Consolidating sharp Monday‘s gains, S&P 500 did OK through the soft landing supportive retail sales, and bonds reliably showed further way. And that was higher – strong 20y Treasury auction tone continued through CBO raising deficit estimates to less than $2T. Similarly to precious metals, stocks had all the reasons to go down to consolidate, but they did not – and the holiday effect worked perfectly as per my predictions.

Today, we got SNB cutting, and the BoE expected to do nothing, which it did. The theme is one of upcoming positive economic surprises bucking the underwhelming trend lately, together with mroe disinflationary data allowing not just the Fed to cut in Sep (the odds of doing nothing are only 34% now). That‘s probably what crude oil alongside not declining copper are trying to say here – whatever increase in core inflation we would get, is to get balanced by the shelter component.

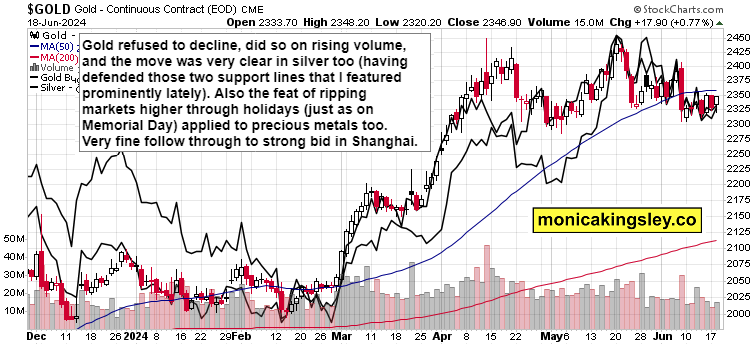

This meaningful chart is clear about where we‘re heading.

Gold, Silver and Miners

Precious metals are rewarding composed decision making, with $2,285 and $28.80 spot prices holding, and both metals turning up. $30.50 XAGUSD is already being challenged, following which I‘m looking at beating $31.75 as the real test of silver bulls not losing the rocket fuel. Not that a measured grind higher above this resistance would be an issue, especially if accompanied by strengthening commodities and base metals (should copper clear $4.55, the picture would get even more positive – tentative optimism on the red metal is in place).

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD retreats from daily highs, holds above 1.0800

EUR/USD loses traction but holds above 1.0800 after touching its highest level in three weeks above 1.0840. Nonfarm Payrolls in the US rose more than expected in June but downward revisions to May and April don't allow the USD to gather strength.

GBP/USD struggles to hold above 1.2800 after US jobs data

GBP/USD spiked above 1.2800 with the immediate reaction to the mixed US jobs report but retreated below this level. Nonfarm Payrolls in the US rose 206,000 in June. The Unemployment Rate ticked up to 4.1% and annual wage inflation declined to 3.9%.

Gold approaches $2,380 on robust NFP data

Gold intensifies the bullish stance for the day, rising to the vicinity of the $2,380 region following the publication of the US labour market report for the month of June. The benchmark 10-year US Treasury bond yield stays deep in the red near 4.3%, helping XAU/USD push higher.

Crypto Today: Bitcoin, Ethereum and Ripple lose key support levels, extend declines on Friday

Crypto market lost nearly 6% in market capitalization, down to $2.121 trillion. Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) erased recent gains from 2024.

French Elections Preview: Euro to “sell the fact” on a hung parliament scenario Premium

Investors expect Frances's second round of parliamentary elections to end with a hung parliament. Keeping extremists out of power is priced in and could result in profit-taking on Euro gains.