- Gold spiked above $1,780 on Friday but lost its bullish momentum.

- Despite the disappointing September jobs report, dollar stays resilient.

- Focus shifts to US September CPI inflation data.

After ending the previous week on a firm footing, the XAU/USD pair continued to edge higher on Monday and reached a 10-day top of $1,770. Nevertheless, gold struggled to extend its rebound amid dollar resilience and formed a horizontal trading channel with a lower limit of $1,750. Although the pair broke above that channel on Friday and touched a 15-day high of $1,781 with the initial reaction to the disappointing September jobs report from the US, it retreated below $1,770 ahead of the weekend.

What happened last week

The risk-averse market environment at the start of the week helped the precious metal find demand. The ongoing energy crisis and heightened concerns over US lawmakers failing to come to terms to raise the debt limit caused investors to seek refuge. The only data from the US showed on Monday that Factory Orders increased by 1.2% on a monthly basis in August but this reading received little to no market reaction.

Reflecting the dismal market mood, the S&P 500 Index dropped to its lowest level since late July at 4,278 on Tuesday. However, the greenback also managed to outperform its rivals as a safe haven and capped XAU/USD’s upside.

On Tuesday, the ISM Services PMI arrived at 61.9 in September, compared to analysts’ estimate of 60, but this print got largely ignored by market participants. On Wednesday, the Automatic Data Processing (ADP) Research Institute announced that private sector employment in the US rose by 568,000, surpassing the market consensus of 428,000.

In the meantime, the US Senate passed the bill to raise the debt ceiling by $408 billion through November, easing concerns over a possible default. Moreover, Russian President Vladimir Putin said that they will be ramping up gas output to ease the pressure on energy prices in Europe and provided an additional boost to risk sentiment.

Although major global equity indexes gained traction in the second half of the week to mirror the positive shift witnessed in risk appetite, gold failed to make a decisive move in either direction as rising US Treasury bond yields supported the dollar. The benchmark 10-year US T-bond yield gained more than 3% on Thursday and reached its highest level in more than four months above 1.6% on Friday.

Finally, the US Bureau of Labor Statistics reported that Nonfarm Payrolls (NFP) rose by 194,000 in September. This reading missed analysts' forecast of 500,000 by a wide margin and triggered a USD selloff. However, the underlying details of the publication revealed that August's print got revised higher to 366,000 from 235,000 and the Unemployment Rate declined to 4.8% from 5.2%. The US Dollar Index, which dropped to a daily low of 93.94 after the NFP data, didn't have a difficult time rebounding above 94.00 and capped gold's upside.

