Taxing billionaires isn't a solution to the government spending problem

Most people don't understand the enormity of the national debt, the amount of government spending, or the size of the monthly deficits. As a result, they come up with all kinds of absurd "solutions" to the problem.

Whenever I talk about the national debt and government spending, somebody invariably comes at me with some variation of, "We just need to tax the rich more."

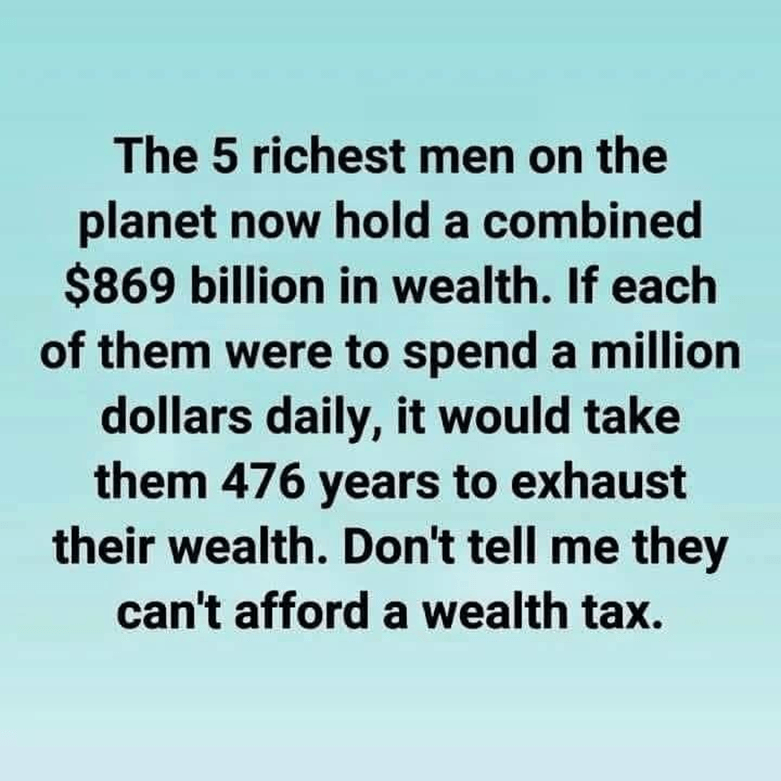

I recently ran across this meme on social media.

Whether or not they could afford a wealth tax is immaterial. The real question is: what good would it do?

(On a side note: the meme uses the five wealthiest people on the planet. One of those people is from France. I don't think the U.S. can tax that individual, although I'm sure it would love to.)

If you read the meme through an emotional lens, and if you don't understand the arithmetic of government spending, you might think taking some of that $869 billion would solve the debt problem.

It wouldn't.

In fact, taking the entire $869 billion would have virtually no impact on the debt or the deficit. It would be like throwing a pail of water into the ocean.

Before I get into the numbers, it's important to note that most wealth is in the form of stocks, real estate, and other assets. It's not like these billionaires are rolling around in vaults of cash. One bad day in the stock market or a real estate bust could quickly wipe out big chunks of that wealth. But for the sake of argument, let's pretend the entirety of billionaire wealth is held in cash and can be confiscated.

The Biden administration blew through $566.7 billion in April. That was right around the average monthly federal outlays for fiscal 2024. That means Uncle Sam spends about $142 billion per week. So, if you confiscated all of the wealth of the top five billionaires, it would fund federal spending for just over six weeks.

Then what?

Of course, there are more than five billionaires in the U.S. As of March 2024, America's billionaires controlled about $5.5 trillion in wealth, according to Forbes.

In fiscal 2023, the federal government spent $6.3 trillion. So, you could take all of the wealth of all of the billionaires in the country and it wouldn't even fund federal spending for one year.

But wouldn't a wealth tax help close the deficit and at least stop the increase of the national debt?

In fiscal 2023, the deficit averaged about $147 billion per month. That means taking all of the wealth from our top five billionaires would cover the deficit for about six months.

That's hardly a solution.

If you took all of America's billionaires' wealth, things look a little better. The government could remain deficit-free for about 39 years, assuming spending remained the same. Of course, the math isn't that simple because the country would lose the productivity generated by those billionaires and other tax revenues would plunge.

And spending wouldn't remain the same. If the government had more revenue, it would spend more money.

Even if everything remained equal, it would still leave a $34.7 trillion national debt.

By the way, all of the wealth held by billionaires in the U.S. is just under 15.9 percent of that national debt.

The bottom line is if you think taxing billionaires would solve anything, you don't understand math. The government doesn't have a revenue problem. It has a spending problem.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.