Gold’s golden age: Can the rally continue?

Gold prices have continued their upward trajectory today, on Wednesday, October 23rd, reaching a new all-time high of approximately $2,758 per ounce. This marks a 0.14% increase for the day and follows a surge of over 1% on Tuesday, October 22nd. With a year-to-date gain of around 33% and a seven-day streak of higher closes, investors are increasingly wondering whether this upward momentum is sustainable or if a potential correction may be on the horizon.

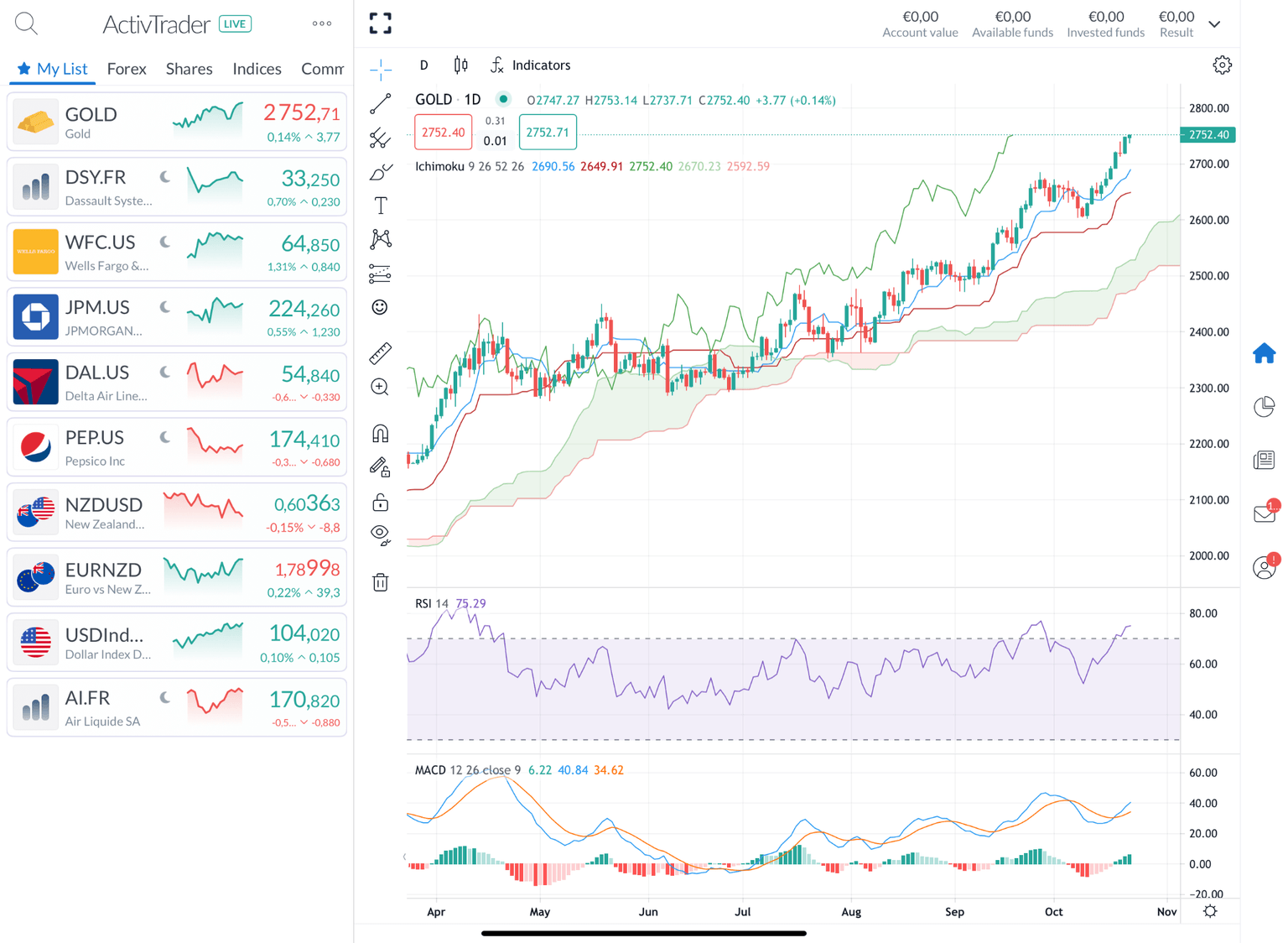

Daily chart of Gold prices - Source: ActivTrades

Gold prices supported by numerous factors

Gold prices have been bolstered by a surge in investor interest amid a backdrop of global uncertainty. Open interest in precious metals reached a new high of just over $231 billion for the week ending October 18 (+9%), according to JPMorgan Global Commodities Research.

Several factors are contributing to Gold’s appeal as a safe haven asset. Uncertainty surrounding the upcoming U.S. presidential election and its potential impact on U.S. fiscal policy, trade, as well as inflation and growth prospects are probably one of the most important factors of this week’s move.

Additionally, inflationary concerns around the world, ongoing geopolitical tensions, more accommodative monetary policies adopted by central banks worldwide and increasing discussions about de-dollarization are also bolstering Gold’s appeal and driving investors towards Gold. These factors collectively highlight the role of Gold as a valuable asset for diversifying investment portfolios and protecting against economic and political instability, as well as market volatility.

