GBP/USD Weekly Forecast: Bets on strong rebound look premature as markets shift to UK GDP, US inflation data

- The Pound Sterling rose for the first time in five weeks against the US Dollar.

- GBP/USD looks to US inflation and UK GDP data for the next push higher.

- Another Bear Cross on the daily chart could keep Pound Sterling sellers alive.

The Pound Sterling (GBP) staged a comeback versus the US Dollar (USD), lifting the GBP/USD pair from the lowest level in three months near 1.2835.

Pound Sterling tested 1.3000 yet again

GBP/USD returned to positive territory for the first time in five weeks, as the global market optimism and the central banks’ policy announcements overshadowed the resurgent demand for the US Dollar.

The Pound Sterling built on its recovery momentum in the early part of the week, as risk flows prevailed on hopes of Republican candidate Donald Trump’s victory in the US presidential race due on Tuesday. Additionally, profit-taking on the USD long positions ahead of the US election also helped the British Pound gain some positive traction, driving the pair back above the 1.3000 level.

However, sellers quickly returned on Wednesday after Trump decisively won the US presidential race and triggered a massive upswing in the US Dollar against its major rivals. Even though risk traders returned, the USD gains outweighed and smashed GBP/USD to the three-month lows of 1.2834, nearly 150 pips down on that day.

Pound Sterling fought back control on Thursday in the lead-up to the BoE and US Federal Reserve (Fed) interest rate decisions, as the traders resorted to position readjustments in the lead-up to the central banks’ event risk.

Buyers received a fresh boost after the BoE reduced the benchmark policy rate by 25 basis points (bps) to 4.75% from 5.0%, as expected but the Monetary Policy Committee (MPC) voted 8-1 in favor of a cut against expectations of a 7-2 voting composition. Further, Governor Andrew Bailey maintained a cautious stance on the future interest rate outlook in the post-policy meeting press conference.

Bailey noted, "we need to make sure inflation stays close to target, so we can't cut interest rates too quickly or by too much.” He added that "we will need to see more on how the budget affects inflation. I do not think it is right to conclude that the path of interest rates will be very different due to budget."

Later in the American session on Thursday, the US central bank cut the fed funds rate by 25 bps to a range of 4.50% to 4.75%, as fully priced in. The Greenback bounced slightly in a knee-jerk reaction to the Fed’s rate decision, which was quickly reversed on Chairman Powell’s press conference. Powell noted that the Fed remains on a gradual easing path and that the election won’t have any near-term effect on the policy decision. He further added that he will not quit even if asked by Trump.

In the Fed’s aftermath, the US Dollar resumed its corrective decline, allowing the major to retest the 1.3000 level. On Friday, the pair consolidated the weekly gains, as the Greenback paused its downside momentum, supported by the cautious market mood heading into the weekend.

Focus shifts back to growth and inflation data

With the central banks’ bonanza week out of the way, the top-tier economic data releases from both sides of the Atlantic grab attention.

It’s a holiday-shortened week though, as US markets are closed on Monday in observance of Veterans Day. On Tuesday, the labor market data from the UK will stand out amid a data-quiet US calendar. However, speeches from several Fed policymakers will keep traders entertained in American trading that day.

Wednesday will feature the all-important US Consumer Price Index (CPI) data, which will be followed by more Fedspeak.

The preliminary and the monthly Gross Domestic Product (GDP) readings from the UK will be in the spotlight on Thursday. Meanwhile, the US Producer Price Index (PPI) will be published alongside the weekly Jobless Claims data later that day.

Fed Chair Jerome Powell’s appearance in a panel discussion, titled "Global Perspectives" at an event hosted by the Federal Reserve Bank of Dallas, will be also eagerly awaited.

The UK and US Retail Sales data will fill in an otherwise light economic calendar on Friday.

