- Gold price struggled to make a decisive move following a correction from $2,000.

- Technical outlook points to a bullish bias, but buyers are likely to remain hesitant in near term.

- US Nonfarm Payrolls data will be watched closely by market participants next week.

Following the rejection from $2,000 in the previous week, Gold price stayed under bearish pressure and suffered heavy losses on Monday. After staging a rebound on Tuesday, XAU/USD struggled to keep its footing on Wednesday but regained its traction ahead of the weekend. As markets remain indecisive about the US Federal Reserve's (Fed) next policy step, next week's jobs report for March could trigger the next big action in the pair.

What happened last week?

Reports of First Citizens BancShares Inc buying all the loans and deposits of SVB and giving the Federal Deposit Insurance Corp equity rights in its stock worth as much as $500 million in return led markets to start the new week on a positive tone. Additionally, the decisive rebound witnessed in Deutsche Bank shares following the previous Friday's scary sell-off helped global bond yields gain traction. In turn, XAU/USD turned south on Monday and dropped all the way to $1,950.

On Tuesday, the data published by the Conference Board showed that the Consumer Confidence Index in the US improved slightly to 104.2 in March from 103.4 in February. Moreover, the one-year consumer inflation expectation of the survey edged higher to 6.3% from 6.2%. This data, however, failed to provide a boost to the US Dollar and XAU/USD managed to erase a portion of Monday's losses.

During the Asian trading hours, news of e-commerce giant Alibaba Group Holdings planning to split its business into six units and have them listed publicly allowed risk flows to continue to dominate the markets during the first half of the day on Wednesday. Nevertheless, in the absence of high-impact macroeconomic data releases, Gold price fluctuated in a narrow channel and struggled to make a decisive move in either direction.

On Thursday, the US Bureau of Economic Analysis (BEA) announced that it revised the fourth-quarter Gross Domestic Product (GDP) growth down to 2.6% from 2.7% in the previous estimate. Furthermore, the weekly data published by the US Department of Labor showed a 7,000 increase in the Initial Jobless Claims in the week ending March 25. On top of these disappointing data releases, the risk-positive market atmosphere caused the USD to continue to weaken, helping XAU/USD to regain its traction.

The data from China showed that NBS Manufacturing PMI edged lower to 51.9 in March from 52.6 in February. On a positive note, the Non-Manufacturing PMI rose to 58.2 from 56.3 in the same period. Mixed PMI readings from China, the world's biggest gold consumer, made it difficult for XAU/USD to find direction early Friday.

Finally, the BEA reported on Friday that the Core Personal Consumption Expenditures (PCE) Price Index declined to 4.6% on a yearly basis in February from 4.7% in January. Pressured by the soft PCE inflation data, the 10-year US T-bond yield turned south and helped XAU/USD hold its ground ahead of the weekend.

Next week

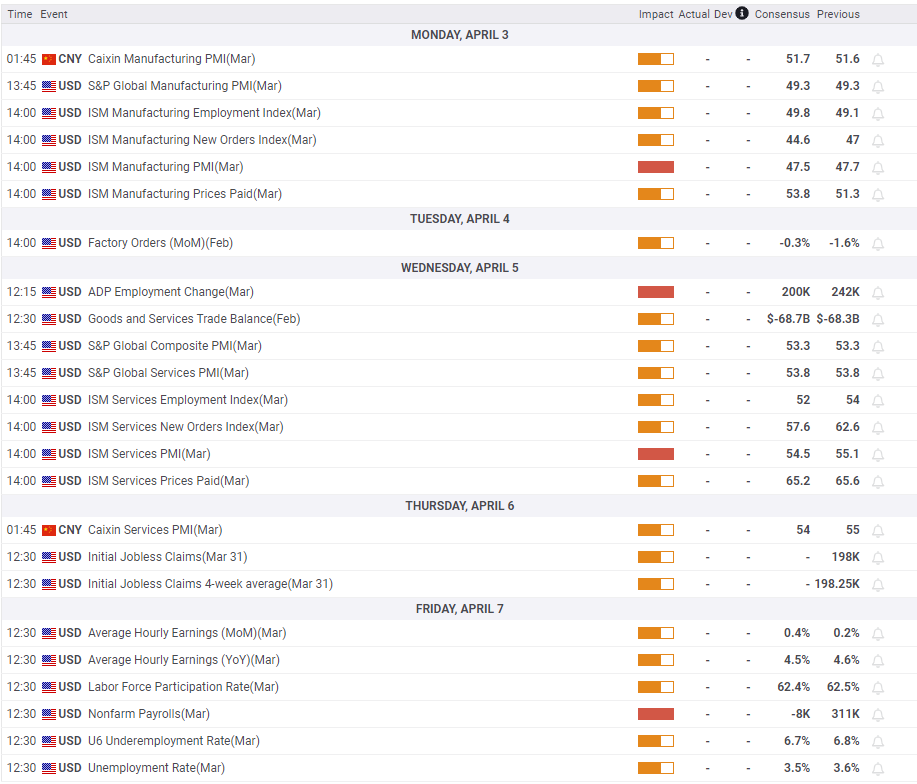

On Monday, the ISM Manufacturing PMI from the US will be watched closely by market participants. In February, the Prices Paid component of the survey climbed to 51.3 from 44.5 in January, revealing an increase in input inflation. Markets are yet to figure out whether the US Federal Reserve will raise its policy rate one more time by 25 basis points (bps) in May. If the PMI survey points to an acceleration in the manufacturing sector's input inflation, hawkish Fed bets could return and help the USD find demand. Evidently, XAU/USD is likely to come under bearish pressure.

ADP's private sector employment report and the ISM Services PMI will be featured in the US economic docket on Wednesday. ADP Employment Change is forecast to decline sharply to 10K in March from 242K in February. A negative print could weigh on the USD as it would likely cause markets to price in a dismal March jobs report. A noticeable decrease in the Prices Paid sub-index of ISM Services PMI could also hurt the USD and vice versa.

Ahead of the weekend, the US Bureau of Labor Statistics will publish the labor market data for March, which is forecast to show a decline of 8,000 in Nonfarm Payrolls (NFP). Even if the NFP comes in higher than expected, any reading below 50,000 should be seen as a red flag and trigger a leg lower in the US yields and the USD. On the other hand, an increase of 100K or higher in NFP could weigh on XAU/USD by lifting yields.

In the meantime, wage inflation, as measured by the Average Hourly Earnings, is expected to tick down to 4.5% on a yearly basis from 4.6% in February. A bigger-than-anticipated decline in this reading could be seen as USD-negative, while an increase should have the opposite effect. Nevertheless, NFP is likely to be the main market driver this time around.

Market participants will also continue to pay attention to comments from Fed officials. Although policymakers are unlikely to try to steer the markets in a certain direction before seeing the jobs report and March inflation data, hawkish remarks could help the USD stay resilient against its rivals.

Gold price technical outlook

The price action witnessed in the second half of March confirmed the significance of $2,000 as a resistance. Although the Relative Strength Index (RSI) indicator on the daily chart holds near to suggest that the bullish bias stays intact, buyers could remain hesitant unless Gold price makes a daily close above that level.

On the downside, near-term support seems to have formed at $1,950 (static level) ahead of $1,930 (20-day Simple Moving Average (SMA)) and $1,900 (50-day SMA, psychological level).

In case XAU/USD claims $2,000 and starts using it as support, the next bullish target is located at $2,050 (static level) before $2,070 (March 2022 high).

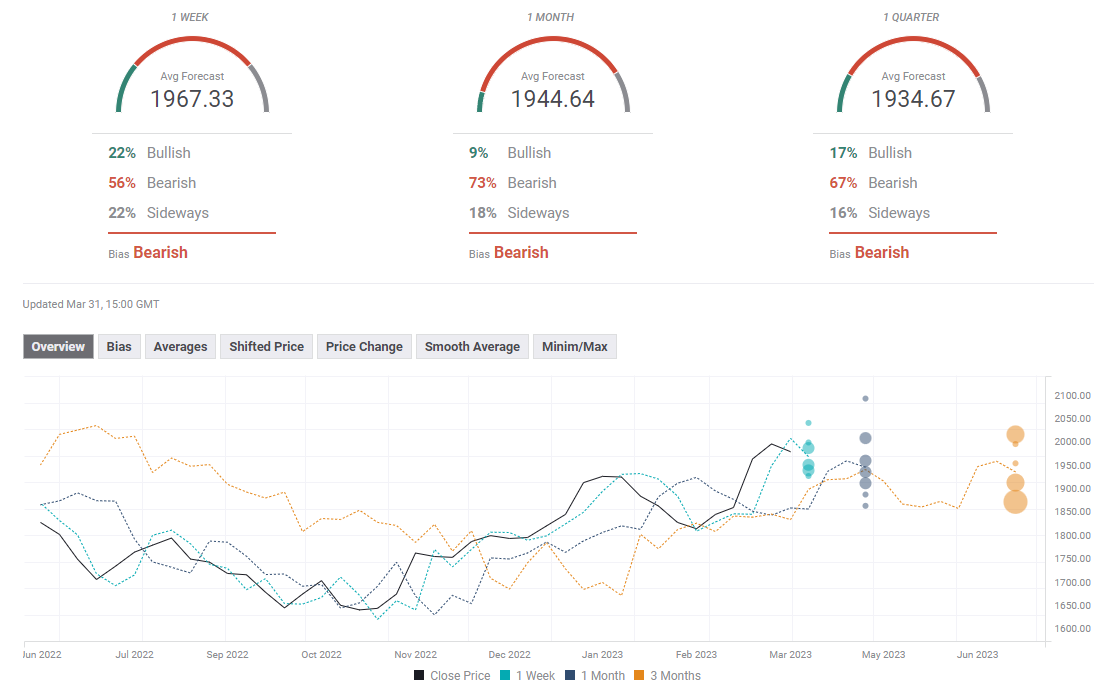

Gold price forecast poll

FXStreet Forecast Poll points to a bearish bias in the short term, with the one-week average target aligning at $1,967. The one-month outlook remains overwhelmingly bearish, with only one expert expecting XAU/USD to be above $2,000 by the end of this time frame.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.