Monetary maneuvers: How Japan's decisions affect global markets

Bank of Japan Deputy Governor Shinichi Uchida announced plans to adjust monetary support in line with economic and price projections. The bank intends to reduce its extensive bond purchases over the next one to two years, starting with a formal announcement in July. Consultations with bond market participants are scheduled for July 9-10 to discuss this tapering strategy. The challenge lies in reducing the bank’s nearly 5 trillion balance sheet and implementing rate hikes without destabilizing the Japanese Government Bond (JGB) market. These plans will be further detailed at the policy-setting meeting on July 30-31.

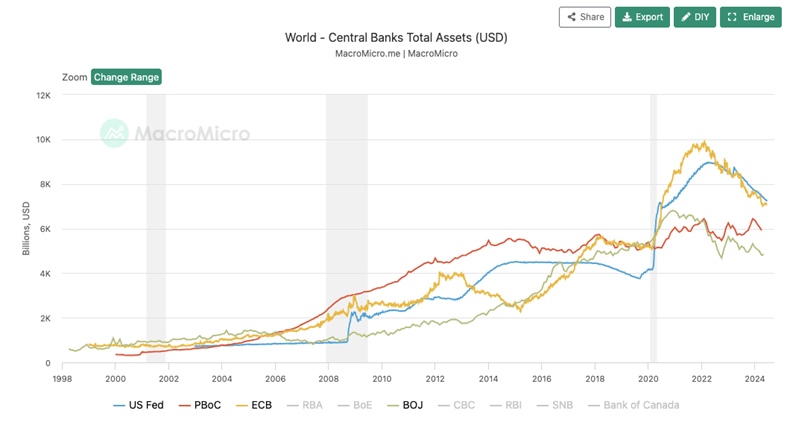

Source: MacroMicro

The balance sheets of the world's four major central banks—Fed, ECB, PBoC, and BOJ—are critical to global central bank liquidity. Changes in their monetary policies can significantly impact global markets. The ECB has started cutting interest rates, and the Fed has reduced the pace of quantitative tightening since June, easing overall central bank liquidity compared to earlier this year.

The BOJ, under Governor Haruhiko Kuroda since 2013, has maintained loose monetary policies, While the ECB and Fed might slightly ease their tightening, making it an opportune time for BOJ to consider tightening.

However, any rapid policy changes by the BOJ could pose challenges for Japan’s economy and JGB market.

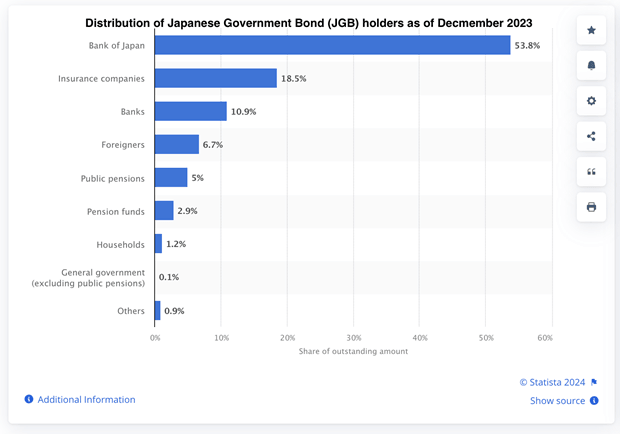

The Bank of Japan (BOJ) controls 53.8% of all marketable Japanese Government Bonds (JGBs), leading to uncertainty about whether insurance companies and banks will expand their JGB holdings. In May's auction, rising long-term JGB yields reflected low demand, casting doubt on the market’s ability to absorb more debt securities. Aggressive tightening by the BOJ could push yields higher. If this happens unexpectedly, a significant drop in the yen might occur, similar to the impact of Liz Truss's mini-budget crisis on the British pound and UK Gilts. This could compel the BOJ to intervene in both currency and JGB markets.

Source: Statista

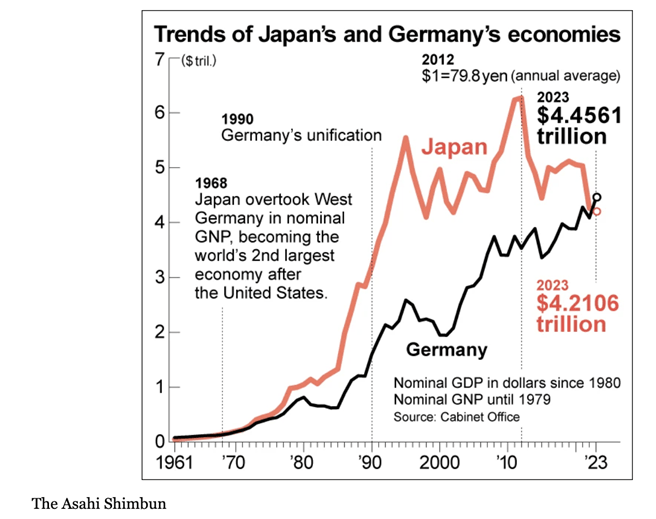

In 2023, Germany surpassed Japan in gross domestic product (GDP) for the first time in 55 years, primarily due to the depreciation of the yen. Further weakening of the yen is not expected to aid economic growth. The Bank of Japan (BOJ) intervened in the currency market to support the yen in 2023 and again this year when it weakened, indicating that the government are not seeking a further decline in the yen's value.

