Gold Price Forecast: XAU/USD sellers take a breather ahead of Fed Minutes

- Gold price pauses its losing streak before the Fed Minutes on Wednesday.

- The US Dollar holds the upside alongside Treasury yields amid China woes and Mid-East risks.

- Gold price looks set to bounce off key $2,630 support amid bullish daily RSI.

Gold price is taking a breather in the lead-up to the release of the Minutes of the US Federal Reserve (Fed) September policy meeting due later on Wednesday.

Gold price eyes Fed Minutes for fresh impulse

In Wednesday’s Asian trading, Gold price is attempting a tepid bounce, snapping a five-day downtrend. Gold traders eagerly await the Fed Minutes to assess the scale of the next interest rate cut, especially after Friday’s strong US Nonfarm Payrolls data took bets for a 50 basis points (bps) rate reduction off the table.

The Fed Minutes of the September meeting will likely show discussions about the labor market and inflation outlook, as well as, on the way forward on the interest rates. Lately, Fed policymakers continued to deliver dovish messages at their respective appearances, although maintaining a non-committal stance on the size of the next rate cut.

Bets for a smaller Fed rate cut have already weighed on Gold price so far this week, as buyers now seem to lack a bullish conviction due to mounting Chinese economic concerns on the lack of further stimulus announced by China. The Dragon Nation is the world’s top yellow metal consumer, and hence, rising economic worries could weigh over the physical demand for Gold from Chinese consumers.

The safe-haven Gold price, however, continues to find a ‘dip-buying’ demand, as escalating tensions between Israel and Iran raise risks of the conflict turning into a wider regional war.

Reuters reported early Wednesday, Israel Prime Minister Benjamin Netanyahu said Israeli airstrikes had killed two successors to Hezbollah's slain leader, as Israel expanded its ground offensive against the Iran-backed group with a fourth army division deployed into south Lebanon.”

Ahead of the Fed Minutes, Gold price could find some trading incentives from speeches by Fed Vice Chair Philip Jefferson and San Francisco Fed President Mary Daly. Fed official Jerfferson said earlier on, the decision for a 50 bps rate cut in September “was timely and consistent" with the Fed's two mandates of attaining 2% inflation and maximum employment.

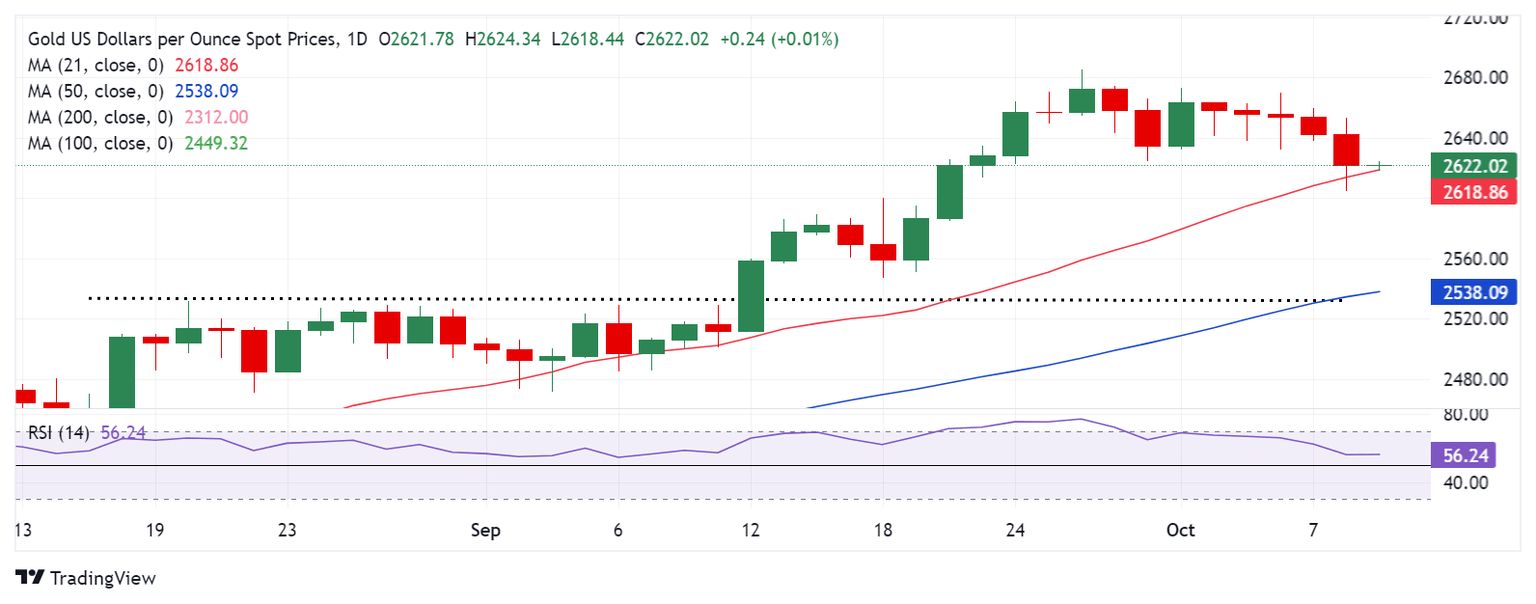

Gold price technical analysis: Daily chart

Gold price outlook remains constructive from a short-term technical perspective even though sellers cracked the key static support of $2,630 on a daily closing basis.

The 14-day Relative Strength Index (RSI) is in a recovery mode while holding above the midline, currently near 56. This suggests that a Gold price rebound could be in the offing.

On the downside, the 21-day Simple Moving Average (SMA) at $2,619 must be defended to revive the upward trajectory to record highs.

A failure to do so will recall sellers, triggering a fresh sell-off in Gold price toward the $2,600 threshold. Additional downside pressure could target the September 20 low of $2,585.

On the flip side, Gold price needs a daily candlestick closing above the $2,650 psychological barrier to take on the lifetime high of $2,686 again.

Ahead of that, the strong resistance near $2,670 will come into play.

(This story was corrected on October 9 at 06:30 GMT to say that "Gold price outlook remains constructive from a short-term technical perspective even though sellers cracked the key static support," not buyers.)

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Read more.Next release: Wed Oct 09, 2024 18:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.