- Gold lost 3% on Wednesday as markets reacted to Donald Trump’s victory in the US presidential election.

- The near-term technical outlook points to a loss of bullish momentum.

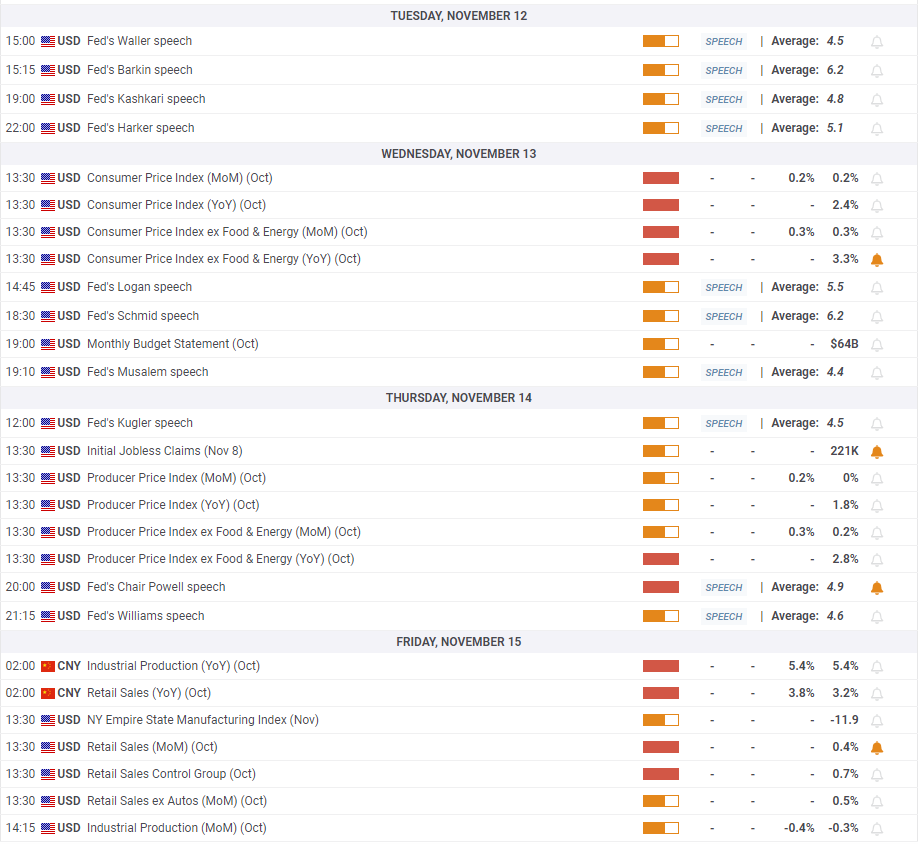

- October inflation data from the US and comments from Fed policymakers will be watched closely next week.

Gold (XAU/USD) came under heavy selling pressure and slumped below $2,700 on Wednesday as US Treasury bond yields rallied on Donald Trump’s victory in the US presidential election. Inflation data from the US and Fedspeak next week could offer fresh insights into whether Gold will be able to shake off the bearish pressure.

Gold suffers large losses on Trump’s victory

Gold started the week in a calm manner and registered small gains on Monday and Tuesday as markets refrained from taking large positions ahead of the week’s key risk events.

During the Asian trading hours on Wednesday, the US Dollar (USD) started to gather strength against its rivals and caused XAU/USD to turn south. News of Donald Trump retaking battleground states Georgia and North Carolina triggered a rally in the US Treasury bond yields, further weighing on the Gold price. In the early European session, news outlets started calling Pennsylvania for Trump, a swing state that was widely seen as Kamala Harris’ only chance to turn the election around, all but officially confirming the winner. Republicans also gained the majority in the Senate and looked on track to take control of the House, fuelling another leg higher in US yields and the USD. Gold broke below $2,700 and fell 3% on a daily basis to register its largest one-day loss of the year.

The initial reaction to Trump’s victory suggests that markets expect his proposed policies to pave the way for a high-octane US economy, which could make the Federal Reserve’s (Fed) job of controlling inflation more difficult and cause the US central bank to reassess the policy-easing strategy moving forward.

The data from China showed early Thursday that Exports rose by 12.7% in USD terms on a yearly basis in October, while Imports declined by 2.3% in the same period. As a result, China's trade surplus widened to $95.27 billion from $81.71 billion in September. Gold managed to find a foothold after this data but struggled to gather recovery momentum, with investors turning their attention to the Fed’s policy announcements.

The Fed announced on Thursday that it lowered the policy rate by 25 basis points (bps) to the range of 4.5%-4.75% following the November meeting, as expected. In its policy statement, the Fed said that risks to the job market and inflation were "roughly in balance," echoing language from its September statement. In the post-meeting press conference, Fed Chairman Jerome Powell refrained from hinting on whether they could opt for one more 25 bps cut in December. Powell added that the results of the presidential election will have no effect on the monetary policy in the near term. Following Wednesday’s upsurge, the benchmark 10-year US Treasury bond yield lost nearly 2.5% on Thursday and helped Gold retrace a portion of its weekly decline.

Gold investors await Fedspeak, US inflation report

Stock markets in the US will remain open on Veterans Day on Monday but bond markets will be closed, limiting the market volatility at the beginning of next week.

On Wednesday, The US Bureau of Labor Statistics (BLS) will publish Consumer Price Index (CPI) data for October. Investors expect the CPI and the core CPI, which excludes volatile food and energy prices, to rise by 0.2% and 0.3%, respectively, on a monthly basis. In case the core CPI increases at a softer pace than forecast, the USD could weaken against its rivals with the immediate reaction. On the other hand, an increase of 0.3%, or bigger, in the monthly core CPI could make it difficult for XAU/USD to hold its ground.

Meanwhile, market participants will scrutinize comments from Fed policymakers now that the blackout period is over. The CME FedWatch Tool shows that markets are pricing in about a 70% chance of another 25 bps rate cut in December. If Fed officials adopt a more cautious tone on further policy easing, citing the potential inflationary effects of Trump policies, US T-bond yields could start pushing higher and weigh on XAU/USD.

Gold technical outlook

After dropping below the lower limit of the ascending regression channel coming from June, Gold found support and returned within this channel. The Relative Strength Index (RSI) indicator on the daily chart, however, failed to push higher after recovering to 50, reflecting buyers’ hesitancy.

On the downside, key support area seems to have formed at $2,680-$2,675, where the Fibonacci 23.6% retracement of the uptrend and the lower limit of the ascending channel meet, ahead of the 50-day Simple Moving Average (SMA) at $2,640. A daily close below this support could open the door for another leg lower toward $2,600.

Looking north, the first resistance could be spotted at $2,720 (20-day SMA). In case XAU/USD flips that level into support, technical buyers could take action. In this scenario, $2,760 (mid-point of the ascending channel) could be seen as the next hurdle before $2,790 (record-high).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.