The big data today is US Nonfarm Payrolls

Outlook: The big data today is US nonfarm payrolls, expected at 185,000 by economists in the Bloomberg survey, down from 236,000 in March and with unemployment up a notch to 3.6%. Reuters has 180,000, unemployment up the same 3.6% and names average hourly earnings up 0.3% m/m and 4.2% y/y, the same as the month before.

“But other measures such as the Employment Cost Index and the Atlanta Fed's wage tracker show momentum. Even at the current pace, wage growth in the employment report remains too strong to be consistent with the Fed's 2% inflation target.”

These forecasts run counter to the ADP private sector forecast of 296,000. In a battle of the contributing factors, the JOLTS report showed vacancies down, firings higher, and quits falling, a sliver of a suggestion the labor market is a tiny bit less tight.

We doubt JOLTS is appropriate for forecasting payrolls and to be fair, the ADP version seems no better than the old version. ADP often has wild variation from the actual, and boasting it’s better than all the rest of the forecasts doesn’t make up for that.

The divergence between the Fed message and market behavior is getting tiresome. Mr. Powell made it perfectly clear that progress on inflation is nice but does not yet suffice to harbor thoughts of a cut, and the Fed is not contemplating a pause. But still the forward markets call for a cut this year, perhaps even as soon as the next meeting. Bloomberg reports “… traders expect the central bank to take back Wednesday’s quarter-point hike almost immediately, with swap contracts penciling in a rate cut by July. At one point, the June swap rate reflected one-in-four odds of a cut at next month’s meeting.”

And maybe that’s not entirely nuts: “Looking at the past 17 hiking episodes, the two-year, 10-year Treasury yield curve bottoms out 108 trading days before the first rate cut, according to a Bespoke Investment Group report.” And we reached that point on March 8 with negative 111 points. Counting from there, that puts 108 trading days in mid-August — “sandwiched between the Fed’s July 26 and September 20 rate decisions.”

Bloomberg notes another forecast is based on how long the Fed tends to stay on hold. BMO Capital Markets comes up with an average of seven months at the terminal rate, and if the Fed is done now, the cut would come in December.

We like data as much as the next guy and always enjoy people forcing data into waves and cycles, but while human behavior remains fairly constant, conditions can be dramatically different. Humans making decisions today are not accustomed to inflation and grew up on cheap or free money. We also have some strange labor market conduct that may be due to simple demographics--or something quite different and unexplained.

It’s safe to say technology is seriously different from the last time, too, and that contributed to astonishingly fast bank deposit withdrawals that would not have occurred even as recently as 2008-09. Herd behavior is affected by the speed of modern technology. In recent days it went after additional regional banks, but is easing off today. And stock market performance is heavily influenced by fads in options that are the same thing as short-selling, itself influenced by influencers at the big investment management houses- itself a herd of its own.

So instead of counting how many angels can dance of head of a pin (and leap to other pins), let’s remember the Samuelson quip that an inverted yield curve has predicted 37 of the last three recessions. If the inverted yield curve is not a realistic predictor and just herd behavior, should we be paying heed to it? Well, yes, for the short term and opportunistic trading, but market sentiment based on barely founded assumptions is not to be trusted.

What can be trusted is the Fed absolutely, positively needing to respond appropriately to inflation. That’s its job, and if it strays from the path, Congress will come down on it like a ton of bricks and threaten the Fed’s independence. So, we need to revert to fundamentals. Payrolls and wages are secondary contributors. The real deal in inflation.

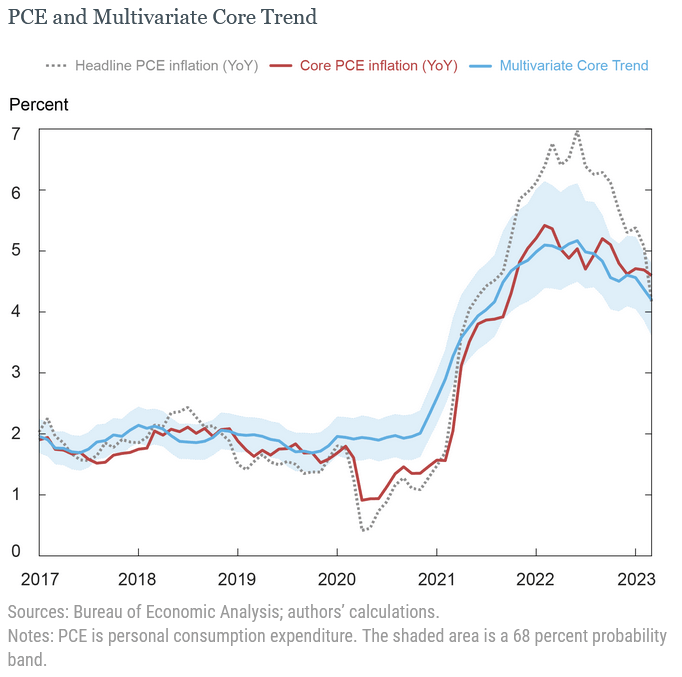

And we have a fresh take from the New York Fed and its Multivariate Core Trend. This is based on the monthly data for the seventeen major sectors of the PCE price index.

The result this time is a drop to 4.2% in March from 4.4% in February (revised from 4.5%) but with super-high uncertainty and thus a likely range wider than we like at 3.6-4.8%. Core PCE inflation also fell to 4.6% in March from 4.7% in Feb.

Bottom line—nowhere near the Fed target of 2%, if headed there. It won’t get there by July or September, either, and so realistically, talk of the lessening inversion of the yield curve pointing to a cut is just sophistry. Inflation is sticky and even the most optimistic of assumptions about lag doesn’t get us to a cut this year. Exactly as Mr. Powell said.

Forecast: The Fed is not pausing even though the markets insist it is and will be cutting rates quite soon. This is a fairy tale and can end badly. Across the pond, the pound is doing better than anyone expected on data nowhere near as bad as expected and economic resilience to be reflected in a hawkish BoE rate decision and rhetoric next week (despite the side show of Labour outperforming in local elections). In the eurozone, a tepid 25 bp hike yesterday will nevertheless be followed by at least one more hike, with Gov Lagarde making it clear the bank is not pausing.

So, if we think traders favor currencies with hawkish central banks, the dollar is toast, even if the Fed is more hawkish than US markets now believe. To imagine the Fed will retreat in the face of unemployment or regional bank turmoil or even the debt ceiling crisis is to disregard its mission—to lasso inflation to the ground.

As usual we warn that trading FX on payrolls day is unwise. Extreme volatility can take prices slicing through both stops and targets. You can get the forecast right and still lose your shirt.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat