Spain: A widespread easing of inflation in sight?

In its second estimate, the Spanish statistical institute (INE) raised slightly the harmonised inflation rate (HICP) for November from 6.6% y/y to 6.7% y/y. This is still a significant decline from the 10.7% y/y figure reported in July, as Spain now reports the smallest rate of inflation in the Eurozone. Energy prices, the main contributor to this deceleration, are falling back sharply, dropping from an 8% y/y increase in October to 4.5% y/y in November. The 3m/3m measure provides an even better illustration of the size of the recent decline: it dropped to -49.3%, the steepest decline since the current statistical series began in 2002. Although the core HICP (excluding energy and fresh food prices) picked up from 6.2% to 6.3% y/y, the 3m/3m (4.4%) declined for the third consecutive month, suggesting the year-on-year rate will head downward this winter.

Although peak inflation seems to have been reached, price pressures are likely to stay at a high level in 2023. To limit this risk, the government plans to expand its anti-inflation package – which proved to be effective on energy prices – to include measures to contain food prices. The specifics of this package have not been released yet.

With wage growth holding below inflation, household purchasing power continues to erode. According to INE, nominal wages rose 0.7% q/q in the third quarter and 2.9% over the past 12 months. Excluding the INE category “bonuses and late payments”, the increase of salaries was even smaller, up 0.3% q/q and 2.3% y/y, respectively.

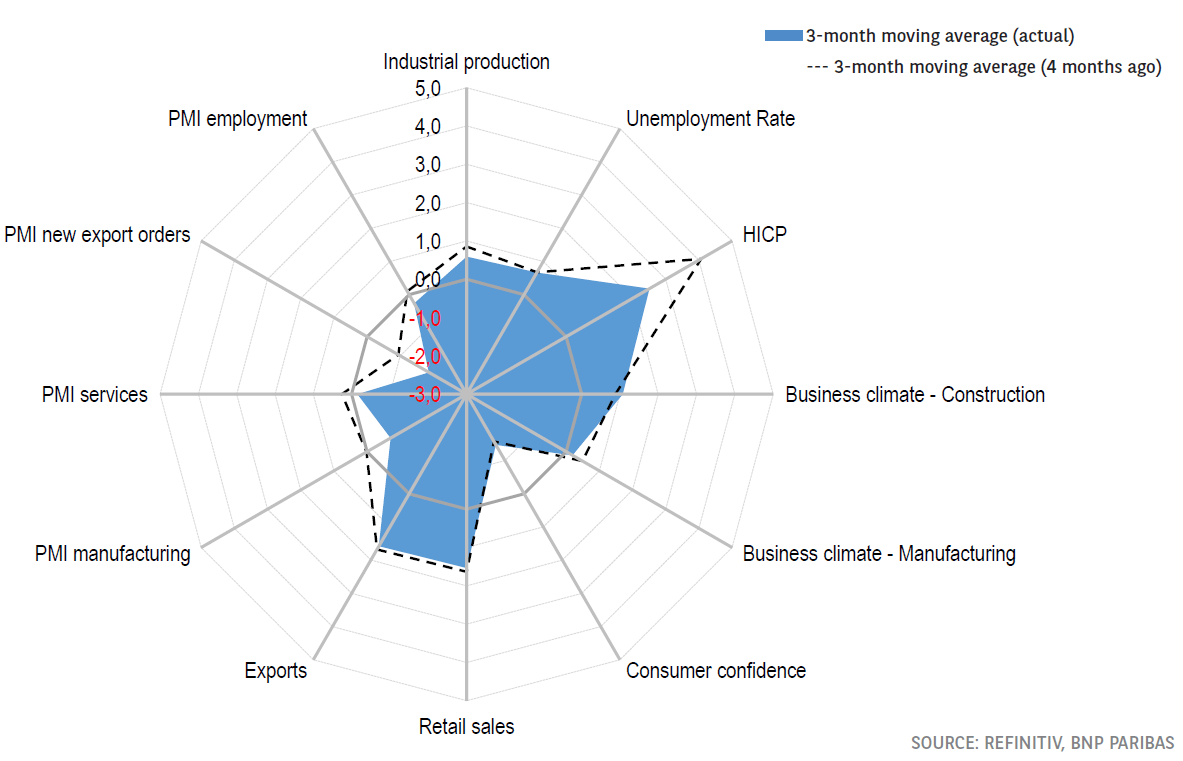

Yet the level of wage increases that companies are willing to give could be hampered by the deterioration of the economic environment (as shown in our barometer). According to the European Commission survey, business confidence in Spain deteriorated in November, down 3.4 points to 7.7. This mainly reflects the increasingly clear decline in demand. The indicators for order books, export orders and production have continued to fall since spring. Although the manufacturing PMI rose slightly in November, up 1 point to 45.7, it is still largely mired in contraction territory. According to these surveys, industrial output should drop after holding flat since the beginning of the year. This is already the case in certain industries hard hit by the energy crisis, including chemicals (-10.1% since the beginning of the year), paper (-4.7%) and lumber (-15.9%).

Spain: Quarterly changes

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.