-defeating, not least because it would come on top of the employer tax rises that kick in next month. So the case for using monetary policy to break the economic logjam is building, despite the hand-wringing about sticky wage and services inflation.”

You have to wonder if the recent rise in sterling could have some early rate cut hopes baked in. Most forecasters think May is the earliest date. But the BoE has been known to surprise.

About the dollar: During the first Trump administration, outrageous acts and rhetoric, including tariffs, raised risk aversion but that pushed the dollar higher on the excuse of the dollar as a safe-haven. We named it a perversion. This time it is starting to look like a more sane and reasonable interpretation of bad White House behavior—the dollar is falling.

It’s not clear that every single instance of bad behavior drops the dollar. The market doesn’t care much about Venezuelan gangsters (if that’s what they are) being deported to Central American prisons, but markets do care about the obvious instability and signs of autocracy. Add up enough of these events and an effect on US assets and the dollar will be seen. We wrote last November that we would try to keep Trump out of the analysis as much as possible. That is not happening for the obvious reason that financial markets are upset and anxious solely because of his erratic and dictatorial behavior.

The BoA global outlook report yesterday is cited by Reuters and it’s a succinct wrap-up: “Allocations to U.S. stocks saw the biggest drop ever in March with concerns over stagflation, trade wars and end of U.S. exceptionalism driving a ‘bull crash’ in sentiment…. “

The sentiment reflected in the stock market is awful, if not every single day. Calling it a crash is meaningful, especially coming from experts. But for FX, the important part of the statement is “the end of US exceptionalism.” One of the top reasons the dollar is the reserve currency is the rule of law over the rule of man (thank you, England). The rule of law allows foreigners to invest in US assets with confidence they have recourse to the law if things go south.

Other instances of the rule of law have to do with keeping one’s word in treaties, something else Trump is violating, including the Canada/Mexico trade law he himself put in place, NATO, and a dozen other things. Finally, as noted in the Tidbit below, there is Trump’s disregard and contempt for the very structure of the US government, whose foundation is the three equal branches of government that were designed to provide checks and balances. The loss of checks and balances is a loss to the dollar.

Forecast

For forecasting purposes, too much depends on the verbal garbage spilling out of the White House. We haven’t heard the word tariff for a few days but the damage has been done. New data can easily be overwhelmed and silenced by the political shenanigans (if not crimes) committed by the White House. The medium-okay data so far is being overwhelmed by negative sentiment. If political conditions were normal, the medium-okay data would be interpreted as positive for equities, growth, etc. But the constant drumbeat of awful statements and actions is too noisy and drowns out the usual data interpretation, especially the two killer words, stagflation and recession. We do not see relief for the dollar anywhere on the horizon, even when obviously oversold.

Tidbit: The Washington Post had an article about tourists cancelling trips to the US, especially from Canada. A booking agency reports that over “the past three months, about 20 percent of preexisting leisure trips to the United States were canceled. In February, bookings to the United States by Canadian vacationers fell 40 percent compared to the same month last year. Both figures are unprecedented in the agency’s 30-year history apart from during the pandemic… “ There follows a series of letters by Canadians explaining their decision—the sense of betrayal, the innate insult, the specific intent to withhold money. It’s not just individuals going to Florida, Oregon, Maine. It’s also companies cancelling trips to the US. Former PM Trudeau had asked Canadians to boycott the US. They did.

Business Insider writes “Last month, the US Travel Association estimated that a 10% decrease in Canadian travel could result in $2.1 billion in lost spending and 14,000 job losses, with Florida, California, Nevada, New York, and Texas — Canadian tourists' top US destinations — most affected.

“While the US travel and tourism industry is projected to generate $223.64 billion in 2025, losses could exceed current estimates if tensions persist, Adam Sacks, the president of Tourism Economics, told BI. ‘Canada is the US top visitor market, so the stakes are high,’ he added.”

Tidbit: The Trump administrations thinks it can do anything to anybody without ever facing the music. The Supreme Court decision last year nurtures that idea. But some of the acts are horrific and should be stopped or tourism will get killed entirely.

We may not mind some of Trump’s goals, like reducing the deficit, but lawful minded people are up in arms about the way he is proceeding, especially the part about stamping on the Constitution. Sending illegal criminals not to their home country but a third one and paying that country to put them in prison is nuts, especially after a court ruled the law being invoked was not applied properly and “turn the planes around.” The judge holds another hearing today on why the Trump administration failed to obey the order.

Alas, we do want them back… to be deported according to the law. Hair was on fire yesterday over this issue. Disrespecting the other two branches of government is part of the Trump deal, and it raises hackles and bares teeth. Another issue is Musk using US Marshals and the FBI to storm into US agencies and one private outfit. The threat of government violence in the absence of a major crime is just awful. Lawful citizens should not have to fear their own government.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat