S&P 500 Index Forecast: Bank's earnings in focus, COVID-19 induced insolvency fears simmer away

- The S&P 500 will be a key theme on Q2 earnings this week, traders watching the banks for guidance.

- Wall Street stocks remain in bullish territory, but the S&P 500 is on thin-ice while below the June highs.

- A relentless COVID-19 pandemic has bankrupted hundreds of US companies and US unemployment remains a ticking time bomb for the financial sector.

The week ahead will be a busy one on Wall Street with an entire quarter of the coronavirus addled economy transpired through second quarter, (Q2), earnings season.

Of particular interest will be the banks reporting their earnings for the period.

There are stronger concerns for insolvencies, at both corporate and personal levels, considering how significant the risks pertaining to the second wave of the coronavirus are to the US economy, companies and the workforce.

All pre-market, we are going to have JP Morgan Chase, Wells Fargo and Citi Bank on Tuesday, Goldman Sachs on Wednesday, Bank of America and Morgan Stanley on Thursday for which implications we will delve into further below.

How did the benchmarks perform?

But first, let's make a quick recap of the close on Friday.

US stocks and their subsequent indexes were higher at the close of trade.

Gains in Consumer Goods and the Oil & Gas stood out, along with the financials sectors.

By the close of play, the Dow Jones Industrial Average had tallied a 1.44% gain while the S&P 500 index added 1.05%, and the NASDAQ Composite index added 0.66%.

The top performers on the S&P 500 were Carnival Corporation which rose 10.84% to 16.16, Royal Caribbean Cruises Ltd which was up 9.87% to settle at 51.77 and Marathon Petroleum Corp which gained

8.55% to close at 36.20.

The worst performers were Mohawk Industries Inc which was down3.62% to 70.47 in late trade, Synopsys Inc which lost 3.20% to settle at 198.01 and Regeneron Pharmaceuticals Inc which was down 3.09% to 620.86 at the close.

Meanwhile, the CBOE Volatility Index, which measures the implied volatility of S&P 500 options was down 6.73% to 27.29 a new 1-month low.

Gold prices were also struggling to convince around $1,800, closing below it and down 0.24% on the day.

Finally, the US 10-year yields were up 2 bps to 0.6348%.

The S&P 500 index ended the week of July 10 up 32.9 points, or 1%, closing out a volatile week with a 1.7% gain.

All in all, a fairly upbeat session on Wall Street to close a positive week for stocks, despite the growing numbers of COVID-19 cases in the US.

Themes in play

Also, at that time, news came out that the US Supreme Court, by a 7-to-2 vote, ruled that New York prosecutors could enforce a subpoena for the President's financial and tax records.

There were a couple of positive headlines, one of which was settling some concerns over the US Supreme Court ruling, by a 7-to-2 vote, that New York prosecutors could enforce a subpoena for the President's financial and tax records.

Instead, the sentiment is that delays could force their release until after the November election.

However, offsetting another day of record new cases and a surge in coronavirus deaths, the bulk of the gains appeared to be largely driven by an announcement from Gilead Sciences that treatment for COVID-19 was showing positive results in phase 3 trials.

The Week Ahead: US banks earnings in focus

While the markets have been fixated the stellar performance of the NDX, the US financial sector is now going to be put firmly under the spotlight.

Some might say that the US stock markets have come through a phase of 'hope', where we have seen an unprecedented come back since the start of the 2020 crash.

However, the impact of the virus has been seen a huge societal change which many predict will be the root cause of the largest insolvency event in all history.

As the coronavirus pandemic shows no sign of receding, the threat of secondary lockdowns and social distancing, COVID-19 is bankrupting American companies at a relentless pace.

From oil companies and gyms to apparel retailers, Brooks Brothers, with a history that goes back to 1818 have declared bankruptcies since March.

"Since early March, at least 114 companies have cited Covid-19 as a factor in the decision for bankruptcy," Bloomberg News reported.

This only serves to illustrate the ongoing extreme stress in the jobs market.

The total number of people claiming benefits under ALL programs has been on the rise as a broader range of people qualify for benefits under the Pandemic Unemployment Assistance program which had 14.4mn claimants as of week June 20.

This suggests unemployment is closer to 20% than the 11.1% currently listed as the “official” rate.

Economists at the Federal Reserve had warned that the unemployment rate could rise to more than 32% over the summer months as more than 47 million Americans lose their jobs.

With all this in mind, we will be watching closely to any guidance provided by US banks as earnings season gets into gear on Tuesday.

Investors will care about only two things: 1. how much money will US banks lose on loans because of the coronavirus recession and 2. guidance.

Any significantly higher provisioning for souring loans or a lowering in guidance stand to insert more volatility into the equation for the S&P 500 index this week.

However, you should note that only 49 of the S&P 500 companies currently provide guidance.

Besides for news on a banks’ capital return plans, investors will want to hear from the likes of CEO of JP Morgan Chase, Jamie Dimon, for answers on just how bad a prolonged recession will be for the banking sector.

Not only will these bank's results tell us a lot about their own business, but the sheer scale of assets they own will help inform the market about the economic outlook for the entire US economy for H2.

