Geopolitical uproar can wreck the most reasonable macro understandings and interpretations

Geopolitical uproar can wreck the most reasonable macro understandings and interpretations. As Keynes put it, “Markets can remain irrational longer than you can remain solvent.”

Trump can remain irrational longer than the peso and Canadian dollar can remain defiant. The idea is still floating around that the tariffs-on-time threat yesterday is a negotiating ploy to drive those neighbors into shunning China, or something.

Today we get the Conference Board consumer sentiment, which observers fear will echo the dreadful U of Michigan report last Friday that showed confidence at a 15-month low and inflation expectations rising. Reuters reports “Consensus forecasts are for a drop in the gauge to five-month lows.”

We also get more Fed speeches, but with Chicago Fed Goolsbee leading the pack with his remark on Monday “we need more clarity.”

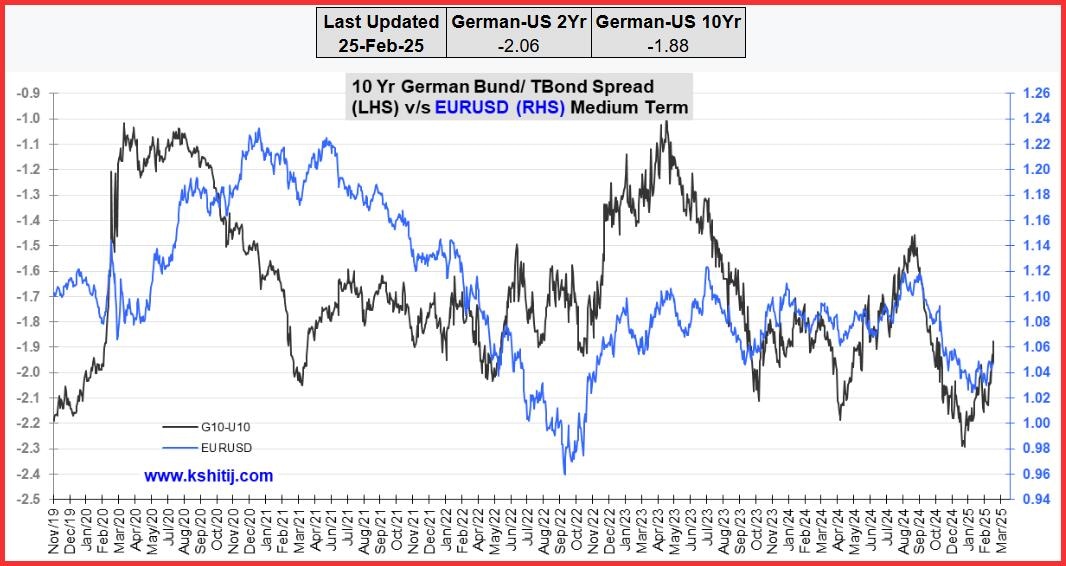

The drop in US yields is remarkable. It’s the top story in the FT today. The 20-year is at the lowest year-to-date for a drop by 20 points in under two weeks. The 2-year has fallen as far as 4.11%, last seen Dec 11. See the chart from Kshitij.

The yield drop is due to the expectation, growing like Topsy, of recession and/or stagflation within the next few months, inspiring the Fed to cut in June and then again in October, if not a third time. Warnings about earnings reports later in the year are starting to spring up, sending the more cautious out of equities and into bonds.

Wait a minute—the Fed is supposed to set policy with the goal of keeping/driving inflation down and employment up (and maintain financial market stability). As Chicago Fed Goolsbee and others Feds have noted, we lack clarity on inflation and probably employment, too, so that rate cuts cannot be assured. Will data be so lousy by June that the Fed feels it has to violate its own data-dependence? Whatever the outcome, the Fed is going to be behind the curve--again.

No longer a tidbit is the disruptive effect of the DOGE firings, rude emails, re-hirings and general mess that Musk is making of the efficiency push. Everyone would like to see government less inefficient, but the consensus arrived very early that this is not the way to do it. The press is having fun revealing the savings as lies built on a failure to understand how the entities and their databases work, like the 150-year olds receiving Social Security checks. The tech geniuses failed to grasp that these are dead people. Pretty basic, you’d think, but youngsters and techies so often lack common sense and never question what looks like “data.”

Here's the crux of the matter: the bond market is judging Trump/Musk as incompetent and not able to bring the deficit down by any meaningful amount. Bloomberg reports “Musk has tossed around huge spending cut targets — $1 trillion or even $2 trillion — but to budget watchers like Yardeni, these numbers are so astronomical they can’t be considered realistic annual goals.

“Even $200 billion a year ‘would be pretty impressive,’ he said. Anna Wong, the chief US economist at Bloomberg Economics, said that figure would likely need to be closer to $400 billion a year to give the administration a chance to curb the deficit enough to contain the breakneck growth in the US debt-to-GDP ratio.”

Therefore, yields must rise, eventually. But first we may see the economy stagnate, inflation rise by leaps and bounds, and the Fed dither.

Forecast

We are in a period of great Noise, with the charts refusing to deliver anything resembling the “correct” response to macro and even geopolitical data. The dollar might get a respite if there is any kind of Ukraine peace deal, but don’t count your chickens. The problem is that risk-off tends to send the dollar higher, even as it’s the US generating the risk. A full-bore stock market selloff may drive a change in rhetoric but then the question arises whether anything that comes out of the White House is not a lie. So while some charts show a dollar resurgence, don’t count on its continuing, except against the CAD and peso.

Tidbit: We await PCE and core PCE on Friday, Feb 28. The last reading was 2.8% y/y but as we showed yesterday, some components are really, really bad, like shelter up 7.9% y/y in Jan, with food up 10.1% and the overall net up 6.4% due to the drop in energy.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat