Markets quake on Russian invasion of Ukraine but quickly discover Realpolitik

- Russian invasion of Ukraine upends all global markets.

- US Treasury yields fall and the dollar rises as investors seek safety.

- Oil and commodity prices jump, eyeing scarcity, supply disruptions, then retreat.

- Equities crash from growth and recession fears, then stage huge recovery.

The not entirely novel spectacle of Russia invading a former Soviet republic, think Georgia in 2008 and Crimea in 2014, was met by a violent but typical market flight to safety on Thursday. What was unusual was the ensuing reversal in the equity, credit and commodity markets and the partial retreat of the dollar’s advantage.

Traders and investors had initially sought safety in the US Treasury market and dollar, selling equities and sending West Texas Intermediate (WTI) and Brent to fresh seven-year highs.

Dow

CNBC

But by the afternoon close, equities in the US had reversed massive losses to finish in the black and Treasury returns concluded nearly on a par with their open. Crude oil prices executed an almost complete round trip. Only the dollar retained the bulk of its gains, the largest percentage versus the yen and about half in the other major pairs.

Russian sanctions

If the markets’ one day assessment had any theme it would probably be that in the long run Russian President Vladimir Putin will win his gamble to incorporate Ukraine fully into his country’s near abroad without excessive cost to the nation's political standing or economy.

Sanctions are coming from Europe and the United States. They will bite the Russian and global economies, but not deeply, and not for too long. Moscow’s political obloquy will fade quickly and the Russian or client government installed in Kyiv will not be so onerous as to instigate the kind of resistance that doomed Soviet occupation of Afghanistan a generation ago.

The international political logic is harsh but uncompromising. Ukraine is not central enough to Western and US strategic interests, as it is to Moscow, and Europe is far too dependent on Russian oil and natural gas, for the Ukrainian invasion to be a permanent blot on the practical relationship between Russia, Germany, NATO and the West.