Next week

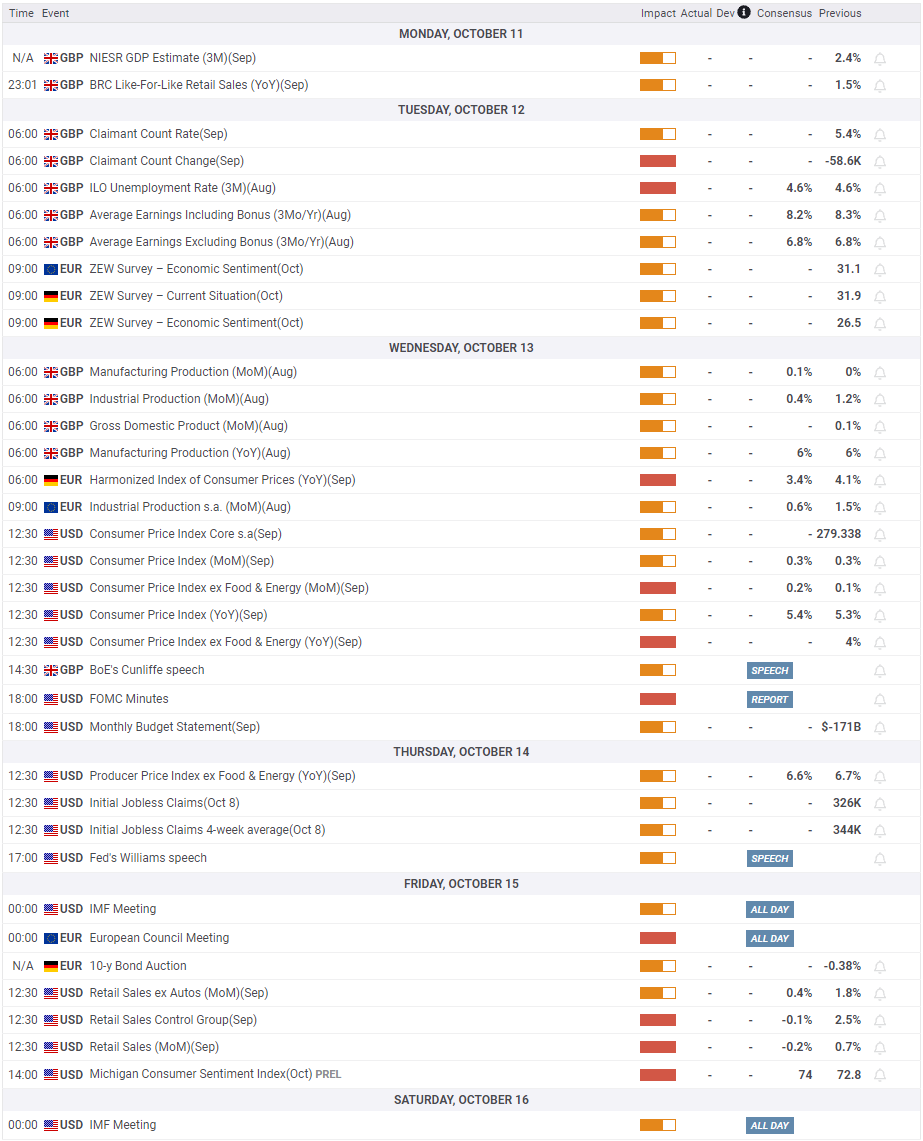

There won’t be any high-impact data releases at the start of the week. On Tuesday, the August jobs report from the UK and the ZEW Survey from Germany will be featured in the European economic docket, which are unlikely to have a significant impact on XAU/USD’s movements.

On Wednesday, the US Bureau of Labor Statistics will release the Consumer Price Index (CPI) data for September. Investors forecast the annual CPI to tick up to 5.4% from 5.3% in August.

Even if the core inflation in the US turns out to be softer than expected in September, this report by itself is unlikely to change the market’s view on the Fed’s tapering plan. In fact, the market reaction to the September labour market report showed that the expectation for a reduction in asset purchases remains intact. Moreover, investors could opt out to remain on the sidelines before the FOMC published the September Meeting Minutes later in the day.

On Thursday, the US Department of Labor’s weekly Initial Jobless Claims data will be looked upon for fresh impetus ahead of Friday’s Retail Sales report, which is anticipated to show a modest contraction in September.

Gold technical outlook

The technical outlook remains bearish with gold failing to break above the 20-day SMA for the 18th straight trading day. Additionally, the Relative Strength Index (RSI) indicator on the daily chart stays slightly below 50, confirming the view that sellers are looking to remain in control of XAU/USD's action.

On the downside, the initial support is located at $1,750 (lower limit of the weekly channel) ahead of $1,730 (static level) and $1,720 (late September low).

The first hurdle aligns at $1,763 (20-day SMA) ahead of $1,780 (October 8 high, 50- day SMA). Only a daily close above the latter could open the door for a prolonged rebound toward $1,800, where the 100-day SMA, 200-day SMA and the Fibonacci 50% retracement of the April-June rally meet.

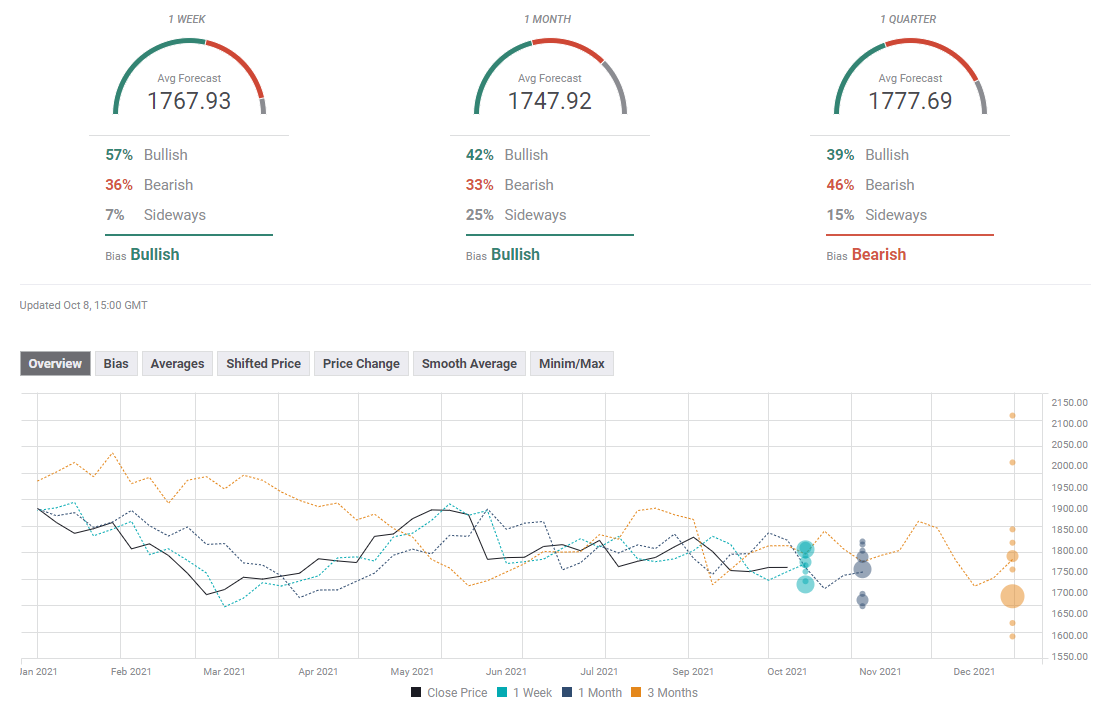

Gold sentiment poll

The FXStreet Forecast Poll points to a slightly bullish bias in the near term with the one-week target sitting at $1,767. The one-month view paints a mixed picture with 33% of experts holding a bearish view against 42% bullish. Furthermore, the average forecast of $1,747 points to analysts' indecisiveness for the one-month time frame.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.