Is the Fed underestimating the risk of future inflation?

Outlook

In part because of the Germany GDP loss, expectations are being built for the ECB to cut again in September—ahead of the Fed. That will give the euro two cuts against the US’ only one, unless it’s that 50 bp that would put them both in sync. This is one of the times you must wonder how much conferring is going on between the two central banks.

But it could just be sentiment, because we see the opposite effect in the dollar/yen. A deputy BoJ Gov told the press the central banks continues to raise interest rates—on the assumption inflation keeps moderating and with an eye on financial market conditions. You’d think the yen would go up a bit but instead it was the dollar that benefited. This is not logical or in keeping with the euro story.

We will get the all-important PCE inflation reading on Friday when half the trading floor will already be empty ahead of the Labor Day weekend. In other words, everybody already has the perception that whatever the number may be, it’s okay with the Fed and the Sept rate cut is safe no matter what.

This reminds us once again of two rules—the institutional factor outweighs the macro data, and that is usually the central bank. But also, sentiment is a combination of preconceived ideas, existing positions, incoming data, and a basket of normally secondary things like geopolitics, the stock market, and occasionally a really left-fielder like the short-lived carry trade unwind.

For example, it’s becoming clearer that unless the Fed speeds up QT, the rate cuts will juice up the economy some more and that usually suggests higher inflation. But given the long lag between interest rate changes and prices, the Fed believes it can afford to forget about impending inflation for the moment—it’s a ways off down the road.

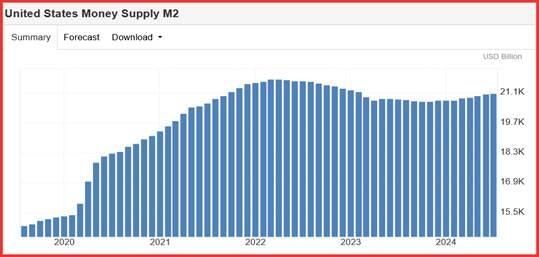

We hardly ever speak of money supply anymore for several reasons—first, you absolutely, positively must couple it with the velocity of money to get the equation inference right and deduce growth and prices. Second, QE and now QT has messed up our understanding of money supply.

All the same, the famous Irving Fisher/Milton Friedman formula is almost certainly valid, and M2 money supply increased in July to $21.054 trillion, the highest in 17 months. Trading Economics reports M2 averaged $5.326 trillion from 1959 until 2024. It reached an all-time high of $21.722 trillion in April of 2022. That’s the Covid handouts. It’s probably a good thing the general public doesn’t have a clue about any of this or their inflation forecast would be very different.

This is a well-hidden reason not to expect 100 bp by Christmas.

Then there’s another institutional factor that hardly ever rears its head in FX—politics. The most recent example was UK Prime Minister Truss and her budget that sent Gilts soaring. This time it’s Trump.

It may pay to listen to Markus at ECR Research. The currency outlook includes scenarios… “In the scenario we consider to be the most likely, EUR/USD is unlikely to far exceed its current rate of around 1.12 and will gradually fall back to approximately 1.08. Depending on the election result, anything is possible in the ensuing period.”

We also have “In all likelihood, USD/JPY will gradually recover to 150-155. In the ensuing period, a great deal will depend on the US election result.”

And there’s more: “At this point, it is very difficult for the Fed to operate. Both Democrats and Republicans want to increase fiscal stimulus after the election and want to implement measures that boost inflation. The outcome will determine the extent to which all this is actually implemented.”

“We expect two to three Fed rate cuts of 0.25 percentage points until the end of this year. What happens next depends on the election result…. We expect the ECB to deliver two to three more rate cuts of 0.25 percentage points this year.

Should the Republicans secure a full election victory (i.e. the White House and Congress), the S&P 500 could climb to 6,000 or slightly higher before the bull market that started in 2009 comes to an end. In any case, we expect a significant correction in the period ahead.”

There is a great deal more, of course, including detailed data and some juicy stuff about China, but the point we are making is that in Europe, the outlook is influenced by the US election more than any other single factor.

Nearly all of the news and analysis of markets today focus on the Fed and/or the Big 7 and the stock market. Markus and his team of economists remind us that the fiscal situation is dire (no matter which side wins the election) and the Fed is in a pickle and feels it must cut despite knowing full well it will promote inflation.

ECR Research is tactful enough not to mention that Trump said, then semi-retracted, then said again he wants to control the Fed. A Trump win would trash the US’ approval rating everywhere else in the world, just as it did last time, not to mention throw more than a single monkey wrench into global politics, such as cutting off military aid to Ukraine and handing it over to Russia. Trump also wants Taiwan to poy for US friendship (although it already does in the form of military spending), take the US out of NATO, and other so-called transactional deals. Just as disgusting is the intent to build concentration camps for illegal immigrants.

We would add that it’s not clear a Harris presidency would deliver the best policies, but just about anyone would be better than Trump. And we should heed the European focus on the election. At a guess, the US election will be on a par with Brexit in terms of the FX fallout.

Reasons for the Fed to cut rates

Avoid embarrassment from getting inflation wrong twice.

Prevent the labor market from further cooling.

Normalize the yield curve.

Head off any recessionary tendencies.

Help housing via mortgage rates.

Help banks rollover commercial property loans.

Help the stock market, especially smaller companies (with debt).

Synchronize with the ECB (and Riksbank and SNB).

Forecast

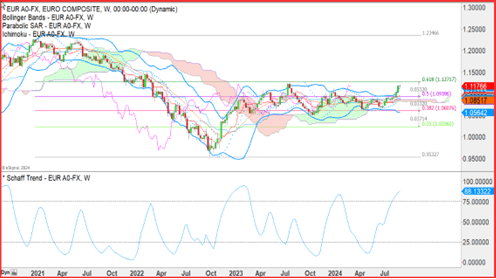

We continue to think a reality check is overdue. But you can’t stop an avalanche with logic when sentiment has the bit in its teeth. Chart-readers know that when the slope of a trend is this abnormally steep and prices keep breaking the channel and B band outer limits but refuse to correct, we have an extraordinary situation. Nobody can call an end to it, and it’s not inconceivable that it goes on, and on and on for weeks or months.

See the weekly euro chart. The 62% retracement level is the flame to which the FX moth is headed—it’s 1.1272. This is handshake distance from the last highest high, 1.1276 from 7/17/23. We would not bet against it until Something Happens.

Political Tidbit: We confess to liking polls, despite their failures in recent years. Pollsters have fixed some of those problems (like calling mostly the college-educated and bending the bias to the Dems).

One of the most interesting shortcomings is the inability to survey people who are not registered voters and declare themselves not likely to vote at all—but then they do. This is what got Trump the win in 2016 and pollsters don’t know how to find them.

Yesterday, Silver had Harris with 49.2% and Trump with 45.4%, more of an advantage than the margin of error. Predcit It had the price of a Harris win at 55 cents, vs. 47 for Trump, a wider margin (but a far smaller pool). The NYT frets about whether momentum can be maintained for the next 69 days to the Nov 5 election.

Another point: Several Republicans have endorsed Harris and some spoke at the convention. The NYT and Washington Post each report “More than 200 former Bush, McCain and Romney staffers endorse Harris.” Needless to say, Fox news does not report any of this, so it’s preaching to the choir.

The Justice Dept revised its indictment of Trump on the insurrection charge, claiming the Supreme Court’s immunity ruling does not apply. The special prosecutor is also taking the stolen documents case to the appeals court, trying to reverse the Trump-appointed judge’s dismissal. Trumpies won’t care because they think charges are fake and politically motivated, but some undecideds and independents might switch sides at the prospect of electing a criminal.

Note to Readers: We will not publish any reports on Thursday or Friday this week ahead of the Labor Day holiday on Monday, Sept 2.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat