- GBP/USD has been moving higher amid some optimism before stalling amid a mix of news.

- UK GDP and jobs, US retail sales, and coronavirus figures are all eyed.

- Mid-July's daily chart is showing bulls are in the lead.

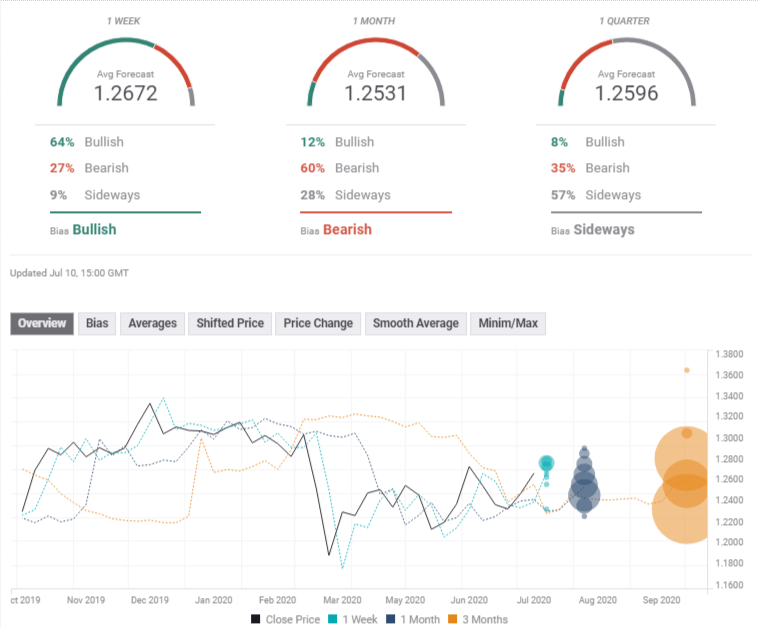

- The FX Poll is pointing to short-term gains followed by falls.

Optimism from China and the Chancellor has pushed the pair higher, yet US coronavirus and also politics held it back. COVID-19 statistics remain dominant, but the calendar also comes into the spotlight with UK GDP, claims, and inflation, while US figures are centered on the consumer.

This week in GBP/USD: Fiscal stimulus hopes and coronavirus concerns

Rishi Dishi: Chancellor of the Exchequer Rishi Sunak detailed a £30 billion program that includes vouchers for meals and also a job retention scheme. The announced, alongside a promise to do more, pushed the pound higher.

On the other hand, Brexit remains deadlocked. Chief EU Negotiator Michel Barnier and his British counterpart David Frost had a dinner – which included fish, one of the controversial topics – and that failed to yield a breakthrough. Their superiors, German Chancellor Angela Merkel and Prime Minister Boris Johnson, also spoke, and both stated that they are ready for a no-trade-deal Brexit.

The UK left the EU on January 31 but remains in a transition period through year-end. Without an accord, the U K falls to World Trade Organization rules in 2021, an unfavorable scenario for sterling.

The safe-haven dollar kicked off the week with a drop after Chinese authorities pumped up a "bullish stock market" and sent shares rising. Beijing was then quick to reign in the enthusiasm.

Relations between the US and China remain tense around Hong Kong. Reports suggested that the US is contemplating destabilizing the Hong Kong dollar peg. The world's largest economies are growing further apart,

