How long can Japan defend the Yen from a speculative attack?

Japan spent $30 billion in foreign exchange funds selling dollars to halt a plunge. How long can this go on?

Yen vs the US dollar chart courtesy of StockCharts.Com, annotations by Mish

Since the beginning of 2021, the yen has declined about 32 percent vs the US dollar.

I discussed this setup on October 20 in Yen Tops ¥150 vs. the Dollar for the First Time in Over Three Decades

Line in the Sand

Mercy me!

The threats of intervention have gone from "appropriate" to "meticulous" with a high sense of vigilance, to threats of "decisive" steps.

Hello Bank of Japan, the ball is in your court.

How much of your dollar reserves will you blow defending your line in the sand?

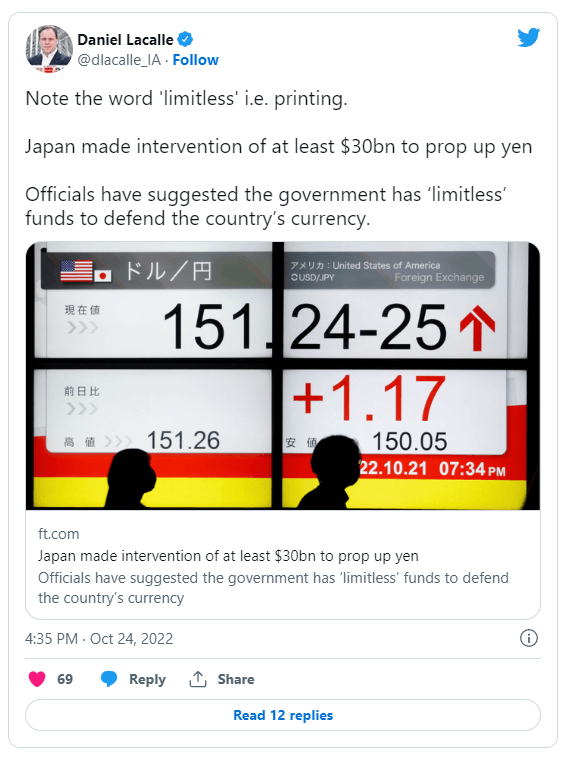

Japan has not only threatened intervention, it has blown $30 billion doing so. A Tweet yesterday caught my eye.

"Officials have suggested the government has ‘limitless’ funds to defend the country’s currency."

Q: Really?

A: No!

Japan does not have limitless funds. It can use foreign exchange reserves but it cannot print dollars.

Limitless myth

As of September 30, Japan's Total reserve Assets were $1,238,056 million, down $ 54,016 million from the end of August.

Japan can (and did) sell some of those reserves to support the Yen. In essence it sells dollars and buys Yen.

Certainly, the Bank of Japan has limitless ability to print Yen, but that would weaken the Yen not strengthen it. Japan does not have limitless dollars.

So where this "limitless" idea comes from is a myth. It's either an absurd bluff or amazing ignorance to make such a claim.

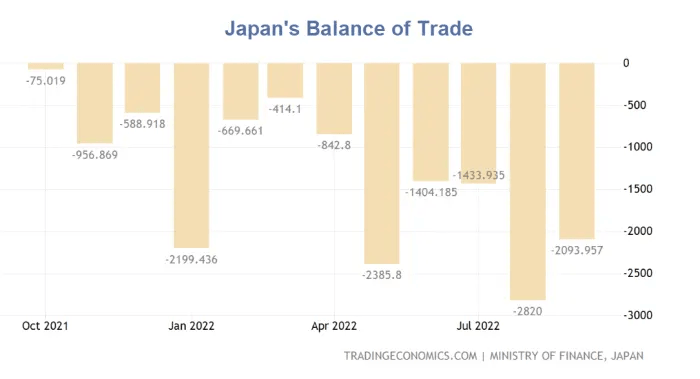

Japan's balance of trade

Japan's Balance of Trade courtesy of Trading Economics

Japan built its huge foreign reserves because it exported more cars, cameras, and other equipment than it imported food and oil.

Now, with food and energy costs soaring and the Yen sinking, Japan has had 14 consecutive months of trade deficits.

Japan's finance ministry said that Japan’s trade deficit for the first half of FY 2022/2023 stood at JPY 11 trillion, the largest on record. That's about $74 billion in six months at the current rate.

And unless Japan starts exporting more goods or the price of energy declines, the current exchange rate will get worse.

Ridiculous bluff or amazing ignorance?

Whether it's a ridiculous bluff or amazing ignorance to make a claim of "limitless" capacity, traders scoff at the idea, as they should.

Given its ongoing trade deficits ,Japan does not even have $1,238,056 million.

Ironically, every dollar the BOJ spends on defending a peg that cannot be defended, weakens the Yen.

Japan can defend the yen by hiking interest rates but it is also defending an interest rate peg on its 10-year sovereign bond.

BOJ announces unscheduled bond buying as key yield broke ceiling

On October 19, Bloomberg reported BOJ Announces Unscheduled Bond Buying as Key Yield Broke Ceiling

The yield on the 10-year note briefly rose 0.5 basis points to 0.255% Thursday as the Bank of Japan held the first unscheduled bond buying operation this month.

The BOJ started an unlimited bond-buying operation every day in May to cap 10-year yields and also plans to buy more debt in the fourth quarter than the previous one through its regular operations.

“The BOJ subscribes to yield-curve-control fundamentalism, so I don’t think it will change policy,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank Ltd. in Tokyo. “As such, 10-year yields are unlikely to rise far beyond 0.25% but we’ll see yields exceeding that level more frequently.”

This has been going on for what seems like forever.

On February 2, 2018 I commented Note to BoJ: Try Something Different or Look Perpetually Foolish

Statements from the BoJ on unlimited bond buying go back many years.

What's different now is the BoJ is defending two different pegs simultaneously.

Simultaneous pegs

- Japan can defend an interest rate peg at the expense of the Yen.

- Japan can defend a currency peg at the expense of interest rates.

It is impossible to defend a currency peg and an interest rate peg at the same time.

Every central bank in the world should understand this.

One of these pegs is going to blow sky high, perhaps both. Simultaneous pegs are a guaranteed disaster for Japan.

I expect some hedge fund will make a killing on this idea when it finally happens. And I believe it will happen sooner rather than later.

Dollar scarcity

Meanwhile, back in the US, I am pondering the dollar scarcity thesis in light of $90 trillion in total market debt owed.

Gold provided a brake on recklessness. There is no brake now. Ask yourself, "How is $90 trillion going to be paid back?"

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc