- Optimism about a covid vaccine shot down gold prices.

- Additional headlines from the medical front, speculation about the Fed, and US retail sales are eyed.

- Mid-November's daily chart is painting a bearish picture.

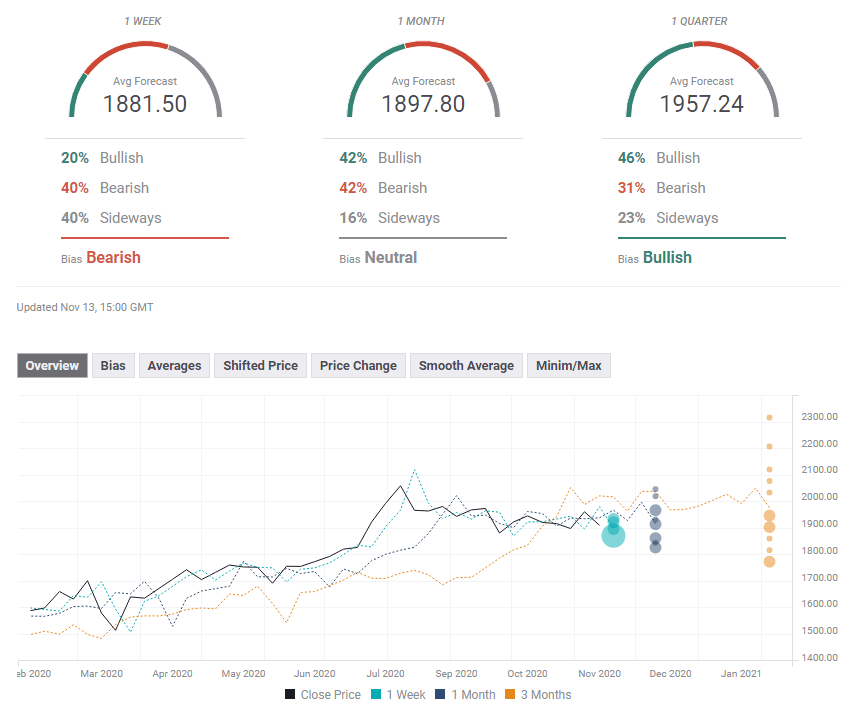

- The FX Poll is pointing to short term falls but long term gains.

Blinded by the light at the end of the tunnel – gold tumbled in response to a breakthrough in developing a vaccine for coronavirus. The implication is less fiscal and monetary stimulus, yet rising cases in the northern hemisphere may change the picture.

This week in XAU/USD: Shot down by the vaccine, political uncertainty

Pfizer and BioNTech reported a 90% efficacy rate in their COVID-19 vaccine candidate. While the results are preliminary, the outcome seems promising not only for these firms – but also for three other efforts using the mRNA approach.

Gold has been rising on hopes for additional fiscal stimulus, yet with prospects of returning back to normal, the urge for additional funds is weaker. XAU/USD tumbled down in response, dipping below $1,850.

On the other hand, the pandemic continues hitting the northern hemisphere, from rising cases in Japan, through increased European deaths and record hospitalizations in the US. Jerome Powell, Chairman of the Federal Reserve, reiterated the need for more support from both central banks and governments.

What about the fiscal stimulus? Democratic candidate Joe Biden won the elections, but his party is unlikely to have a majority in the Senate, needed to pass ambitious support to the economy. Control of the upper chamber hinges on two runoff races in Georgia, due only in early January.

While President Donald Trump has not conceded, he has ordered the White House to step back from talks about a new relief package, leaving the task to Republican lawmakers, who seem reluctant to strike an accord with Democrats. The stalemate in Washington has also put a lid on gold prices.

Next week in Gold: Pharma in focus

Who will be the next pharmaceutical firm to publish results from its Phase 3 trial? Massachusetts-based Moderna seems to be the front-runner. If its efficacy levels are similar to those of Pfizer/BioNTech, the yellow metal is set for another hit. The firm hinted that the fast spread of coronavirus in the US exposed more of its trial participants to the disease.

XAU/USD traders would be wise to continue following covid statistics, especially in the US. If cases, hospitalizations, and deaths continue their upward trajectory, state governors could impose new restrictions. In turn, that would push lawmakers to get a fiscal relief package out the door – perhaps boosting gold's price.

Overall, the virus is left, right and center, with a rising potential for stimulus serving as a bullish factor and vaccine news boosting the bears. Apart from Moderna, other firms to watch are AstraZeneca and Johnson & Johnson.

The US presidential elections are winding down, with certifications from additional states due out during the week. Republicans are gradually coalescing around President-elect Biden. However, the races in Georgia are gaining traction. If Dems come ahead in opinion polls, it could support the precious metal. However, the margins are likely to be razor-thin, given the minuscule gaps in the first round for the Senate and the presidential race in Georgia – the former Vice-President is ahead by only 0.28%.

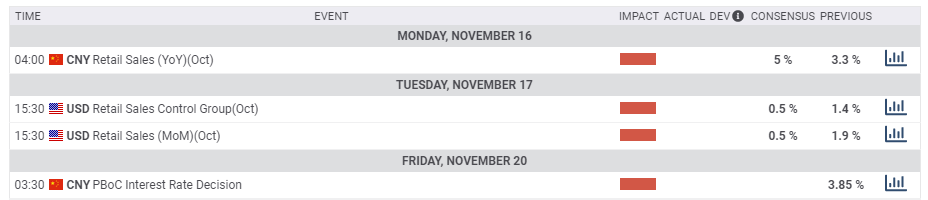

Retail sales stand out on the economic calendar. Expenditure figures from China kick off the week. An ongoing recovery in the world's second-largest economy implies higher demand for gold. Consumption figures in the US are critical for the economy. Yet, if the comeback remains robust, it would weaken the case for an injection of federal funds, potentially weighing on the metal.

Here are the key events for gold on the economic calendar:

XAU/USD technical analysis

Gold has dropped below the 50-day and 100-day Simple Moving Averages and still suffers from some downside momentum – bearish signs. On the other hand, XAU/USD is trading above the all-important 200-day SMA.

Support awaits at $1,860, which was a cushion in late October. The next level to watch is $1,850, now a double bottom after halting the decline in November and September. Further below, $1,820 and $1,790 are noteworthy.

Resistance is at $1,905, which is where the 50-day and 100-day SMAs converge. The next cap awaits at $1,935, which held gold prices down twice in recent weeks. The next barrier is at $1,965, which is November's high point. Next up, $1,995 and $2,020 are worth watching.

Gold sentiment

While rising virus cases could provide room for recovery, excitement about additional vaccine candidates may deal further blows to gold.

The FX Poll is pointing to further pressure in the short term, followed by stabilization in the medium term and then a rally in the long term. Experts seem to have adjusted to the recent fall – all three targets have dropped in the past week.

Related Reads

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD below 1.0400 as mood sours

EUR/USD loses its traction and retreats to the 1.0380 area in the second half of the day on Monday. The negative shift seen in risk mood, as reflected by Wall Street's bearish opening, supports the US Dollar and makes it difficult for the pair to hold its ground.

GBP/USD nears 1.2500 on renewed USD strength

GBP/USD turns south and drops toward 1.2500 after reaching a 10-day-high above 1.2600 earlier in the day. In the absence of high-tier macroeconomic data releases, the US Dollar benefits from the souring risk mood and weighs on the pair.

Gold falls below $2,600 amid mounting risk aversion

Gold fell below the $2,600 level in the American session on Monday, with US Dollar demand backed by the poor performance of global equities and exacerbated by thin trading conditions ahead of New Year's Eve.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637408660714661389.png)