Gold Price Forecast: XAU/USD down but not out on looming geopolitical risks

- Gold price bounces toward $2,350 after correcting on hot US CPI data.

- US Dollar retreats with US Treasury bond yields ahead of US PPI data, Fedspeak.

- Gold price could retest record highs on a bullish technical setup on the 4H chart.

Gold price is reversing a part of the previous day’s losses, bouncing toward $2,350 in Asian trading on Thursday. Gold price finds its feet heading into another eventful US economic docket, with eyes on the Producer Price Index (PPI) data and speeches from US Federal Reserve (Fed) policymakers.

Geopolitical woes offset hot US CPI, as Gold buyers stay hopeful

The upswing in Gold price could be attributed to the latest leg down in the US Dollar alongside the US Treasury bond yields, as Asian stocks see a modest rebound amid hopes of more policy support from China after the country’s monthly Consumer Price Index (CPI) fell 1.0% in March, compared with a 0.5% decline expected.

The retreat in the US Dollar is also seen on the back of a USD/JPY correction, as the Japanese Yen attempts a recovery after some verbal intervention from Japan’s authorities. USD/JPY hit a fresh 34-year high at 153.24 on Thursday after the US Dollar rallied hard, tracking the upsurge in the US Treasury bond yields, capitalizing on hotter-than-expected US CPI inflation data.

The US CPI rose 0.4% MoM in March, higher than the estimates of 0.3%, according to data released by the Labor Department's Bureau of Labor Statistics on Wednesday. Monthly Core CPI also rose 0.4% in the same period, beating expectations of 0.3%. The annual headline CPI grew 3.5% against the market forecast of 3.4%.

Hot US CPI poured cold water on June Fed rate cuts, with markets now pricing in only an 18% chance of the Fed lowering rates in June, compared with a roughly 52% probability seen before the data release.

In the US CPI aftermath, Gold price corrected sharply to near $2,320 before staging a decent comeback to settle Wednesday at $2,334. Escalating geopolitical tensions in the Middle East helped the late rebound in Gold price while lending support to the safe-haven at the moment as well.

Citing people familiar with the intelligence, Bloomberg reported that “the US and its allies believe major missile or drone strikes by Iran or its proxies against military and government targets in Israel are imminent, in what would mark a significant widening of the six-month-old conflict.”

Looking ahead, Gold price could resume its upward trajectory on a sustained basis if the geopolitical tensions intensify, prompting investors to flock to safety in Gold price. However, risks to the Gold price rebound could emerge on the US PPI data releases and the European Central Bank (ECB) policy announcements. The ECB is widely expected to keep borrowing costs at a record high. The focus, however, will be on whether officials signal a rate cut in June.

A hawkish hold by the ECB, suggesting that the central bank could keep its policy tight for longer, could reinforce the selling interest around the Gold price. Higher interest rates reduce the appeal of holding non-yielding Gold.

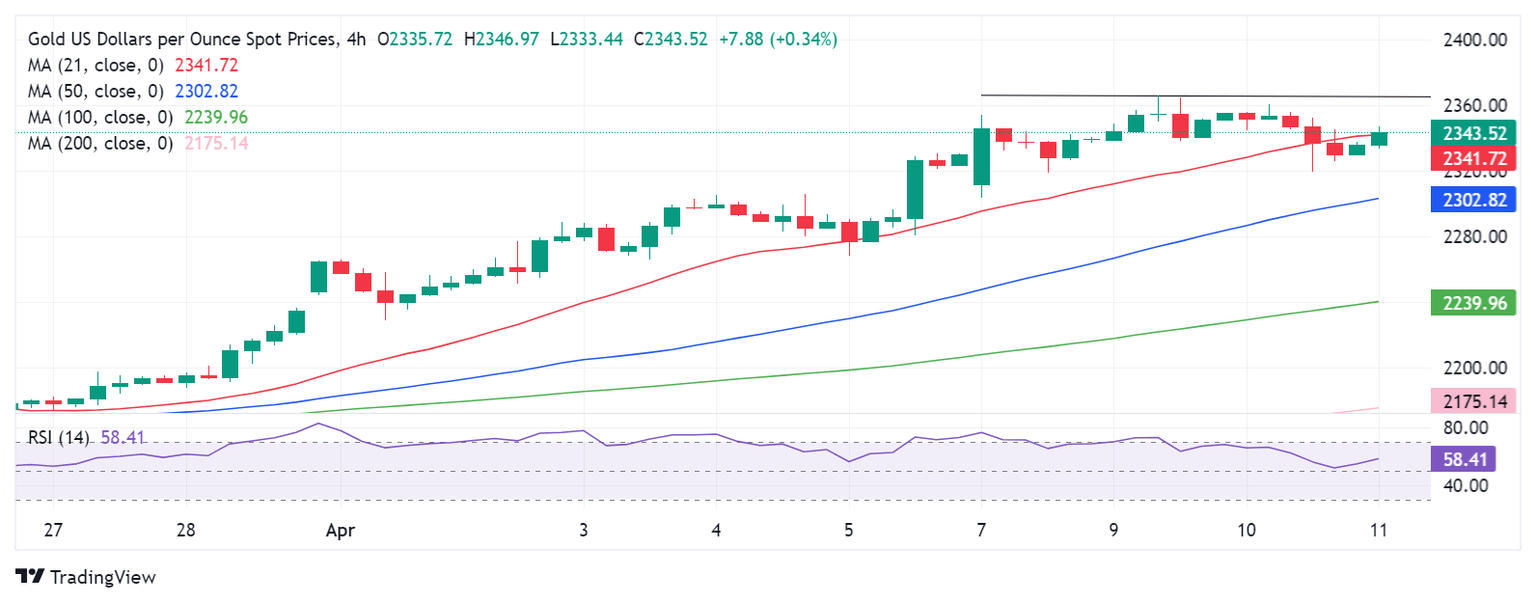

Gold price technical analysis: Four-hour chart

As observed on the four-hour chart, Gold price is on track to challenge the record high of $2,365, as it recaptures the 21-Simple Moving Average (SMA) at $2,342.

The Relative Strength Index (RSI) is pointing north above the midline, near 59.00, indicating that there is a scope for further upside.

The immediate resistance is seen at the $2,350 psychological level on the way to all-time highs.

Further up, a fresh rally toward the $2,400 level cannot be ruled out.

If the Gold price correction regains traction, the static support at $2,330 will immediately rescue buyers.

Failure to defend the latter will reinforce sellers toward the April 4 high at $2,305, below which the April 5 low of $2,268 will be tested.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.