GBP/USD: Technical Outlook

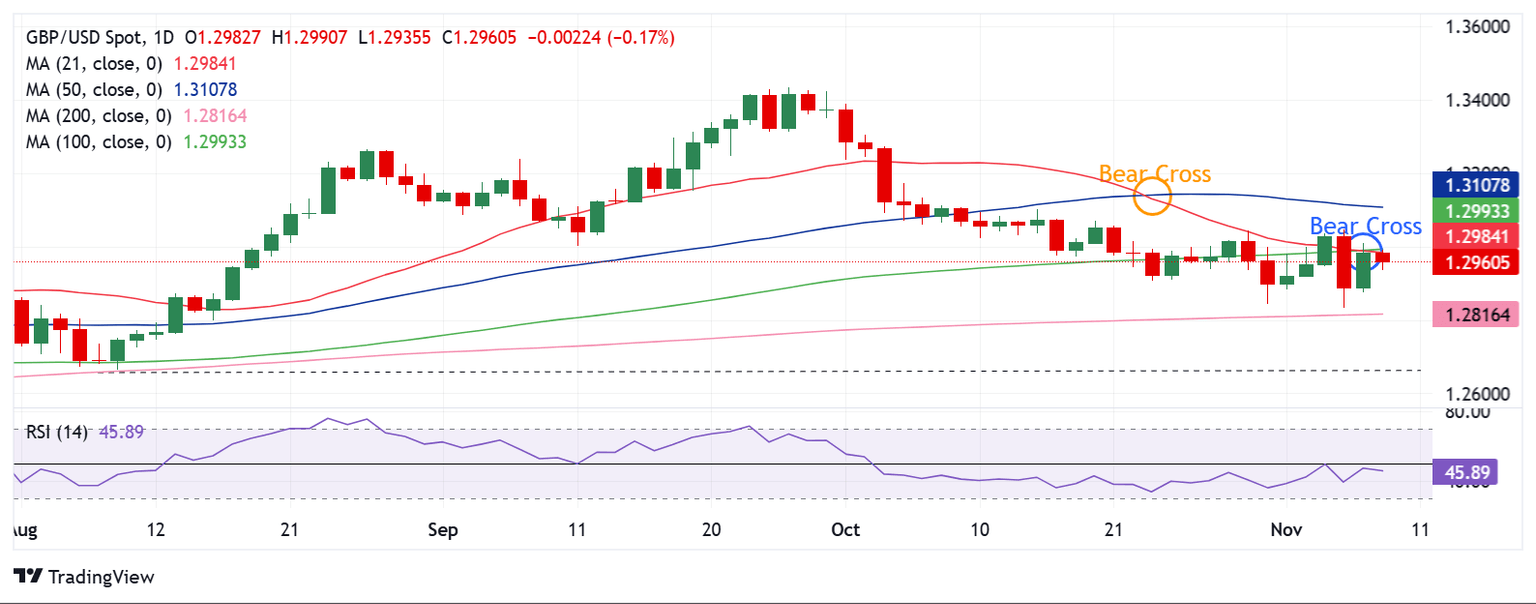

The daily technical setup for the GBP/USD pair indicates that sellers are not yet ready to give up, despite the recovery attempt.

The 200-day Simple Moving Average (SMA) at 1.2816 continued to guard the downside but the double Bear Crosses and a bearish 14-day Relative Strength Index (RSI) remained a looming threat for buyers heading into a new week. The RSI indicator holds slightly below the 50 level.

The 21-day SMA crossed the 50-day SMA from above on a daily closing basis on October 23, Meanwhile, the 21-day SMA and 100-day SMA bearish crossover occurred on Thursday, adding credence to the downside potential.

Therefore, a daily candlestick closing below the 200-day SMA at 1.2816 is critical to initiating a fresh downtrend for the Pound Sterling.

The next bearish target is seen at the 1.2750 psychological barrier, below which a test of the August 8 low of 1.2665 cannot be ruled out.

On the flip side, a sustained recovery is possible only on a firm break above the confluence of the 21-day SMA and the 100-day SMA near the 1.2990 region.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.