Outlook: We get nonfarm payrolls today, an interesting event because most markets are closed for the holiday. The WSJ forecast is a gain of 238,000 jobs and the unemployment rate the same 3.6%. No matter how hard the pundits stretch, you can get only so much cooling of the hot labor market.

As we warned yesterday, the press can be brazenly misleading. The WSJ headlines “cooling labor market” from the jobless claims data but that is true only in the context of the BLS having revised its seasonality protocol. Buried down near the bottom of the story: “Claims totals remain close to the 2019 pre-pandemic average of about 220,000.” In fact, the latest week was 218,000.

Granted, we have seen a series of somewhat disappointing data that might be starting to add up to something serious, and off in the corner is the fear of a credit crunch, if not an outright banking crisis. Some of the data includes factory output and the building of inventories, with the ISM manufacturing PMI down to 46.3 in March from 47.7 and the lowest since May 2020—with new orders and employment down (but prices, too).

While we can grant there is a litany of mostly minor economic setbacks, including the Atlanta Fed Q1 GDPNow sinking from over 3% to 1.5%, it’s not at a level that clearly signals recession. That’s what makes the market clinging to the idea of rate cuts this year so puzzling, especially in light of St. Louis Fed Bullard yesterday being crystal-clear--“Financial stress seems to be abated, at least for now. And so it’s a good moment to continue to fight inflation and try to get on that disinflationary path.”

In fact, the Fed’s remediation is working. “Continued appropriate macroprudential policy can contain financial stress, while appropriate monetary policy can continue to put downward pressure on inflation…. I do think we should continue to pursue our interest rate path and make sure that we get the disinflation to occur in 2023 and 2024 so that we put the inflation problem behind us while the labor market is still strong.

“I think inflation’s going to be sticky going forward and it’s going to be hard to get inflation back down to the 2% target. So we’re going to have to stay at it.”

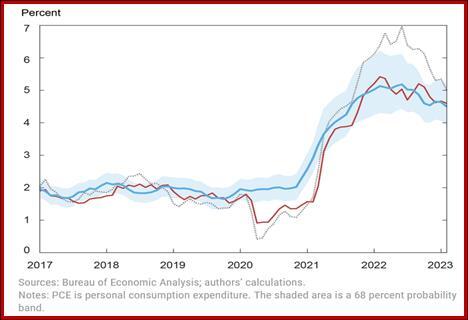

About that sticky inflation—the New York Fed affirms it. The New York Fed has revised its Multivariate Core Trend (MCT) It fell in Feb to 4.5% from 4.6% in Jan but uncertainty is high, resulting wide range of 4-5.2%. This differs very little from the core PCE already reported at 4.6% from 4.7%.

It’s a nice chart, but look how much higher the band lies compared to the Fed’s desired 2%. Not even close. Remember Cleveland Fed Meister expects 3.5% by year-end this year.

“According to our latest estimates, the trend has held steady at a level between 4.5 and 4.7 percent since October 2022 after exceeding 5 percent during most of 2022. The sectoral composition remained stable with the contribution of core goods, core services excluding housing, and housing not too different from their values in October 2022.”

Bottom line: US inflation is sticky and will persist, even if PMI services prices are falling. The labor market will remain tight. The Fed will not get evidence it can stop tightening and as we know from the forecast, it’s willing to accept GDP down to a lousy 0.4% this year without blinking. Those inverting the yield curve are exaggerating, if not entirely wrong. Payrolls today are just another brick in the wall. A high number reinforces the Meister/Bullard stance without giving the dollar any real support. A low number encourages the recession and rate-cut gang—and a falling dollar. We can’t see anything here that supports a rising dollar except position adjustment. And note that commodities are increasingly in the recession-coming camp, including gold (yields down, gold up).

Forecast: We saw a minor dollar firming on short-covering and position-paring due to the holiday, but the primary loser was the pound and did not, surprisingly, include the yen. That could be due in part to expectations of a bad jobs report in the US and the incoming BoJ Gov Ueda on Monday who might ditch curve control, despite his protestations of not having any such plan.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD trades sideways below 1.0450 amid quiet markets

EUR/USD defends gains below 1.0450 in European trading on Monday. Thin trading heading into the Xmas holiday and a modest US Dollar rebound leaves the pair in a familair range. Meanwhile, ECB President Lagarde's comments fail to impress the Euro.

GBP/USD stays defensive below 1.2600 after UK Q3 GDP revision

GBP/USD trades on the defensive below 1.2600 in the European session on Monday. The pair holds lower ground following the downward revision to the third-quarter UK GDP data, which weighs negatively on the Pound Sterling amid a broad US Dollar uptick.

Gold price holds comfortably above $2,600 mark; lacks bullish conviction

Gold price oscillates in a range at the start of a new week amid mixed fundamental cues. Geopolitical risks continue to underpin the XAU/USD amid subdued US Dollar price action. The Fed’s hawkish stance backs elevated US bond yields and caps the pair’s gains.

The US Dollar ends the year on a strong note

The US Dollar ends the year on a strong note, hitting two-year highs at 108.45. The Fed expects a 50-point rate cut for the full year 2025 versus 4 cuts one quarter earlier, citing higher inflation forecasts and a stubbornly strong labour market.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.