For most traders the fact the rate cut is fully factored means they are turning their backs on the opportunity. But for the professionals there’s a lot more to it.

The “Statement” is the key. Will the RBA signal further rate cuts or hold off for now? That’s the question and the answer to the next major move in the AUD.

If the RBA cut rates…the AUD will hardly move. If they don’t, it will be 100 points higher in 5 seconds.It all comes down to the statement.

We want to know if they are still considering cutting rates further. If this line is still in, then consider it as another cut coming next month. If it’s out, then the currency may in fact rally.

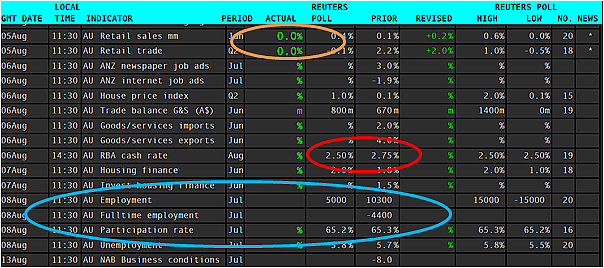

Unemployment data on Thursday will be huge as it’s the first piece of the puzzle following the Rate decision. We just had weak Retail Sales so another big weak number and another cut next month will be a forgone conclusion anyway regardless of what the statement says today.

Big day really….. So watch the statement! Good Luck.

Recommended Content

Editors’ Picks

EUR/USD holds steady above 1.0500 ahead of FOMC Minutes

EUR/USD trades marginally higher on the day above 1.0500. The US Dollar struggles to preserve its strength amid a modest improvement seen in risk sentiment, helping EUR/USD hold its ground before the Fed publishes the minutes of the November policy meeting.

GBP/USD extends recovery, trades near 1.2600

GBP/USD extends its daily recovery toward 1.2600 in the European session on Tuesday, following a slump to the 1.2500 area in Asian trading. The pair finds footing as the US Dollar retreats with markets looking past Trump tariff threats, bracing for FOMC Minutes.

Gold stabilizes after sell-off on hope of ceasefire in Lebanon

Gold stabilizes in the $2,630s on Tuesday after sliding almost three percent – a whopping $90 plus – on Monday due to rumors Israel and Hezbollah were on the verge of agreeing on a ceasefire. Whilst good news for Lebanon, this was not good news for Gold as it improved the outlook for geopolitical risk.

Trump shakes up markets again with “day one” tariff threats against CA, MX, CN

Pres-elect Trump reprised the ability from his first term to change the course of markets with a single post – this time from his Truth Social network; Threatening 25% tariffs "on Day One" against Mexico and Canada, and an additional 10% against China.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.