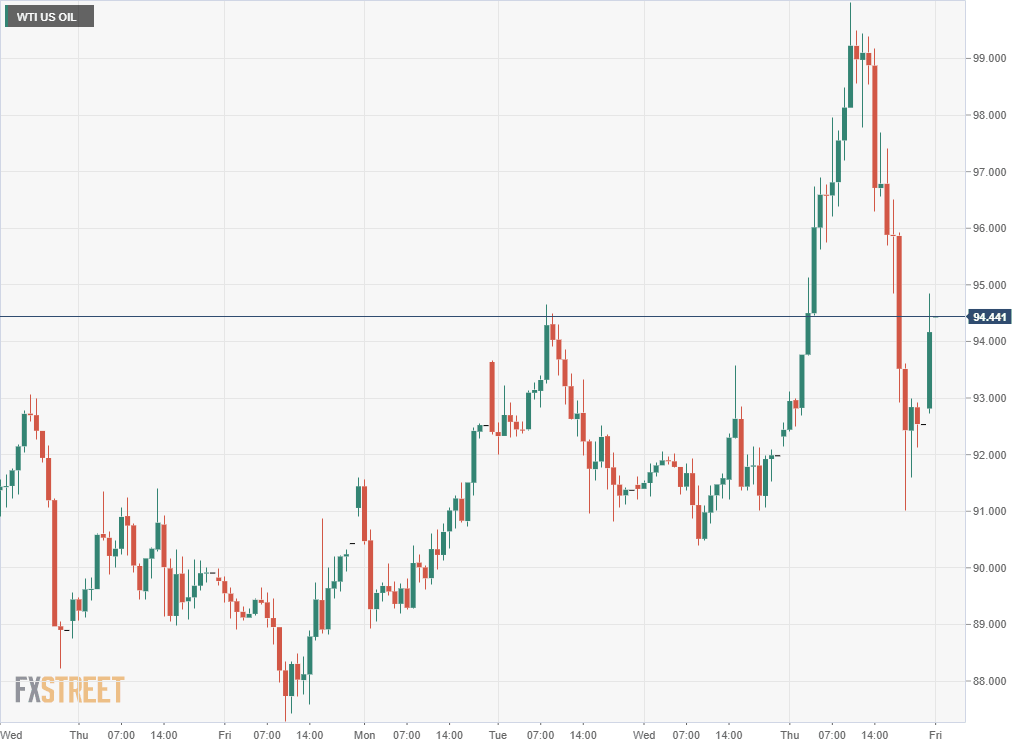

That, at least, is the initial reflection from Thursday’s market actions. What started out as a fearful and potent but standard risk-aversion equity reaction turned into a stock buying free-for-all. West Texas Intermediate (WTI) executed a 8.8% round trip in prices, Brent rose and fell 8.4% and the Bloomberg Commodity Index covered 3.5% top to bottom and return. The dollar rose in every major pair, but except for the USD/JPY, ended with half its initial improvement.

Let's look at the specifics.

Treasury yields and the dollar

Treasury yields sank sharply from the market open as traders bought US securities in the first rush. The 2-year yield closed at 1.60% on Wednesday. Within 10 minutes of the 9:30 am New York open it had shed 14 basis points to 1.46%. The bottom was brief and though the subsequent rally to 1.542% was not uniform–the yield fell back to 1.498% early in the afternoon–it was a fairly steady climb from there to the close at 1.58%, two points below yesterday’s close.

2-year Treasury yield

CNBC

The 10-year yield opened at 1.976%. In the same time frame it dropped to 1.846% then rebounded to close at 1.970%, less than a point down. The 30-year return traded as low as 2.161%--11 basis points down from Wednesday’s 2.275% final quote–but closed at 2.293%, a 2 point increase.

The dollar’s move higher was more gradual, occupying the Asian and European sessions and the retracement, the latter part of New York.

The EUR/USD opened on Thursday 1.1305, dropped almost two figures to 1.1107, before closing at 1.1200. The sterling began at 1.3544, fell nearly 300 points to 1.3273 and finished at 1.3390. The USD/CAD started at 1.2744, ran to 1.2878, and ended at 1.28046.

