Outlook: As we wrote yesterday, the focus today will remain on three things—the debt ceiling, the Fed’s stance on pause/skip/cut-or-hike, and today’s plateful that includes April income and spending, PCE inflation, and a bunch of vegetables (the trade balance, inventories, durable goods, and the final University of Michigan survey).

We expect a debt ceiling deal by Monday night, but may have to wait for midnight on May 31, given horse-traders like to wait until the very last minute. Whatever the exact timing, the debt ceiling as a market factor is going to vanish in a puff of smoke over the next six days.

Before turning attention to today’s US news, traders will be transfixed by a fistful of deeply negative Bloomberg stories about how Germany is failing and flailing as Europe’s engine of growth. Example: “Decades of flawed energy policy, the demise of combustion-engine cars and a sluggish transition to new technologies are converging to pose the most fundamental threat to the nation’s prosperity since reunification. But unlike in 1990, the political class lacks the leadership to tackle structural issues gnawing at the heart of the country’s competitiveness.”

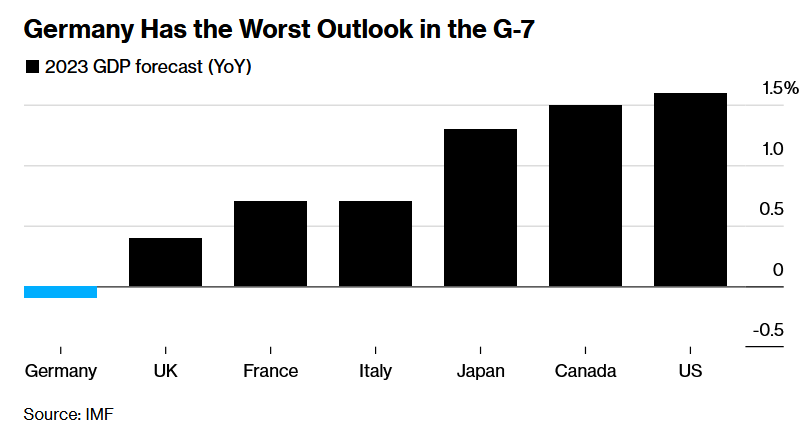

See the chart. As usual, the Bloomberg story is stuffed with overstatements and presents mostly the negatives. While that list is indeed long, it’s also true that German leaders are fully aware of the issues and not all politics is petty infighting. Bloomberg admits “To its credit, industrial behemoths like Volkswagen AG, Siemens AG and Bayer AG are flanked by thousands of smaller Mittelstand companies, and the country’s conservative spending habits put it on a stronger fiscal footing than its peers to support the transformation ahead.” To say time is running out is an exaggeration.

A fun side story is the FT’s about the new law that requires home heating systems be 65% green by next January, which can force homeowners to restructure their houses up to the roof. This is not only a green initiative (not dead after all) and anti-Russian natgas effort, but also anti-inflationary in the long run. Homeowners are furious.

The important question today is PCE inflation and how it stands up to the level that would be needed to move the Fed off its stance that more hikes are definitely needed, probably in July.

Headline PCE inflation was a mere 4.2% last time and might make it below 4% this time, but the core CPE is expected to come in the same 4.6% as April. Trading Economics has 4.5%. The Fed’s own guidelines say it’s headline PCE used for rate decisions, but that has morphed to the core version over the past two years in both the press and Fed member statements. Powell himself has named core services ex-housing.

Multiplying the number of inflation measures sows confusion. Bottom line, the market expects headline PCE inflation to fall a bit but core inflation not to budge, or to dip only the tiniest bit. That means even if the Fed skips a hike in June, it is gearing for a hike in July.

We can’t neglect the underlying personal income and spending data that drives the PCE deflator. Personal income is forecast up 0.4% in April, the same as Q1, but with personal consumption up in the air after a surge in Jan (2%) that collapsed by March. This time the forecast for personal spending is 0.4% (Trading Economics has 0.3%). The number is important because it’s a key component of the Atlanta Fed’s GDPNow, which gets updated today. The forecast is for Q2 and the Fed is contemplating recession not appearing until Q4, but if the Q2 comes in strong today, the recession story takes another hit.

When we surface from this dive down into the weeds, the resulting conclusion is “We’re all right, Jack.” If we buy that the UK is stuck with high inflation and Europe is all but already in recession, led by Germany, then the US wins the growth sweepstakes and that is generally currency-favorable.

Forecast: We will probably get dueling factors today. We expect the dollar to lose support when the debt ceiling deal gets done, the illogical outcome but the standard perverse one in the FX mindset. Less risk, less return.

Offsetting the debt ceiling issue, PCE inflation is expected not to improve at all or at least not enough to deter the Fed from another hike, even if that hike is deferred to the July meeting and June gets skipped. That makes June a “hawkish hold” and may provide underlying dollar support that limits any position paring from the drop in risk from the debt ceiling story.

But first things first. First is the debt ceiling and the holiday. Both suggest paring long dollar positions. Do NOT forget that Monday is a holiday in the US and traders will start taking off as early as noon today. FX liquidity will crash after the European close and the US data today. Any re-positioning then will not necessarily reflect new sentiment—only paring ahead of the holiday. Don’t be fooled! In fact, Monday is a double FX market holiday with the UK also closed for a bank holiday.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.