Outlook: Regular folks and economists alike are puzzled and confused by conflicting data. It’s interesting that nobody is talking about the Philips Curve these days–that’s the theory that unemployment must rise for the Fed to lasso demand-driven inflation. In a slowdown, let alone a recession, unemployment should be rising, not falling to the lowest since 1969.

But Atlanta Fed Pres Bostic is the first to say the wildly strong jobs report last week means the Fed has to consider a higher ending rate than imagined. Bloomberg says “He reiterated his base case for rates to reach 5.1%, in line with the median of policymakers’ December forecasts, and stay there throughout 2024.” And yet market tea-leaves continue to show the Fed starting to ease in the second half of the year. We get a Powell speech today which will likely be rinse and repeat.

We are confused perhaps because two things collided and we are getting the fallout. The first is the pandemic and recovery from it, creating completely new behaviors. Second is the peculiar and perhaps irrational financial market behavior, like a majority contradicting the Fed about the terminal rate and the end of hiking.

First we have recovery from the pandemic, which was wild and had characteristics we have never seen before, like the jump in savings, due mostly to the government handouts. At the same time, except for the 2020 lockdown months, consumer spending kept to a rising trend, more or less in line with jobs created and actually steadier. The consumer is two-thirds of the US economy and it’s a different consumer than before Covid–a lot more work from home vs. hardly any pre-pandemic, more interest in the quality of life than in ambition, a surge in green interest, and heaven only knows what else. Something we can almost smell–this is not your grandfather’s Oldsmobile.

Adding to what we must name culture-changing is the large swathe of workers who just plain quit and are not coming back. First, the 65 and older gang. In 2020 they were 16.9% of the population and “As of the third quarter of 2021, 50.3% of U.S. adults 55 and older said they were out of the labor force due to retirement, according to a Pew Research Center…..” Pre-pandemic, it was 48.1%. “… in the third quarter of 2021 66.9% of 65- to 74-year-olds were retired, compared with 64.0% in the same quarter of 2019.

Those seems like fractional changes but with the 65 and over population at about 3.5 million over the past two years, it adds up. The Bureau of Labor Statistics thinks the pandemic/retirement relationship will fade and older folks will either come back or stay longer. But they have some savings, buttressed by inflated home prices, and we have our doubts. A brush with death–those photos of portable morgues--makes you stop and smell the roses.

Then there are the younger folks undergoing the “great resignation.” While the data shows workers stay at the same job about the same as in earlier decades, voluntary quitting increased substantially in 2021. See the chart, selected deliberately to show earlier years. What had been about 2% moved to 3%. Again, a fractional move but in a labor market of some 163 million persons, 1% is 1.63 million. It all adds up. And let us assume that the tens of thousands of tech workers recently let go will mostly get hired again, but many will join the gig economy. The Feds were not being silly when taking the reporting requirement at Paypal and Stripe, et al. to $600.

The second Big Factor driving confusion is weird financial market gyrations in which corporate bonds pay less than US sovereign paper (in some tenors), the stock market rises after the Fed hikes, and a slew of other things that haven’t happened before or hardly ever–and all at once. Example: the ML/BoA bull/bear needle went up toward bullish from near zero–after the Fed hiked last week. If the dollar goes up, we claim it’s because of x and y, but when it falls, we still name x and y, only in the context of risk perception instead of economics. Tried-and-true relationships are upside down. Correlations and inverse correlations are not normal--VIX and the dollar, oil and gold and the dollar, even the S&P and the dollar. FX ignores political stuff–except when it’s convenient, as in “geopolitical risk” that can be ignored 10 times but comes in handy to explain an otherwise inexplicable 11th time.