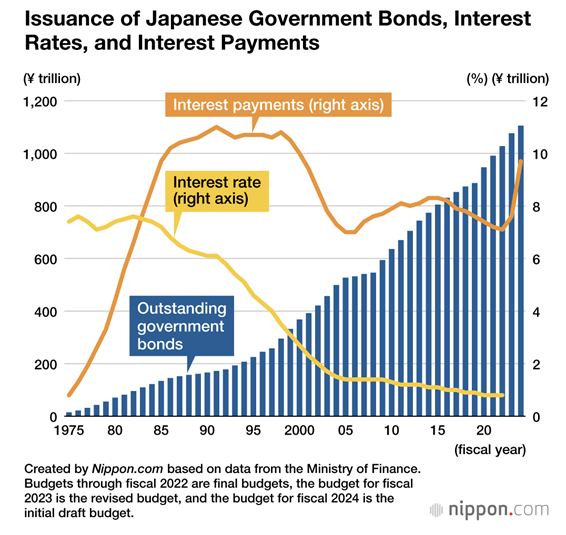

Source: nippon.com

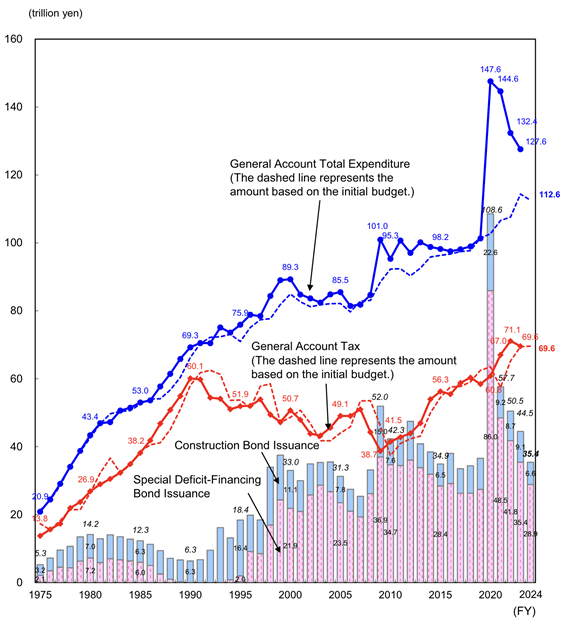

Another challenge for the Bank of Japan (BOJ) is the increasing interest payments on Japanese government debt. If the BOJ reduces its purchases of Japanese Government Bonds (JGBs) too aggressively, it could lead to higher interest payments and necessitate issuing more debt. In contrast to the U.S., U.K., and Eurozone, Japan's inflation rate is only 2.8%, which suggests that any interest rate hikes by the BOJ should be mild.

Since these hikes are expected to be mild, and with no aggressive rate cuts anticipated from the Fed and ECB, the interest rate gap between Japan and the U.S., EU is unlikely to narrow significantly, which means the yen is not expected to appreciate substantially.

Japan's government’s tax revenue and expenditure

Source: MOF

In the coming years, Japan's government is likely to continue issuing new bonds as interest payments increase. The combination of increased bond supply and reduced purchasing by the Bank of Japan (BOJ) could lead to higher yields. To address potential market impacts, the BOJ will meet with bond market participants on July 9-10 to discuss the extent of its future bond purchases and the potential effects of a drop in JGB prices.

Last fiscal year, Japanese corporations reinvested 10.57 trillion yen ($67.8 billion) of their overseas profits abroad, which contributed to the yen not strengthening in February and March—months that typically saw the yen gain over the past 30 years.

Will the Bank of Japan intervenue?

The U.S. Treasury reported that no major trading partner manipulated its currency last year, but it placed Japan on its foreign exchange monitoring list, joining China, Vietnam, Taiwan, Malaysia, Singapore, and Germany. Masato Kanda, Japan's Vice Minister of Finance for International Affairs, stated that excessive currency fluctuations harm Japan's economy and that the government is prepared to intervene if necessary. This reflects concerns that a weaker yen is detrimental to economic stability.

