Outlook:

Fed chairman Powell has a tough row to hoe this morning selecting exactly the right words to describe the economy and thus inferences the crowd is sure to make about what that means for policy. In practice, we are in a semi-Goldilocks phase, with growth but little infla-tion.

But what’s the forecast? It can trip into recession, or stagflation, or secular stagnation, or some other thing. From what we can tell from the minutes last week, the Fed is more willing than before to assume the tax cuts and fiscal spending are stimulative. Maybe the inflation worry-warts are right. But Powell is not likely to speak of a 4th rate hike this year, not because he may not believe it personally but because of the audience. Sometimes Congress asks smart questions, but on the whole, they are ridiculously stu-pid (like the Representative who asked Bernanke whether he knew anything about the Great Depres-sion).

If Powell seems hawkish, as expected, this is favorable for yields and the dollar to benefit. We have two offsets. The first is the new GDP forecast from the Atlanta Fed today and from others ahead of the offi-cial number. The latest number is likely to show a pullback. The second factor is inflation being largely imaginary so far. Oddly enough, if NAFTA talks go badly, inflation fear becomes more realistic.

While the current situation favors the dollar, the upcoming Italian election has the potential to be euro-unfavorable.

Everybody loves Italy but nobody, even Italians, likes Italian politics. The election is this coming Sun-day, and alas, Italy’s own Trump, Berlusconi, may surge ahead. The culprits are older women, now undecided but likely to go for him because he talks big about protecting the country, according to the FT. Sound familiar? Never mind that he was convicted of felonies and likes underage girls at his sex parties. Technically, he was barred from public office for 6 years after his conviction in 2013, so not until 2019. And hello, this is 2018.

Recently the leader in the polls was the 5-Star party, started by comedian Grillo who began by making astute and useful criticisms but then gave up leadership to a scary guy named DiMaio who is an anti-eurozone fascist. The third candidate is Renzi, who is adorable as well as smart and sane, but his need to resign last year reduces credibility or maybe just machismo, which the other guys have in spades. Speaking of polls, Italy disallows them during the last week before the election. What a great idea.

Nobody thinks Italy will go the way of Greece and actually exit the eurozone, although it will be hard to tell true intentions with all the shouting. To be fair to the tight-lipped Teutons, one reason to deny debt relief to Greece as the IMF demands is to cut off any prospect of any other country, specifically Italy, from trying to pull the same stunt. And Italy comes in second behind Greece for over-indebtedness at about 133% of GDP. Only Japan among the developed countries is in that club. When the ECB stops buying so much of Italy’s paper, the cost to the Italian voter must rise.

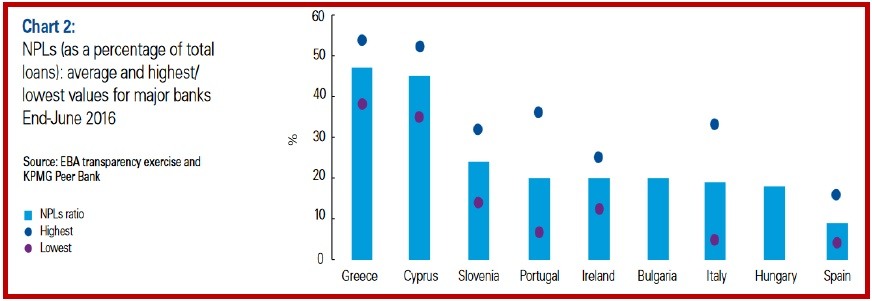

Depending on how coalitions with other parties take shape, Italy could end up with a hung Parliament and general gridlock. This is not anything new. Italy has had 65 governments in 70 years. And that’s precisely the problem—Renzi tried for constitutional reform, and resigned when he failed. Logically, the voters should put him back in to finish the job, but as we all know, politics is anything but logical. And the financial sector is not improving at anywhere near the pace needed, even if Monte dei Paschi got rescued. According to the KPMG study from last spring, nonperforming loans at Italian banks are not really any worse than four or five other countries, about 20%.

The aggregate number might not be so bad, but the fixes take longer in Italy because of famously slow and obstructionist bureaucracies. There’s a whisper of fear that banks’ conditions could get worse in-stead of better because of ending QE—the banks hold about 20% of the national debt. While banks are busy holding nonperforming loans and government paper, they are not out lending to entrepreneurs.

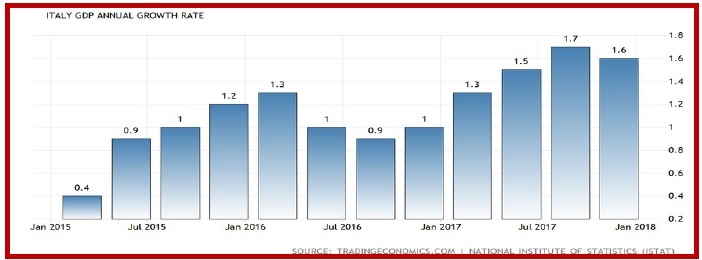

Finally, as Mr. Draghi reminds us at frequent intervals, the true underlying problem is one of economic growth, sorely lacking in Italy, hobbled by outdated structural rigidities. Tradingeconomics.com puts Italian GDP at 1.5-1.7% for the past three months, a lovely improvement, but consider the comparison with previous years. The first chart shows the recent robust growth.

The second chart shows Italian GDP has not recovered to pre-recession levels. No wonder the voters are in a bad mood. And how can such a vibrant, innovative population have such a lousy economy? Reluctance to change norms and customs, some of them positively medieval.

There’s no way to see happy light at the end of this tunnel. We may, conceivably, see the euro take a hit on Sunday night or Monday, depending on election results. It won’t be long-lasting, because the process of forming a coalition by the winner and generally setting up shop will take days or weeks. But if it’s the scary Five Star DiMaio, a euro dip could last longer, since he may actually start talking right away about Italy leaving the eurozone, making at least some traders very nervous.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes. To see the full report and the traders’ advisories, sign up for a free trial now!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.