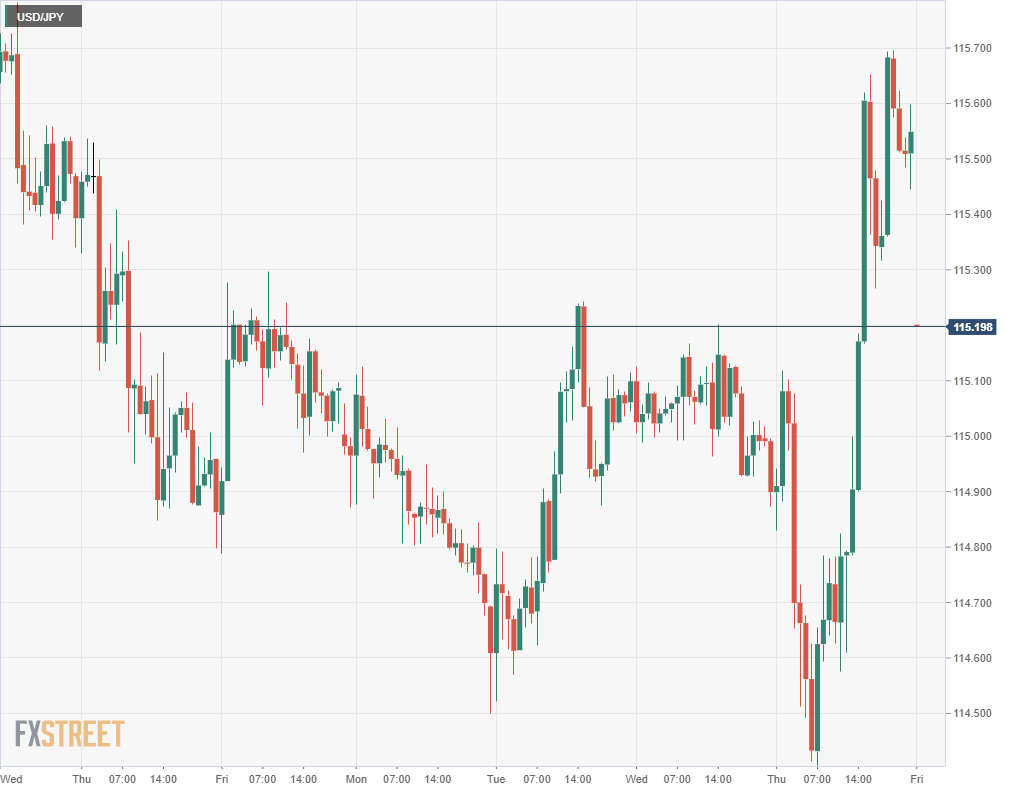

Only the USD/JPY retained the bulk of its earnings, opening at 115.00, moving to 115.70 and finishing at 115.59.

European sovereign yields fared worse than their American counterparts and Japanese returns were mostly unchanged. The Federal Reserve is still expected to hike at least a quarter-point in March, returning some advantage to the dollar.

Oil and commodities

Crude oil had a tumultuous trading day. The North American pricing standard, WTI, opened at $91.92, peaked at $100 in the London market, a 8.8% jump and then collapsed in the New York afternoon to finish at $92.84, a bare 1% increase. Brent, the European price measure, had a 8.4% round trip from $94.20 to $102.13 and back to $95.65.

The respective 1% and 1.5% increases in WTI and Brent hardly seem indicative of pending sanctions-based global oil and energy shortages.

The Bloomberg Commodity Index (BCOM) jumped 3.5% at the open to a high of 118.42 from 114.34 before closing just 0.08% ahead at 115.27.

CNBC

Equities

The S&P 500 closed up 1.5% at 4.288.70 after plunging 2.6% at the open. Even with the recovery the average was just at correction, down 10.02% this year from its all-time high of January 3. The Nasdaq Composite ended Thursday’s session 36.59 points higher, adding 3.3% to 13,473.59. At one point the average was down nearly 3.5%. The Nasdaq is down 13.4% for the year and about 16% from its record high. The Dow Jones Industrial Average finished 92.07 points to the good, 0.28% at 33,223,83. At its low the Dow had declined 859 points. It closed Thursday off 8.57% for 2022.

Nasdaq Composite

CNBC

Tech issues drove much of the recovery. Amazon, Netflix, Alphabet (the parent of Google) and Microsoft all finished higher, erasing steep early losses.

Conclusion: Realpolitik

A 19th century German coinage, Realpolitik describes an international world governed by national interests and possibilities not ideologies or moral and ethical premises.

Markets are not passing judgment on the morality of the Russian invasion of Ukraine. They are measuring the potential impact of the European and American responses on the commodity, credit and financial markets and the global economy.

The initial conclusion is not flattering to the notion that the West has much ability or will to deter the Russian attempt to take over Ukraine or to inflict long-term punishment if it is successful.

The US and its allies are not contemplating cutting Russian access to the SWIFT international payments system or the Society for Worldwide Interbank Financial Telecommunication, which facilitates financial transactions and bank funds transfers worldwide. Without SWIFT the Russian government and financial institutions would be isolated from most international business transactions. For instance, Russia would be unable to obtain the proceeds from international sales of its oil and natural gas production that are 40% of the country's revenue.

Another sign that the western sanctions will not threaten core Russian interests was the response from Daleep Singh, the US National Economic Council Deputy Director and Deputy National Security Advisor for International Economics. When asked by a reporter if “Targeting the Russian energy industry is totally off the table? Is that what you are saying, Daleep.

Mr. Singh answered. “What I am saying is that our measures were not designed to disrupt, in any way, the current flow of energy from Russia to the world.”

Traders have demonstrated the directions markets will take should the conflict in Ukraine become a matter of effective sanctions and the damage a concerted effort to isolate Russia might have on the global economy. Markets simply do not believe those sanctions will happen.

Perhaps President Joe Biden said it best, if inadvertently after his short speech on Ukraine on Thursday.

When asked if the sanctions were tough enough he said: “Let’s have a conversation in another month or so to see if they’re working.”

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637813598342619073.png&w=1536&q=95)