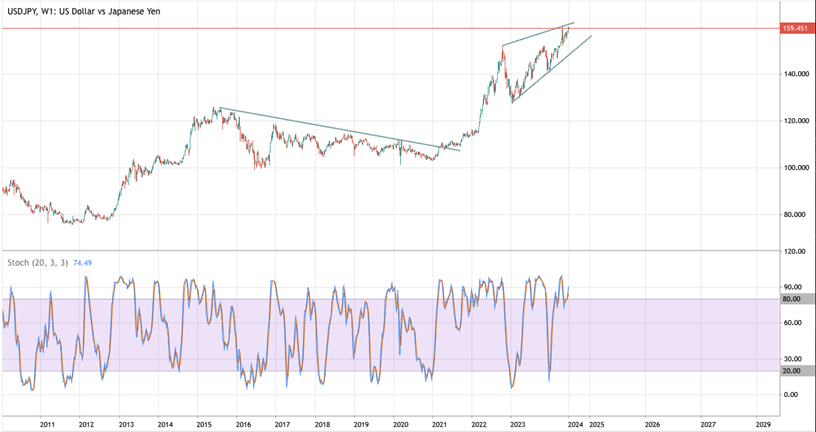

Technical analysis

Source: Deriv MT5

The USDJPY currency pair is showing a rising wedge pattern, a sign that typically suggests a bearish outlook. This pattern narrows as prices rise and the trading range tightens. Technical indicators reinforce this view: the stochastics are overbought and the MACD shows divergence, indicating declining momentum. Resistance levels are identified at 160, and then between 164 and 167, while support levels are positioned between 135 and 140.

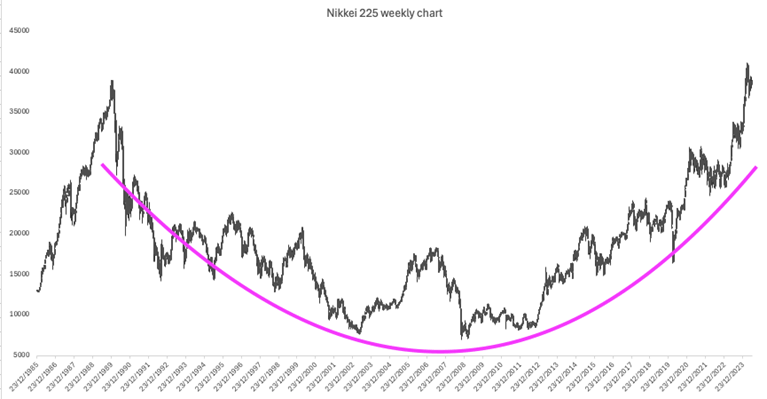

Source: Adapted from Reuters

Since 1987, the Nikkei 225 has established a prolonged round bottom pattern, suggesting a strong foundation for future growth. Additionally, the potential formation of a cup and handle pattern indicates a consolidation phase may occur before another rally ensues.

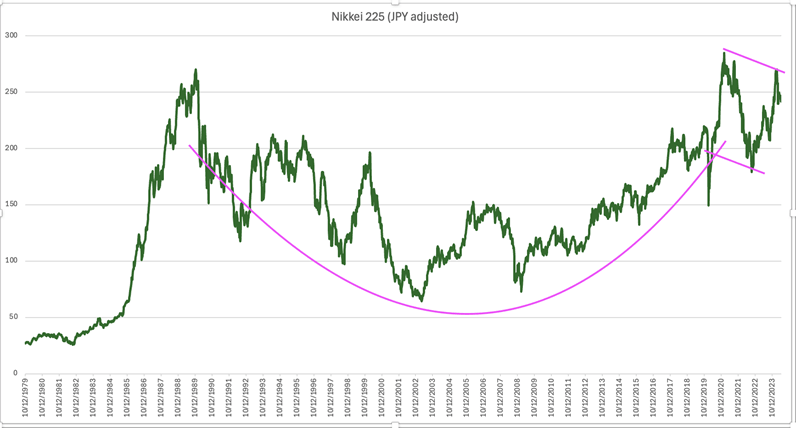

Source: Adopted from Reuters

The weekly chart of the Nikkei 225, adjusted for yen, shows a cup and handle pattern. While a break above the upper resistance line could trigger a rally, it is expected that the Nikkei 225 will consolidate and continue forming the handle in the upcoming months.

Conclusion

The Bank of Japan (BOJ) plans to reduce its bond purchases over the next two years, starting with an announcement in July. This adjustment aims to align with economic projections and follows similar shifts in monetary policy by other major central banks like the ECB and Fed. The BOJ faces the challenge of managing its substantial balance sheet while avoiding market instability. Upcoming consultations and a policy meeting at the end of July will provide further details on the strategy. As global central banks adjust their policies, these changes could significantly influence global markets, interest rates, and economic stability.

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.