Moreover, equity valuations are already high and vulnerable to such matters due to a divided Congress that is still no closer to announcing the second round of payments to households.

Government support remains critical to the outlook for US equities.

Monitoring the US banking sector

The positive news about remdesivir was helping boost this industry last Friday

The biggest-gaining financial services and bank stocks included American International, Group Comerica and People's United Financial all up 7%.

Megabanks CitiGroup, U.S. Bancorp, Wells Fargo, JPMorgan Chase and Bank of America all had a huge day, up between 5.4% and 6.4%.

Friday set a hopeful tone for the big banks heading into this week.

Meanwhile, rather than trading individual stocks, there are a few ETFs that investors like to monitor the US banking sector from a price perspective.

One of which is via the XLF, standing for the Financial Select Sector SPDR Fund.

The XLF is useful when wishing to monitor the health of financial stocks within the S&P 500.

It is a tradable index that seeks to provide an effective representation of the financial sector of the S&P 500 Index.

The index had started to climb mid-march until the start of June from where the index peaked and dropped significantly in a 50% mean reversion of the recovery period.

On Friday, ahead of the earnings week for the banks, the index rallied some 3.4%.

Another is via the SPDR S&P Bank ETF, or the KBE.

KBE finished the day up 4.8% on Friday, the best-gaining sector for the end of the week.

Still, investors remain very down on the banking sector. To date, the SPDR S&P Bank ETF is down 37% from 2020 highs.

US data this week

Meanwhile, we will have more sentiment around the consumer from this week's Retail Sales.

Analysts at TD Securities said that they likely rose fairly sharply again in June, even with stalling late in the month. "The stalling likely reflects the renewed uptrend in COVID cases as well as the boost from stimulus payments starting to fade.

The stimulus payments, along with expanded unemployment benefits, temporarily led to income surging, even with a huge net decline in employment."

To a lesser degree, traders will be looking to the Consumer Price Index as well, which was likely boosted by a bounce in gasoline prices, the analysts at TD Securities suggested.

"Core inflation probably also turned positive again, led by a reversal of some of the recent plunge in travel-related prices. The data will likely still show significant net slowing: Our forecast implies YoY readings of 0.5%/1.1% for overall/core prices, down from 2.3%/2.4% four months earlier (pre-COVID)."

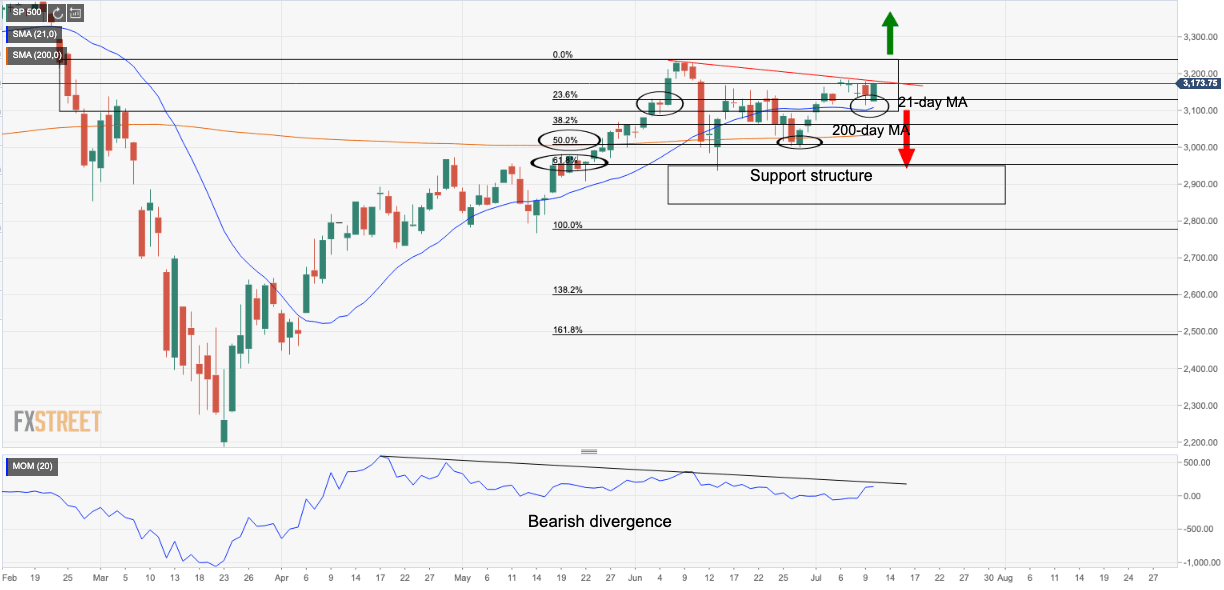

S&P 500 Index technical outlook

The main points of this daily analysis are with the June peaks towering over recent highs, creating a bearish trendline resistance.

The bulls need to get and hold above the June peaks or run the risk of slipping below the 21-day moving average.

A break below the 21 DMA would equate to a break of the current support structure opening risk to a 50% mean reversion of the May rally.

The price would meet a confluence of the 200 DMA and the late June support. This guards a run to a 61.8% Fibonacci retracement and prior support structure.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.