- Pound Sterling stood tall, driving GBP/USD to fresh three-month highs above 1.2700.

- GBP/USD is set to find dip-demand, as the US employment data take center stage.

- GBP/USD buyers are likely to find strong support near 1.2450 if the correction extends.

The Pound Sterling extended its reigns over the United States Dollar (USD) this week, pushing GBP/USD to the highest level in three months above 1.2700. Traders brace for the US Nonfarm Payrolls (NFP) in the upcoming week, keeping the sentiment around GBP/USD underpinned.

Pound Sterling capitalizes on the US Dollar descent

Divergent interest rate outlook between the US Federal Reserve (Fed) and the Bank of England (BoE) helped the Pound Sterling maintain its bullish momentum, as the US Dollar registered its worst month in a year in November.

Expectations surrounding a dovish Fed policy pivot in 2024 gained ground throughout the week, underwhelming the US Dollar while the Pound Sterling benefited from the hawkish commentaries from several BoE officials, including Governor Andrew Bailey, following strong UK business PMI data last week. In lieu of this, the GBP/USD pair reached a three-month peak of 1.2733.

Markets are pricing in a 97% chance of the Fed standing pat in its December meeting, the CME Group’s FedWatch tool showed, with a 48% chance of a rate cut in March next year compared with a 22% chance last week.

The Fed rate cut bets rose substantially after Fed Governor Christopher Waller, a known hawk, flagged a policy pivot, spelling doom for the US Dollar and the US Treasury bond yields.

"I am increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%," Waller said in his speech on Tuesday. If the decline in inflation continues "for several more months ... three months, four months, five months ... we could start lowering the policy rate just because inflation is lower," he added.

Chicago Fed President on Tuesday, expressed concerns about keeping rates too high for too long. Meanwhile, Fed Governor Michelle Bowman noted that she was willing to vote for another rate increase should the incoming data support such a case.

Adding to more dovishness, New York Fed Bank President John Williams said on Thursday, “In balancing the risks of too-high inflation and a weaker economy, and based on what I know now, my assessment is that we are at, or near, the peak level of the target range of the federal funds rate.”

Meanwhile, on the economic data front, markets ignored the upward revision to the US Q3 Gross Domestic Product (GDP) data, which expanded at a faster pace than previously estimated. The highly anticipated Core PCE Price Index rose at an annual pace of 3.0% in October, moderating from a three-month string of 3.4% readings, remaining above the Fed's 2% target. On a monthly basis, the Core PCE inflation showed no growth in the reported month, missing a forecast of a 0.1% increase while down from the 0.4% print registered in September.

On the Pound Sterling side of the story, a few BoE policymakers took up the rostrum during the week, with the central bank’s Deputy Governor for Markets and Banking Dave Ramsden noting that “monetary policy is likely to be needed to be restrictive for an extended period of time to get inflation back to 2% target.”

BoE’s hawkish dissenter, Megan Greene, said that “…the policy may have to be restrictive for an extended period of time in order return inflation to 2% over the medium term.”

BoE Governor Andrew Bailey dismissed rate cut talks, saying that “we are not in a place now where we can discuss cutting interest rates – that is not happening.” Bailey added “We will do what it takes to get to 2% inflation target.”

Finally on Friday, the US published the ISM Manufacturing PMI, which came in worse-than-anticipated, holding at 46.7 in November, vs expectations of 47.6. The US Dollar fell with the news, helping GBP/USD to retain the 1.2600 mark.

Key events to watch out for Pound Sterling traders

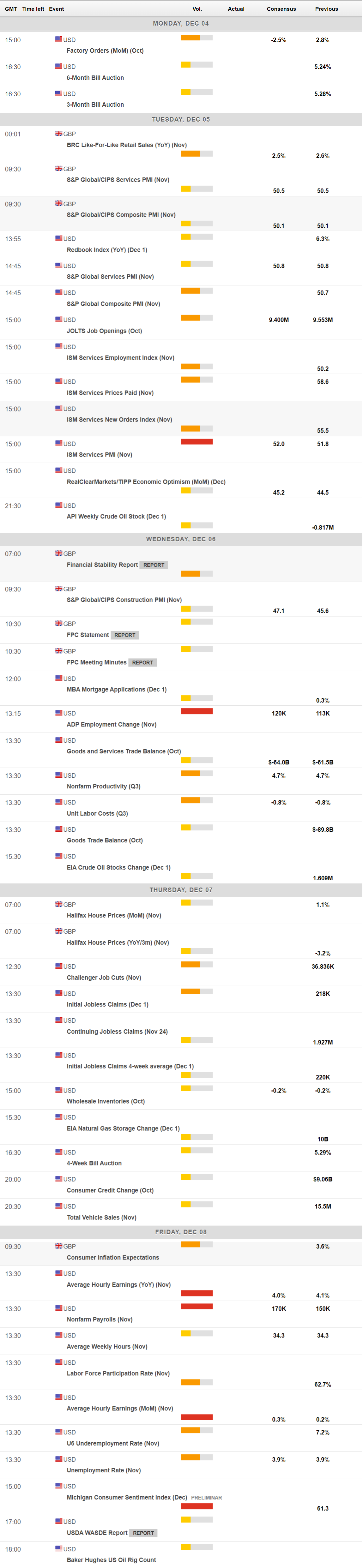

A fresh week kicks off on a quiet note on Monday, as the mid-tier Factory Orders data from the United States is likely to fill an otherwise uneventful docket on both sides of the Atlantic.

Tuesday will feature the Chinese Services PMI data, which will be followed by the final print of the UK and US Services PMIs for November. Of note will be the ISM Services PMI and JOLTS Job Openings data for fresh signs on the US economic resilience and the Fed’s interest rate outlook.

On Wednesday, the BoE Financial Stability Report (FSR) will be published but it is unlikely to have any impact on the Pound Sterling. Later that day, the US ADP Employment Change data will be published, the precursor to Friday’s all-important Nonfarm Payrolls report. Any deviation from the expectation is likely to fuel a big move in the US Dollar, eventually impacting GBP/USD.

Thursday is a light day for the UK traders, as there are no top-tier events from the United Kingdom. However, the US will see the release of the weekly Jobless Claims data. Meanwhile, China’s Trade data could set the tone for markets earlier in the day.

The UK consumer inflation expectations data will be published on Friday but the main event risk that day is expected to be the US labor market report. The headline US NFP figure and the wage inflation data will hold the key to repricing the Fed rate cut expectations for 2024.

The week will dry in terms of the speeches from Fed officials, as the Fed’s ‘blackout period’ begins on Saturday ahead of the December 12-13 policy meeting. The sentiment around the Fed expectations is likely to play a pivotal role in driving GBP/USD price action.

GBP/USD: Technical outlook

The bullish bias in the GBP/USD pair remains intact, especially after the ascending triangle breakout validated a couple of weeks ago.

That said, a test of the triangle target, measured at the 1.2815 level, still remains on Pound Sterling buyers’ radars on a sustained move above the August 30 high of 1.2746.

The next crucial upside barrier is seen at the 1.2900 round figure, above which doors will open up for a retest of the July 27 high of 1.2996.

The 14-day Relative Strength Indicator (RSI) is off the overbought territory and holds comfortably above the 50 level, suggesting that the upside potential remains in place.

Adding credence to the bullish outlook, the 21-day Simple Moving Average (SMA) is on the verge of crossing the 200-day SMA and the 100-day SMA, charting an impending bullish crossover.

However, if Pound Sterling buyers fail to sustain the upside, any retracement could find strong support at the confluence zone of the 21-, 100- and 200-day SMAs at 1.2475.

A daily closing below the latter will negate the uptrend in the near term, calling for a test of the November 17 low of 1.2374. Additional declines could challenge the flattish 50-day SMA at 1.2297.

Economic Indicator

United Kingdom Consumer Inflation Expectations

Consumer Inflation Expectations, released by Bank of England, is a percentage that consumers expect the price of goods and services to change during the next 12 months.

Read more.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.