GBP/USD Weekly Forecast: Range bound with an eye on the BOE

- Weak July GDP data restrains sterling and rate hike expectations.

- GBP/USD finishes the week on par and at the middle of three-month range.

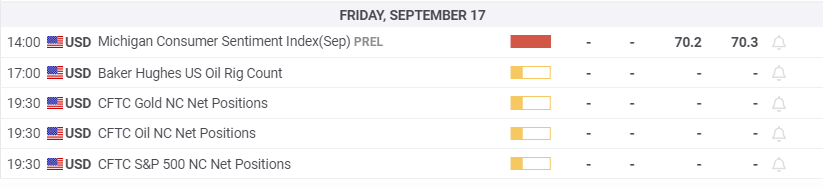

- FXStreet Forecast Poll is bullish but without leaving its current ranges.

Sterling’s recovery on Thursday and Friday ended, temporarily, the threat of the GBP/USD breaking below 1.3765 support and entering the lowest part of its seven-month range.

The safe-haven trade to the US dollar slackened this week, but the threat of the Covid-19 delta variant and the potential for the Federal Reserve to announce a tapering of its bond purchases remain active proponents for the dollar.

Prime Minister Boris Johnson’s proposed 12 billion sterling tax increase is designed to help the National Health Service and may help pave the way for a change in policy from the Bank of England (BOE).

The BOE is moving toward tighter monetary policy, as are the ECB and US Federal Reserve, even if none of the bankers are calling it such.

Governor Andrew Bailey’s recent comment in the House of Commons that the new BOE guidance infers that the minimum criteria for rate hikes are in place but that the continuing uncertainties over the pandemic and global and domestic economic conditions preclude an immediate move.

All three central banks have made it clear that the next policy shift is to curtail then end the emergency measures that have been in place for over 18 months. From a market point of view, these assertions are by now old news. Action is needed to break free of the range paralysis of the last three months.

Industrial production in the UK was better than forecast in July though manufacturing failed to improve. The chief disappointment was GDP which came in well below expectations in July and likely set back any BOE policy shifts.

American statistics were divided incongruously between plunging consumer sentiment figures and strong jobs data.The IBD/TIPP Economic Optimism Survey dropped into contraction in August while the labor market registered a record number of open positions for the fifth month in a row in July and Initial Jobless Claims dropped to their lowest level of the pandemic.

Consumer pessimism is likely a function of inflation, which has seen a steep rise this year. The Producer Price Index for August rose to 8.3% annualy, ensuring that consumer prices will continue their disturbing run higher.

Treasury rates were mixed on the week with the 10-year adding 2 basis points to 1.343% and the 2-year losing less than a point to 0.215%.

European Central Bank (ECB) President Christine Lagarde’s relatively optimistic take on the eurozone recovery in her Thursday press conference did little to bolster the euro or sink the sterling. Federal Reserve Chair Jerome Powell saw a similar disinterested response to his August taper promise.

Markets have had 18 months of warnings, rhetoric and conjecture, they await action.

GBP/USD outlook

In the absence of a fundamental trend technical considerations are paramount. The GBP/USD is in a gently upward sloping channel that extends back to August 20 largely due to the improving UK economic and pandemic picture. It has been rejected at 1.3900 three times in the past two weeks. Support at 1.3765 held firm but the rebound stopped short of resistance. The recent 1.3700-1.3900 range seems unlikely to be challenged.

Pending UK data, unemployment, CPI and Retail Sales for August should provide the sterling with support but without a more definite buy-in from the BOE on policy, the pound will not traverse new ground.

In the US, consumer prices and Retail Sales for August have center stage. Inflation is a major factor behind the drop in consumer sentiment and its impact on sales after July's unexpected decline will be closely watched. Weaker than expected US figures will favor the pound over the dollar.

The bias in the GBP/usd is higher, but it will be unable to leave its recent ranges.

UK statistics September 6–September 10

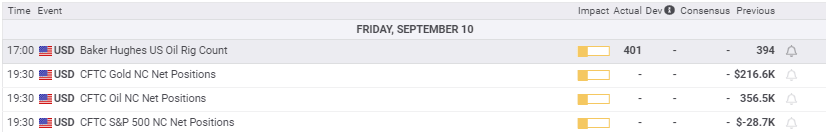

US statistics Sept 6–September 10

UK statistics September 13–September 17

FXStreet

US statistics September 13–September 17

GBP/USD technical outlook

The MACD (Moving Average Convergence Divergence) has a slight upward cast as does the Relative Strength Index (RSI), both having benefited from the late week rebound in the GBP/USD. Momentum in theTrue Range is weak with Friday's identical open and close at 1.3836.

Moving averages reflect the recent narrow trading ranges and are gathered around the market with three of four presenting support. The 21-day moving average (MA) at 1.3772 served as Wednesday's close and Thursday's open. The 50-day MA at 1.3807 and the 200-day MA at 1.3825 are active support lines. The cross of these three lines this week is a firm endorsement of the GBP/USD upward bias. Only the 100-day MA is above the market at 1.3917.

Resistance: 1.3870, 1.3900, 1.3917 (100 MA), 1.3965, 1.3990, 1.4100

Support: 1.3825 (200 MA), 1.3807 (50 MA) 1.3772 (21 MA), 1.3760, 1.3700, 1.3625

FXStreet Forecast Poll

The FXStreet Forecast Poll is nominally bullish but the lack of upward movement betrays the range-bound nature of the moment.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.