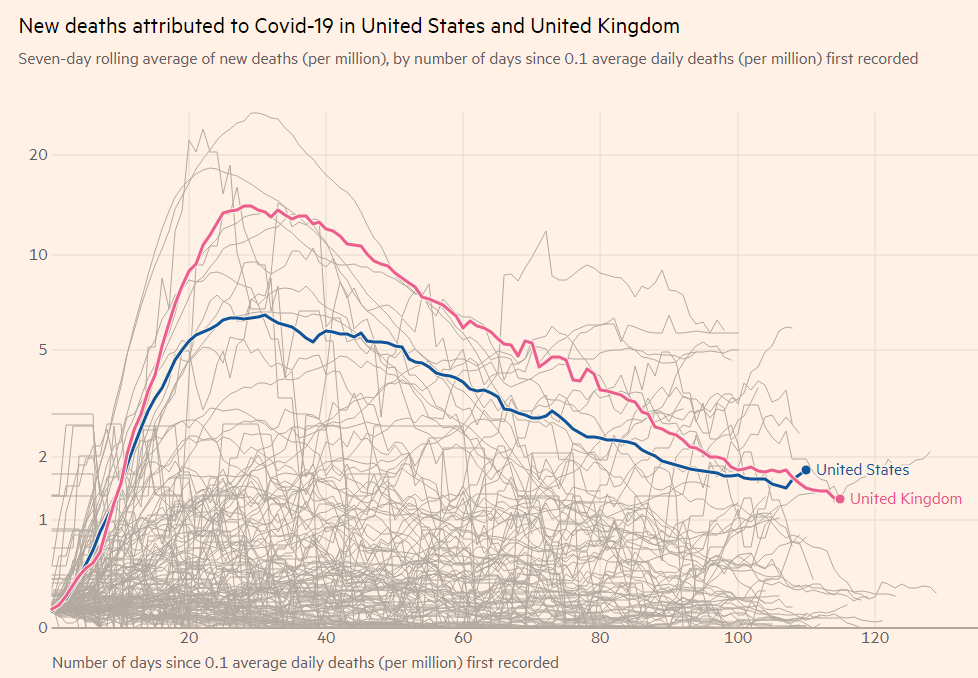

America's coronavirus crisis remains worrying – including in mortalities, which are nearing 1,000 per day. Cases hit a record of around 60,000 daily, and Intensive Care Units are strained in more and more hospitals.

Per million, the seven-day rolling average in the US has surpassed that of the UK:

Source: FT

President Donald Trump continued dismissing the disease and pushed for reopening schools. He seems to double down on his claims to be successful in the economy – ignoring the looming trouble. Trump is trailing rival Joe Biden by around nine points.

The presumptive Democratic nominee delivered a speech on the economy and spooked investors by saying that "Wall Street CEOs did not build America" amid calls to change the country's current capitalistic structure. His words also boosted the dollar.

UK events: GDP, Employment, and coronavirus cases

Outside Leicester, coronavirus seems to be under control in the UK, allowing for extending the gradual reopening and leaving the focus on other topics. Investors seem to accept no progress in Brexit talks through the summer, especially as the EU is focused on thrashing out is a recovery fund.

After the government introduced its stimulus, what will the central bank do? Andrew Bailey, Governor fo the Bank of England, delivers a speech on Monday and may move the pound. The BOE will likely leave its policy unchanged in August, after boosting bond-buying in June.

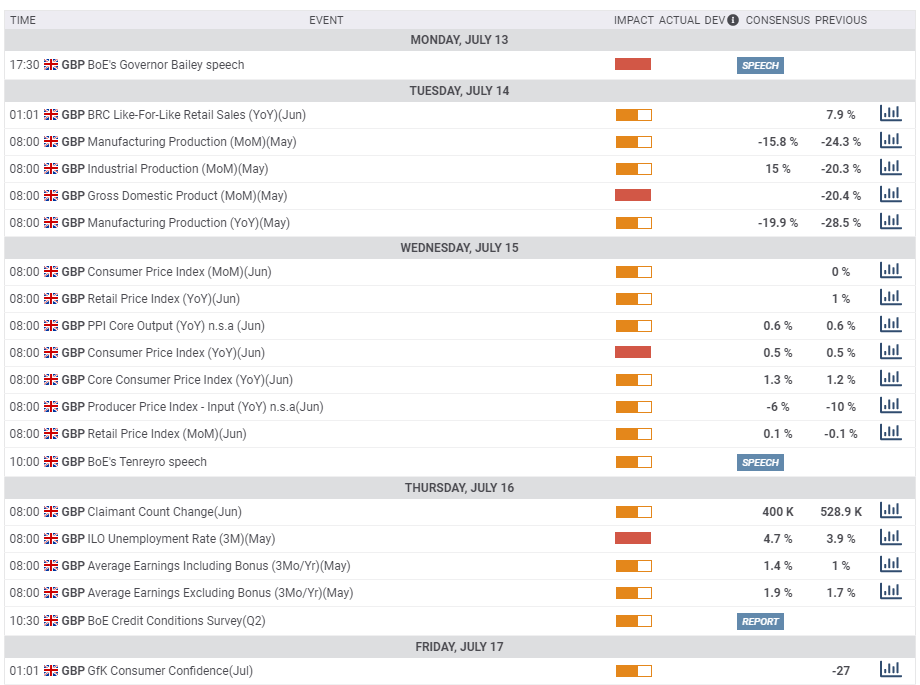

Gross Domestic Product figures for May are due out on Tuesday and could show stability after a collapse of 20.4% in April. Britain began its gradual easing of restrictions in May. Manufacturing output is also of interest. If output surprises with a significant rebound, sterling could surge.

Similar to GDP, inflation is also likely to consolidate its falls, with the headline Consumer Price Index projected to remain at 0.5% yearly. The pandemic plunged CPI from around 2% to its current levels and that provides the BOE another reason to remain accommodative.

The most significant release is due out on Thursday – the jobs report. The Unemployment Rate carries expectations for an increase to 4.7% in May after remaining at 3.9% in April. The government's furlough scheme – extended through October – is keeping joblessness low. Wages are projected to bounce from the lows, from 1% to 1.4% in the gauge including bonuses.

The more up-tot-date Claimant Count Change for June is set to show a more worrying picture, with another increase of around 400,000 jobless applications. It stood at 528,900 beforehand.

Here is the list of UK events from the FXStreet calendar:

US events: Coronavirus and its impact on the consumer

President Donald Trump will be holding a rally in Florida over the weekend – despite the state's terrible COVID-19 situation. If opinion polls show a mean reversion – Trump closing some of the deficit with Biden – stocks would advance and the dollar may struggle. Yet if Trump's dismissal of the disease continues and Biden widens the gap, the greenback may gain ground.

Figures coming out of the Sunshine State, as well as California, Texas, Arizona, and others, are of interest. With labs struggling to cope with the pace of testing, the number of infections may plateau but deaths could continue rising.

The economic calendar is busy, with inflation figures kicking off the week and are forecast to edge up in June, from 1.2% to 1.3% on the Core Consumer Price Index.

Thursday is a busy day. Retail sales are projected to continue rebounding from in June, but to a lesser extent than the 17.7% surge reported in May. The control group – or "core of the core" is also of interest. The first half of the month saw extended reopenings, but the second half already had consumers wary of going out and about.

Weekly jobless claims will likely compete for attention, for the same reason – have they edged up due to the new restrictions or continued falling?

Economists expect the University of Michigan's Consumer Sentiment Index to edge up to 80 points in the preliminary read for July. This forward-looking indicator could retreat if more Americans are concerned about coronavirus.

Here the upcoming top US events this week:

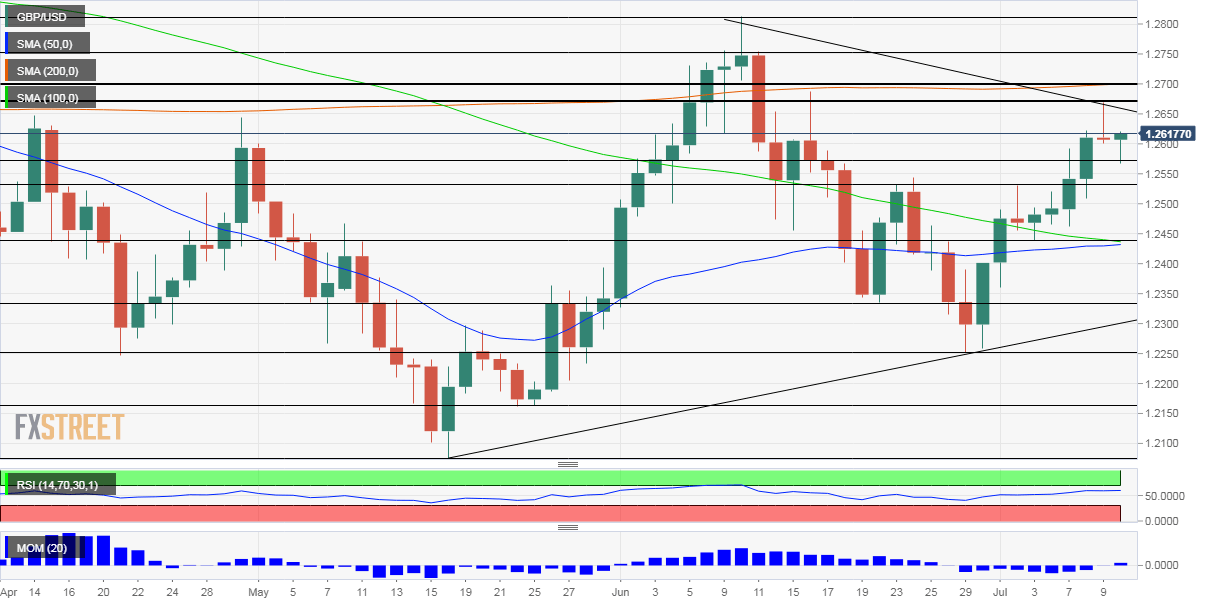

GBP/USD Technical Analysis

Pound/dollar faces a tough region of resistance between 1.2680 and 1.27 – which includes July's high, a swing high in mid-June – and the 200-day Simple Moving Average. Can cable climb above this critical cap? Momentum has turned to the upside and GBP/USD is holding above the 50 and 100-day SMAs.

The currency pair set higher lows but also lower highs – a triangle that suggests a robust reaction once it is broken in either direction.

Above 1.27, some resistance awaits at 1.2750, which is been a temporary top on the way up and on the way down. It is followed by 1.2815, the June peak.

Some support is at 1.2565, a swing low in mid-July, followed by 1.2530, a swing high from earlier this month. It is followed by 1.2445, a support line from this month which also converges with the 100-day SMA. Further down, 1.2340 is the next level to watch.

GBP/USD Sentiment

The pound side of the equation looks positive – ongoing economic recovery without expectations from Brexit for now. UK monthly GDP also carries low expectations and jobs are probably under control.

The US dollar side is far more uncertain, with coronavirus, the consumer, and campaign for the White House all potentially triggering safe-haven flows.

The FXStreet Forecast Poll is showing a short-term recapture of the 1.26 level before a retreat later on. Targets for the medium and long terms are little changed.

Related Reads

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends slide toward 1.0300, touches new two-year low

EUR/USD stays under bearish pressure and trades at its lowest level since December 2022 below 1.0350 on Thursday. The pair turned south amid a resurgent US Dollar demand and worsening market mood. Investors stay cautious at the onset of 2025, awaiting the US jobs data for fresh incentives.

GBP/USD slumps to multi-month lows below 1.2450

Following an earlier recovery attempt, GBP/USD reversed its direction and declined to its weakest level in nearly eight months below 1.2450. The renewed US Dollar (USD) strength on worsening risk mood weighs on the pair as markets await mid-tier data releases.

Gold benefits from risk aversion, climbs above $2,640

Gold gathers recovery momentum and trades at a two-week-high above $2,640 heading into the American session on Thursday. The precious metal benefits from the sour market mood and the pullback seen in the US Treasury bond yields.

XRP rockets 11% as Bitcoin starts New Year with bullish bang

Crypto majors zoomed higher in the past 24 hours as the market entered a widely expected bullish year, with Bitcoin inching above $95,000 to shake off losses from last week. XRP surged 11% to lead growth among majors as of Thursday, led by $1.3 billion worth of trading volumes on Korea-focused exchange UpBit.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.