The impact of the US Presidential election on Gold prices

The upcoming U.S. presidential election is expected to have significant implications for Gold prices, as both candidates—Republican Donald Trump and Democrat Kamala Harris—hold divergent views on key economic policies such as tax cuts, tariffs, and international trade relations, particularly with China.

Gold is often viewed as a hedge against political instability and uncertainty, and this election is no exception. Historically, geopolitical and economic uncertainties surrounding U.S. elections tend to boost Gold demand. As the World Gold Council points out, the U.S.’s pivotal role in the global economy makes its elections especially important for global markets. The contrasting economic policies between the two candidates—Trump’s favouring of tax cuts and protectionist tariffs, and Harris’s likely more liberal stance on fiscal policy—could shift investor sentiment regarding financial markets, including Gold.

The World Gold Council’s analysis shows that U.S. demand for Gold bars and coins tends to increase on average during Democratic presidencies, but this trend does not consistently hold for other forms of Gold investment. While party affiliation itself may not directly drive Gold price changes, the economic policies implemented by the winning administration—domestically and internationally—are more significant drivers of Gold’s performance.

JPMorgan: Republican victory could boost Gold

According to JPMorgan, Gold strength is likely to continue in the lead-up to the election, particularly under the scenario of a Republican sweep. JPMorgan suggests that a Republican victory would create a more favourable environment for Gold, primarily due to the party’s history of tax cuts and pro-business policies. Conversely, a Democratic victory could signal a less favourable backdrop for Gold, depending on the economic measures implemented.

Historically, Gold typically performed better in the six months preceding a Republican victory, as investors anticipate policy shifts. For example, Gold returned approximately -2.6% in the six months following Trump’s inauguration in 2017, compared to -6.4% after Biden took office in 2021. These fluctuations suggest that the lead-up to elections, rather than the actual post-election period, might be more significant for Gold prices.

Policy potential impacts on Gold prices

The economic policies that follow the election, especially those affecting inflation, interest rates, and fiscal spending, are crucial to Gold’s performance. Both candidates’ policies will directly impact inflationary expectations, which are closely tied to Gold’s price movements.

Trump’s previous term saw Gold benefiting from trade wars and protectionist policies, which weakened the dollar and made Gold more attractive as a hedge. Harris, however, may pursue policies aimed at increased government spending, which could also fuel inflation and support Gold prices, albeit through a different mechanism.

While no election outcome guarantees a specific trend for Gold, the policy direction taken by the incoming administration will be crucial for Gold traders.

The impact of de-dollarization talks and central banks’ Gold purchases on Gold prices

Recent discussions among the BRICS nations (Brazil, Russia, India, China, and South Africa) and other emerging economies have sparked interest in the possibility of de-dollarization—a shift away from reliance on the U.S. dollar in global trade and finance. Central to these discussions is Gold, an asset long viewed as a hedge against currency volatility and inflation. As BRICS nations explore ways to reduce their dependency on the U.S. dollar, making Gold increasingly important, global Gold prices are impacted.

BRICS nations and their growing Gold reserves

With a combined gold reserve exceeding 20% of the world's total, the BRICS countries might be contemplating the creation of a gold-backed currency as a potential alternative to the U.S. dollar's dominance according to some rumours. This potential move can be seen as a strategy to enhance their economic independence and mitigate the risks associated with dollar fluctuations, particularly amid global geopolitical tensions. Russia and China alone account for a staggering 74% of BRICS’ Gold reserves, positioning them as major players in the effort to diversify away from the U.S. dollar.

Russia and China have been the most aggressive in boosting their Gold reserves in recent years, using the precious metal as a hedge against the dollar’s global dominance. For instance, as of 2024, Russia holds approximately 2,300 tonnes of Gold, while China holds over 2,100 tonnes. These reserves not only bolster their financial security but also reflect a growing sentiment among BRICS countries to move towards assets considered more secure and inflation-resistant than fiat currencies.

Record central bank Gold purchases

In 2023, central banks globally have begun diversifying their foreign-exchange reserves away from U.S. dollars, with Gold becoming a preferred alternative. Currently, around 58% of global foreign reserves are held in dollar-denominated assets. However, the trend of boosting non-dollar reserves has seen an uptick, with Gold being a major beneficiary. Though the pace of central bank Gold purchases slowed slightly in recent months, the overall structural trend remains strong.

In 2022, central banks globally made record-breaking Gold purchases, amassing over 1,080 tonnes. The trend continued into 2023, with an additional 1,037 tonnes of Gold added to global reserves. This surge in demand from central banks has supported a steady rise in Gold prices, with many analysts predicting that this accumulation will persist in 2024 and in the coming years.

Stay up to date with what's moving and shaking on the world's markets and never miss another important headline again! Check ActivTrades daily news and analyses here.

Author

Carolane de Palmas

ActivTrades

Carolane graduated with a Masters in Corporate Finance & Financial Markets and got the AMF Certification (Financial Markets Regulator in France). Afterward, she became an independent trader, investing mostly in European and American stocks/indices.