GBP/USD Weekly Forecast: UK growth and US inflation data leave no room to rest after the crash

- GBP/USD has crashed in response to the BOE's no-hike decision and Fed tapering.

- Brexit and central bank speculation will likely set the tone now.

- Early November's daily chart is painting a bearish picture.

The first week of November has been one to remember – a crash of nearly 300 pips due to BOE's "close call" to refrain from raising rates and the Fed's expected, yet marginally hawkish tapering decision. Politics on both sides of the pond may now move from the back burner to the fore.

This week in GBP/USD: One-two punch sinks the pound

"Markets must make unconditional calls in response to the conditional statements" – Bank of England Governor Andrew Bailey's attempt to explain why markets were caught wrong-footed on the decision to leave interest rates unchanged. Only two out of nine members opted for fighting rising inflation with higher borrowing costs. Sterling fell sharply in response.

Better employment forecasts and expectations for inflation to hit 5% failed to help the beaten pound, nor did expectations for a move in December, when the BOE's bond-buying program concludes.

On the other side of the pond, there was far less drama. The Federal Reserve announced tapering its bond-buying scheme at a reduction rate of $15 billion per month – at least in November and December. The flexible nature of the plan raised speculation of an early end and a rate hike coming sooner rather than later.

However, Fed Chair Jerome Powell called for patience on raising rates and said the bar is higher for such a move. Moreover, he seemed to prefer a predictable path of tapering. The dollar pared its early gains. However, the greenback later benefited from rate hike speculation.

Brexit: After a relatively quiet period in which French officials praised British negotiators regarding fishing, the UK raised the option of triggering Article 16 of the Withdrawal Agreement. The mere talk of using this unilateral emergency mechanism to break the deal raised fears of a trade war and added to sterling's suffering.

In Washington, critical Democratic lawmakers inched closer to agreeing on a scaled-back spending bill, but there was still no white smoke at the time of writing.

US economic indicators were mostly upbeat, with one theme standing out – inflation is rising. The ISM Services Purchasing Managers' Index hit 66.7 points, the highest since 2005, but also its Prices Paid component reached levels last seen back then. Annualized Unit Labor Costs also accelerated to 8.3%, reflecting wage pressures.

That was a warm-up toward Friday's Nonfarm Payrolls. These beat estimates with 531,000 jobs gained in October, and on top of upward revisions worth 235,000 for previous months. The dollar benefited from the news and also from an increase in wages to 4.9% YoY.

UK events: GDP and Brexit stand out.

Was the Bank of England's decision to keep rates low justified? Quarterly Gross Domestic Product figures will give partial answers for the third quarter. After leaping by 5.5% QoQ, a significant slowdown is likely, but it is unclear by how much.

America's economy expanded by only 0.5% quarterly, partially due to higher inflation, lower in Britain. With growing sensitivity to economic indicators as predictors of rate hikes, sterling has significant room to move in response to UK GDP. It will likely overshadow Industrial Production and other statistics.

Will lingering Brexit issues result in a UK-EU trade war? That is a remote option, as both sides would lose – but one that cannot be ruled out. A lobbying scandal has rocked prime Minister Boris Johnson's government, and clashing with an external rival would be shrewd politics. However, there is probably more room to calm down and return to quieter talks. That would benefit the pound.

COVID-19 cases remain elevated as temperatures continue falling. While slapping new restrictions seems like a remote option, covid headlines could weigh on the pound if the health system comes under pressure.

Here is the list of UK events from the FXStreet calendar:

US Events: Fresh inflation data stands out

Is inflation rising even further, or is Team Transitory en route to recovery? All available signs are pointing to persisting rise prices – and economists also expect ongoing pressures. The calendar points to an increase of 5.3% in the headline Consumer Price Index (CPI) in October, only 0.1% less than 5.4% in September.

Core CPI – which is of higher interest to markets and the Fed – is set to hold up at 4%. Any slight change could shake the dollar substantially, with a straightforward trade – above 4% in Core CPI is dollar positive and below it is negative.

The University of Michigan's preliminary Consumer Sentiment Index for November is also worth mentioning – despite its lack of correlation with retail sales. It remains a market mover. The indicator has failed to recover from its sharp fall in August and could fall even further.

On the political front, it seems that Democrats are closing in on a deal to approve vast long-term spending programs and changes to the American economy. In the short term, markets have fully priced in an accord. Moreover, it is essential to remember that the sums mentioned are for expenditure in an entire decade – not an immediate splash of cash. The market reaction will likely be muted.

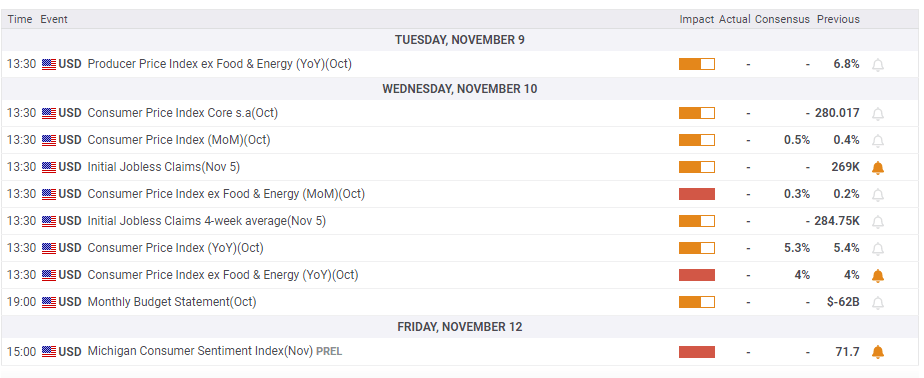

Here are the upcoming top US events this week:

GBP/USD technical analysis

Pound/dollar is on the back foot – and that is also clear on the daily chart. Momentum has turned to the downside just after the currency pair failed to break above the 50-day Simple Moving Average (SMA). Early in the week, GBP/USD also lost the uptrend support line.

The Relative Strength Index is still above 30, thus outside oversold territory and allowing for more losses, at least for now.

Critical support awaits at 1.34, the low point from late September. It is followed by 1.3310 and 1.3250, levels last seen in late 2020.

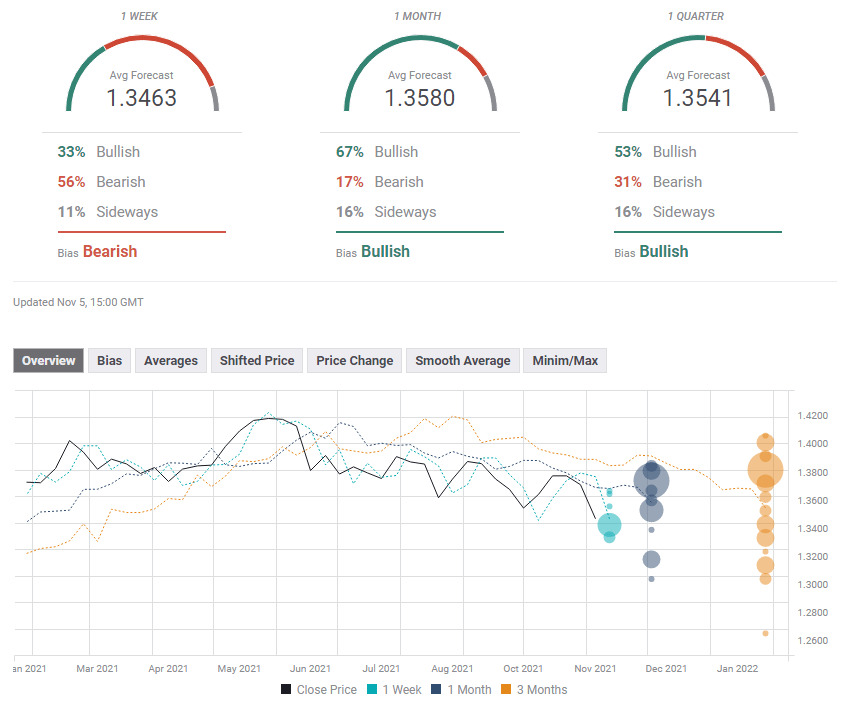

GBP/USD sentiment

Cable has room to recover, as the BOE is still on course to raise rates in December – and some short-covering is due.

The FXStreet Forecast Poll is showing a short-term bearish tendency and an upward move later on. It seems that experts foresee more BOE suffering before a recovery, albeit not to previous levels.

Related reads

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.