Inflation is expected to do what? Implications for Gold

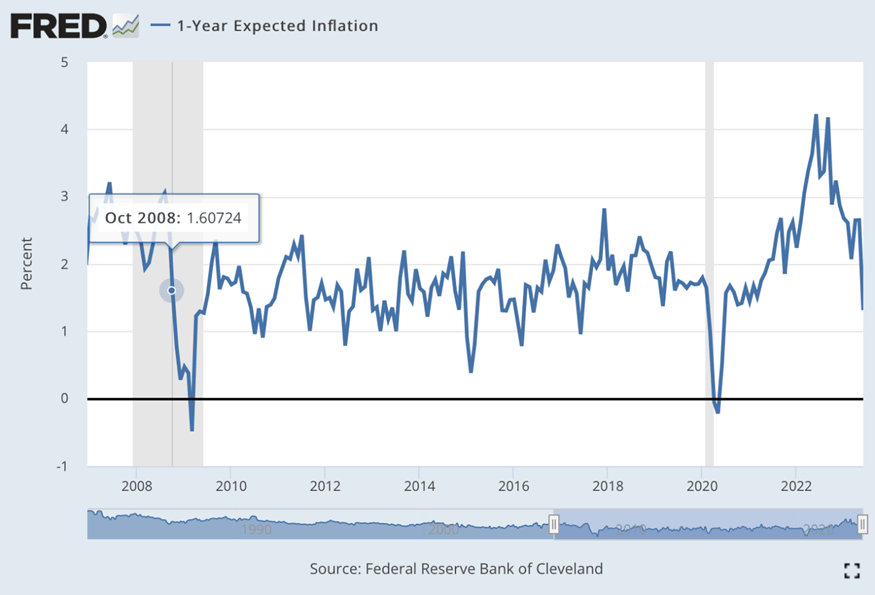

The markets just assumed a dovish U-turn in interest rates, thinking that the inflation problem is handled. The below chart features the inflation that’s expected in one year.

Yes, you see it correctly.

The market expects the inflation to move to about 1.31% in one year.

A bit over 1% in one year… Really?!

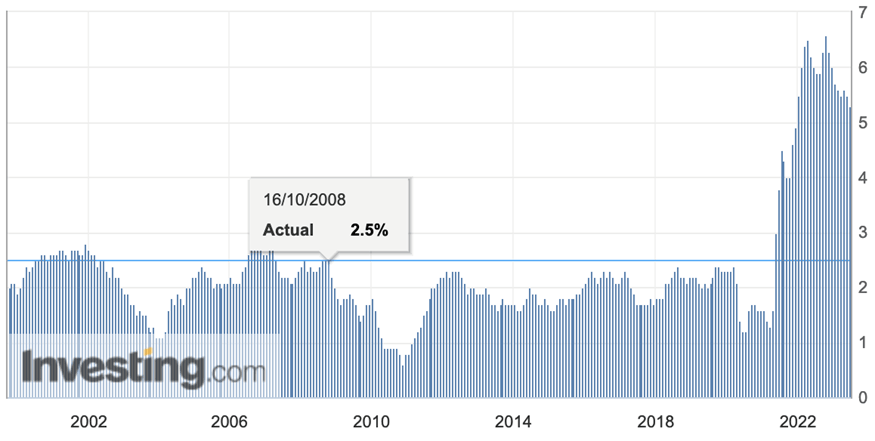

Here’s the recent CPI (YoY) reading:

Long road ahead for inflation reduction

So, the CPI declined from above 6% to a bit above 5%, given all those rate hikes…

Not below 2%, not below 3%, not below 4%. And not even below 5%.

If the trend persists, then it would take years for the CPI to move below 2%. And let’s keep in mind that the Fed kept hiking interest rates in order to trigger this trend…

And now, at the same time, the market is expecting the rates not to be raised significantly and the inflation to somehow move to 1.31% in a single year. It doesn’t take a PhD in economics to see from just those two charts that this is not just impossible. This expectation is plain ridiculous.

To show you the extent of the current delusion, I marked a somewhat similar situation from the past.

The last time the market’s expectations regarding inflation declined from over 3% to more or less, those levels were in October 2008.

But that was when inflation was just 2.5%! It made sense to expect a ~1% decrease in CPI in a year.

But now? The market expects the Fed to push inflation lower several times more and… without many more rate hikes.

Implications and warning signs

The war against inflation is far from being over, and the market’s dovish expectations and overall bullishness are out of touch with reality.

Oh, and by the way, since the analogy is to October 2008, do you remember what happened to the gold price then?

Here’s a reminder:

That was when gold’s rebound and consolidation ended and when the biggest part of the slide started.

That was also the time when stocks declined, and the USD Index rallied.

Why did stocks rally so high, then? Because the investment public entered the market, and it’s the “return to normal” stage of the bear market in stocks, while most investors (primarily the investment public) assume that it’s the return of the bull market.

The wake-up call will not be pleasant for many – but you have been warned.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any