Gold Price Weekly Forecast: Bottom could be in place ahead of US inflation data

- Gold price declined modestly this week after posting gains for two consecutive weeks.

- Buyers remain hopeful as XAU/USD holds above the key 200-day SMA.

- August inflation data from the US could trigger a noticeable reaction in the pair.

Following a bearish opening to the week, Gold price stabilized above the key 200-day Simple Moving Average (SMA) located slightly below $1,920. In case this support stays intact ahead of next week’s highly-anticipated August inflation data from the US, investors could hesitate to bet on further XAU/USD weakness.

What happened last week?

As macroeconomic data releases from the US pointed to a lack of progress in inflation and a relatively healthy economic activity, investors started to reassess the possibility of the Federal Reserve (Fed) raising its policy rate one more time before the end of the year. As a result, US Treasury bond yields stretched higher and the US Dollar continued to find demand, forcing XAU/USD to stay on the back foot in the first half of the week.

Gold price fluctuated in a tight range on Monday because trading volumes remained thin on the US Labor Day holiday. Early Tuesday, data from China showed that the service sector continued to lose growth momentum in August, with the Caixin Services PMI falling to 51.8 from 54.1 in July. As safe-haven flows began to dominate the action in financial markets, the USD gathered strength against its rivals, and XAU/USD lost more than 0.5% on the day.

The ISM Services PMI in August advanced to 54.5 in August, signaling that economic activity in the US service sector continued to expand at an accelerating pace in August. Underlying details of the report highlighted that employment in the sector grew, while input price pressures gathered strength. The benchmark 10-year US Treasury bond yield climbed to 4.3% on Wednesday after the data release, causing Gold price to fall below $1,920 for the first time in a week.

On Thursday, the number of first-time applications for unemployment benefits in the US declined by 13,000 to 216,000 in the week ending September 2, the Department of Labor reported. This marked the lowest reading since early February and emphasized tight conditions in the labor market. Meanwhile, the Bureau of Labor Statistics announced that the increase in Unit Labor Costs in the second quarter got revised higher to 2.2% from the initial estimate of 1.6%. The USD Index, which gauges the greenback’s valuation against a basket of six major currencies, advanced to its highest level in nearly six months above 105.00 after these data releases and didn’t allow XAU/USD to stage a rebound.

The 10-year US T-bond yield corrected lower on the last trading day of the week. XAU/USD found a foothold and went into a consolidation phase above $1,9220.

Next week

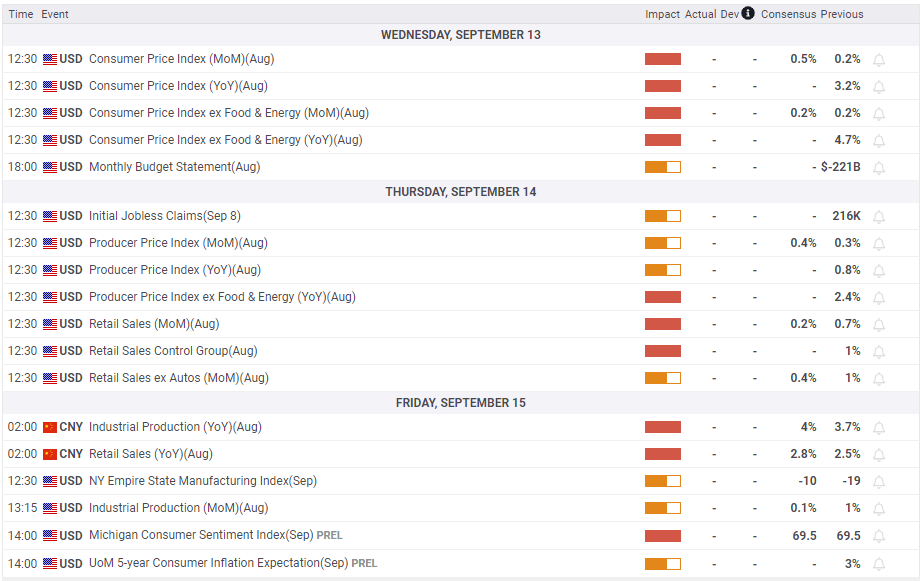

August Consumer Price Index (CPI) data from the US on Wednesday will be the highlight of the week. On a monthly basis, the CPI is forecast to rise 0.5%, while the Core CPI is expected to increase 0.2%. Markets don’t expect the Fed to raise the policy rate in September and inflation readings are unlikely to alter that view. However, the CME Group FedWatch Tool shows that investors still see a nearly 40% probability of the Fed hiking again before the end of the year, either in November or December.

The immediate market reaction to the CPI data could be straightforward. A stronger-than-forecast monthly reading could attract hawkish Fed bets and weigh on XAU/USD, while a soft print could have the opposite impact on the pair’s action and help it stage a rebound.

In the current market climate, however, it’s difficult to say how much room Gold price has on the downside even if investors lean toward more Fed tightening. The yield on the 10-year US Treasury bond yield rose for four consecutive months and gained nearly 20% from May to September. In the meantime, concerns over a global economic slowdown have increased even though the US economy proved to be more resilient than other major economies.

The 10-year US yield might be approaching its near-term ceiling if investors see the combination of mixed macroeconomic US data releases, the hawkish Fed policy outlook and the overall risk-averse market mood with signs pointing to an economic downturn. This could cause investors to seek refuge in Treasury bonds with longer maturity.

In summary, markets could be nearing a point where the US yields are dragged lower by stronger demand for Treasury bonds, with investors adjusting their positions for a potential economic downturn rather than “higher for longer” Fed policy rate.

In its monthly report published on September 6, “recent changes in yields have led to a ‘bear steepening’ of the yield curve, historically a more challenging environment for risk off assets such as Gold,” noted World Gold Council. “But the expectation of a slowdown remains – a scenario in which gold has historically performed well,” the report read.

Gold technical outlook

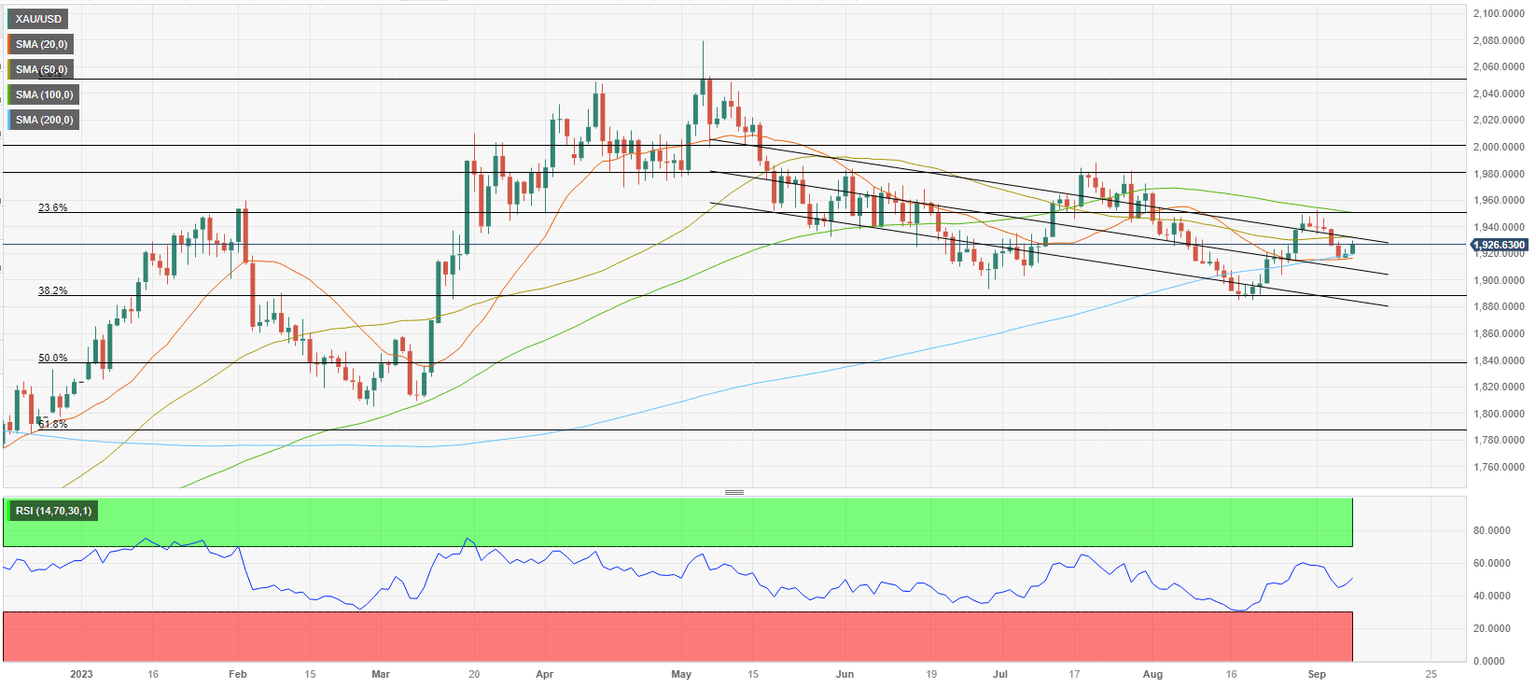

Despite the decline seen in the first half of the week, the Relative Strength Index (RSI) indicator on the daily chart held above 50, reflecting the sellers' hesitancy. Additionally, XAU/USD staged a rebound after testing the 200-day SMA near $1,920.

On the upside, $1,930 (50-day SMA, upper limit of the descending channel) aligns as immediate resistance ahead of the $1,950 barrier (100-day SMA, Fibonacci 23.6% retracement of the latest uptrend). A daily close above that level could bring in additional buyers and help XAU/USD target $1,980 (static level) next.

If Gold price drops below $1,920 (200-day SMA) and starts using that level as resistance, $1,900 (psychological level) and $1,890 (Fibonacci 38.2% retracement) could be set as next bearish targets.

Gold forecast poll

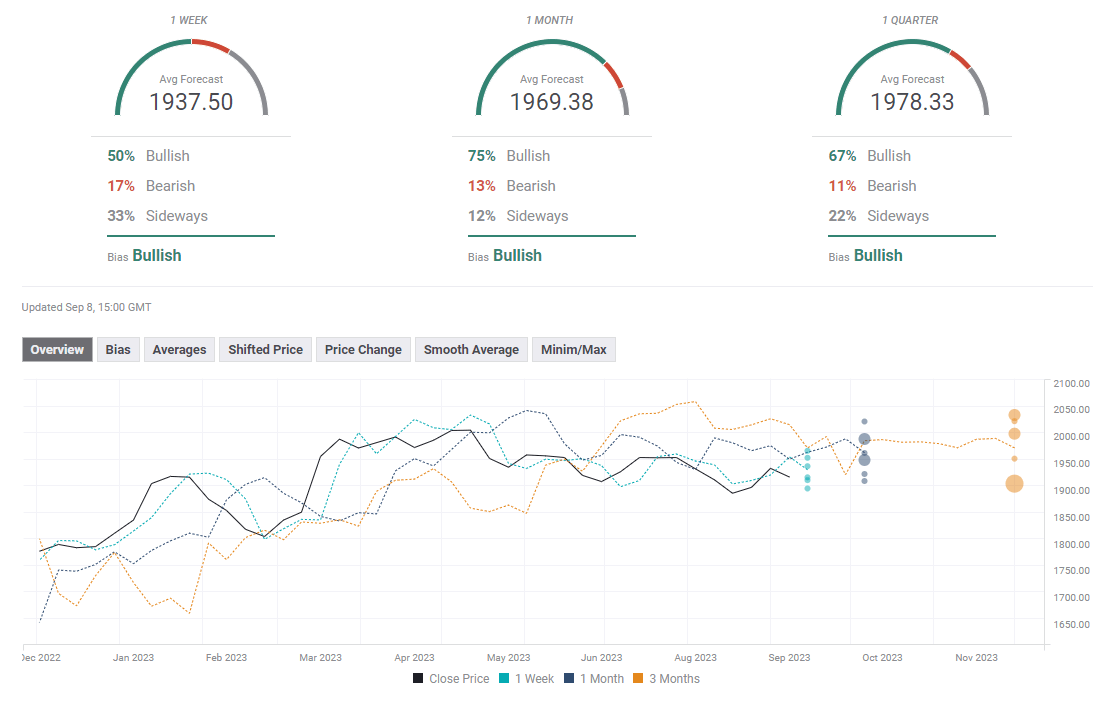

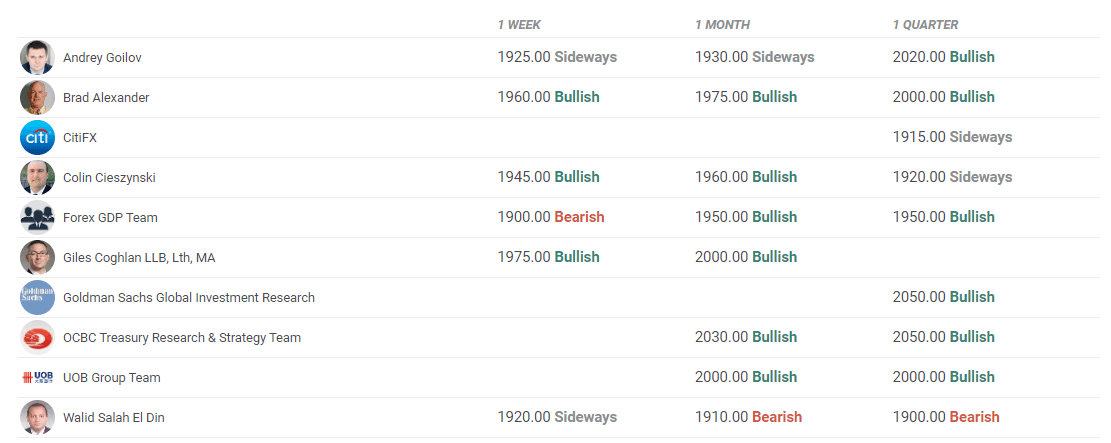

FXStreet Forecast Poll points to a slightly bullish bias in the short term, and the one-week average target aligns at $1,937. The one-month outlook remains overwhelmingly bullish, with several experts who took part in the poll seeing XAU/USD rising to or above $2,000 in that time frame.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.