- Gold price has come under pressure on a spot basis, but a break of daily resistance this week could be on the cards.

- Meanwhile, mitigation of lower time frame price imbalances could be in play to start the week off.

Before getting into the spot gold price technicals, analysts at TD Securities explained that money managers aggressively liquidated gold longs as a hawkish Fed continues to sap interest in the yellow metal.

''After all,'' the analysts said, ''as the world chases the same hawkish Fed narrative, position squeezes continue to drive price action in the yellow metal.''

''Notwithstanding, proprietary traders are the cohort raising risks of additional liquidations, after having built a massive and complacent position since the pandemic. While the war in Ukraine has sent the bears packing at prop-shops, the cohort's longs have yet to capitulate. This week, prop traders only marginally liquidated their length, whereas the breadth of traders long hasn't budged, suggesting a liquidation event is still forthcoming.''

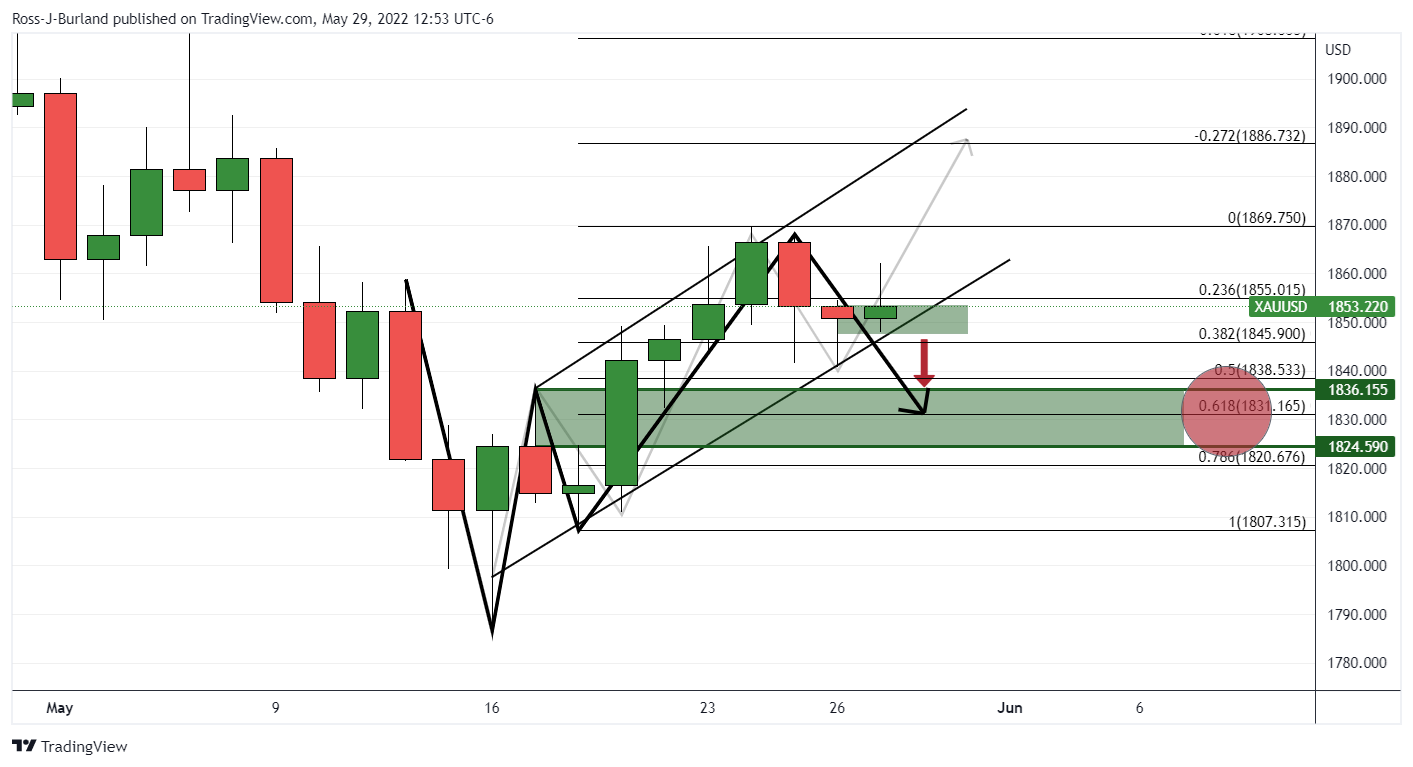

For the technical outlook, as per the prior pre-open analysis for last week, Gold, Chart of the Week: XAU/USD bulls need to hold $1,850 or a 61.8% golden ratio will be next on bear's menu, it was shown that the daily chart's W-formation's neckline near a 61.8% golden ratio was yet to be fully tested:

Gold daily chart, live market

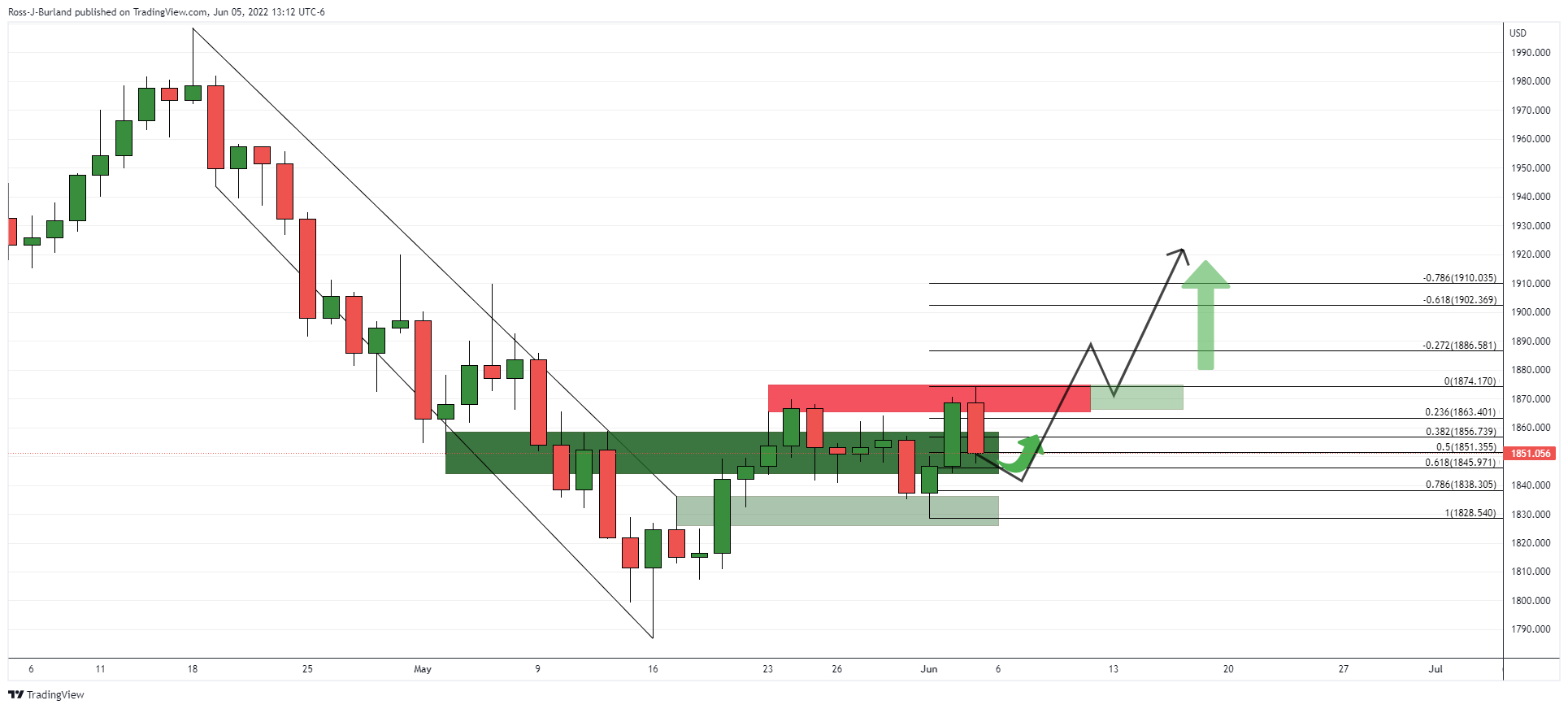

As illustrated, the price moved in on the area and completed the retest of the neckline. This now offers prospects of a move higher from here following the move out of the downside channel. However, the resistance will need to give:

Gold, H1 chart

For the open, the hourly chart could see some initial bids come through to mitigate some of the latest bearish impulse. The 50% mean reversion area aligns with the prior support as a target. However, should resistance hold up, there could be a move into the downside to fully test the demand area in the $1,840s again.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

ECB reduces rates by 25 bps as largely expected – LIVE

On Thursday, the ECB delivered the 25 bps cut everyone expected, trimming the Deposit Facility Rate to 2.25%. EUR/USD remained within its daily sideline theme around the 1.1350-1.1360 band in the wake of the release. Now, all eyes are on Christine Lagarde’s live press conference as investors hang on her every word for clues about what comes next.

GBP/USD advances to daily highs past 1.3250

GBP/USD is picking up extra upside impulse and is revisiting the 1.3250 zone, or daily peaks, as the US Dollar is trimming part of its earlier advance. The move in Cable remains propped up by a firm tone in the risk complex.

Gold remains affered, recedes to the $3,340 area post-ECB

Gold powered to a fresh record, flirting with the $3,360 area per troy ounce, before embarking on a correction to the current $3,340 zone, always on the back of the decent rebound in the US Dollar and the recovery in US Treasury yields across the curve.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.