Despair ye not. A topsy-turvy world will look clearer in the rear-view mirror when we accept that prices come from money flows in a world in which segmentation is changing. Segmentation comes in the form of the demographics, like the baby boomer retirements, and in assets themselves. The big new segment there is, of course crypto, which is not dead. Bitcoin tanked to 15,757 on Nov 9 but has more than recovered to 23,705 last evening for no reason other than the madness of crowds. The retail financial press is choking on articles questioning the classic 60-40 ratio. Big money managers went seriously underweight US equities during the pandemic and are still there as the S&P has added 78% since the bottom in 2020. And most of all, the market denying the Fed is right about higher for longer.

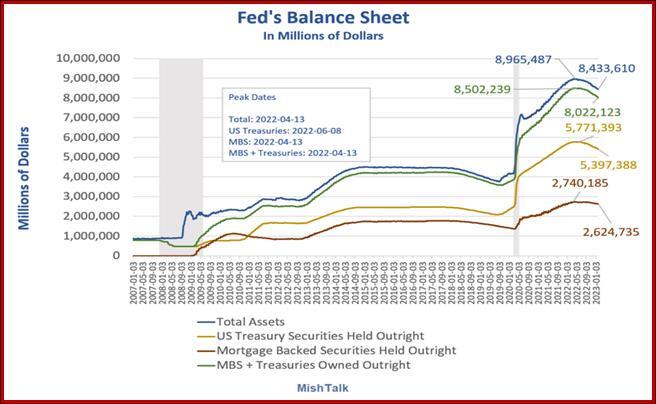

Finally, notice that hardly anyone is talking about TE anymore–that dumping of Treasuries at the Fed that was going to crash markets and the economy. Well, the Fed has been shedding assets since June, or over six months, quietly and carefully, so that only the most diehard Fed critics see it. See the chart from Mish Talk. There is nothing here to frighten the horses.

Tonight we get Biden’s State of the Union address. He will boast about authentic accomplishments but it won’t move the favorability dial, stuck down around 41%. This is another curiosity–why do people not acknowledge real success? At a guess, it’s not a vote on achievement but rather on age. The majority of the Dems simply think someone who is 80 is too old to lead, and besides, if Biden were to die in office, we’d get the screechy/whiny Harris.

Normally the state of the union speech is not of interest to market players, but this time there is the possibility Pres Biden will announce a tax on billionaires to pay for the deficit that so bothers the Republicans (if only when a Dem is in the White House). They will scream bloody murder, of course, but at least it will turn attention away from that Chinese balloon and back to the debt ceiling. The Republicans have every intention of driving the US into default with no plan or policy stance whatever to fix the debt problem. Sovereign default is a very big deal that these bozos seem not to appreciate and Pres Biden will call them out. What shame hardly anyone will be listening.

Forecast: We have changed the signals for sterling, the yen and the peso. The euro and Swissie are up next after we get through whatever consolidation we see today.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD: Next on the downside comes 0.6500

Further gains in the US Dollar kept the price action in commodities and the risk complex depressed on Tuesday, motivating AUD/USD to come close to the rea of the November low near 0.6500.

EUR/USD: No respite to the sell-off ahead of US CPI

The rally in the Greenback remained well and sound for yet another session, weighing on the risk-linked assets and sending EUR/USD to new 2024 lows in the vicinity of 1.0590 prior to key US data releases.

Gold struggles to retain the $2,600 mark

Following the early breakdown of the key $2,600 mark, prices of Gold now manages to regain some composure and reclaim the $2,600 level and beyond amidst the persistent move higher in the US Dollar and the rebound in US yields.

SOL Price Forecast: Solana bulls maintain $250 target as Binance lists ACT and PNUT

Solana price retraced 7% from $225 to $205 on Tuesday, halting a seven-day winning streak that saw SOL become the third-largest cryptocurrency by market capitalization.

Five fundamentals: Fallout from the US election, inflation, and a timely speech from Powell stand out Premium

What a week – the US election lived up to their hype, at least when it comes to market volatility. There is no time to rest, with politics, geopolitics, and economic data promising more volatility ahead.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.