- The Pound Sterling hit a new 2024 top above 1.2950 against the US Dollar.

- GBP/USD looks to UK inflation and jobs data for a fresh leg higher.

- The daily technical setup continues to favor Pound Sterling buyers.

The Pound Sterling (GBP) extended its two-week uptrend against the US Dollar (USD), as the GBP/USD pair clinched fresh 2024 highs.

Pound Sterling cheers Fed-BoE policy divergence

The monetary policy divergence between the US Federal Reserve (Fed) and the Bank of England (BoE) came to the fore in the past week and remained the underlying theme, driving the GBP/USD price action.

A September interest rate cut by the Fed emerged as a done deal and slammed the US Dollar to a five-week low against its major currency rivals, as the US Treasury bond yields resumed their downtrend. The Greenback saw broad weakness throughout the week on dovish Fed expectations, barring Tuesday when it briefly came up for air, following round one of Fed Chairman Jerome Powell’s congressional testimony.

Though Powell sounded prudent on the policy outlook, during his testimony on Tuesday, saying that inflation had been improving in recent months and that "more good data would strengthen" the case for the rate cut. The US Dollar upswing was temporary, as his words failed to temper rate cut expectations for September. Markets continued pricing in over a 70% probability that the Fed will lower rates in September, according to the CME Group's FedWatch Tool, following his comments. Another rate cut in December is also on the table.

The selling interest around the Greenback was reinforced after the June US Consumer Price Index (CPI) data was released on Thursday. The US CPI climbed 3.0% YoY in June, slowing from a 3.3% increase in May and below the 3.1% expected print. Meanwhile, the annual core CPI inflation dipped to 3.3% in the same period, against the market consensus of 3.4%. On a monthly basis, CPI fell 0.1% while core CPI rose 0.1%. Both readings fell short of expectations.

In the aftermath of the dismal US inflation data, bets for a September Fed rate cut spiked to above 90%, compared to a 74% chance seen pre-CPI release. The GBP/USD pair extended its upward trajectory and refreshed 2024 highs at 1.2949.

The pair’s bullish momentum could also be attributed to the renewed demand for the Pound Sterling, courtesy of the encouraging UK growth numbers and the pushback against the timing of the BoE’s first rate cut since the COVID pandemic hit the world in 2020.

Data released by the Office for National Statistics showed on Thursday, the UK economy grew by 0.4% in May, above the 0.2% monthly expansion estimated, having stagnated in April.

Meanwhile, BoE Chief Economist Huw Pill dampened expectations of an August interest rate cut on Wednesday. Pill said, "I think it's still an open question on whether the timing for a rate cut is now," adding that services inflation and wage growth showed "uncomfortable strength" despite headline inflation falling to the BoE's 2% target in May.

Money markets priced in a 50% chance of 25 basis points (bps) cut to the Bank Rate on Aug. 1 after Pill's comments, down from 62% seen on Tuesday.

On Friday, the data from the US showed that the Producer Price Index (PPI) rose 2.6% on a yearly basis in June, up from the 2.4% increase recorded in May. This reading came in above the market expectation of 2.3% but failed to trigger a meaningful recovery in the USD ahead of the weekend.

Week ahead: UK CPI inflation to hog the limelight

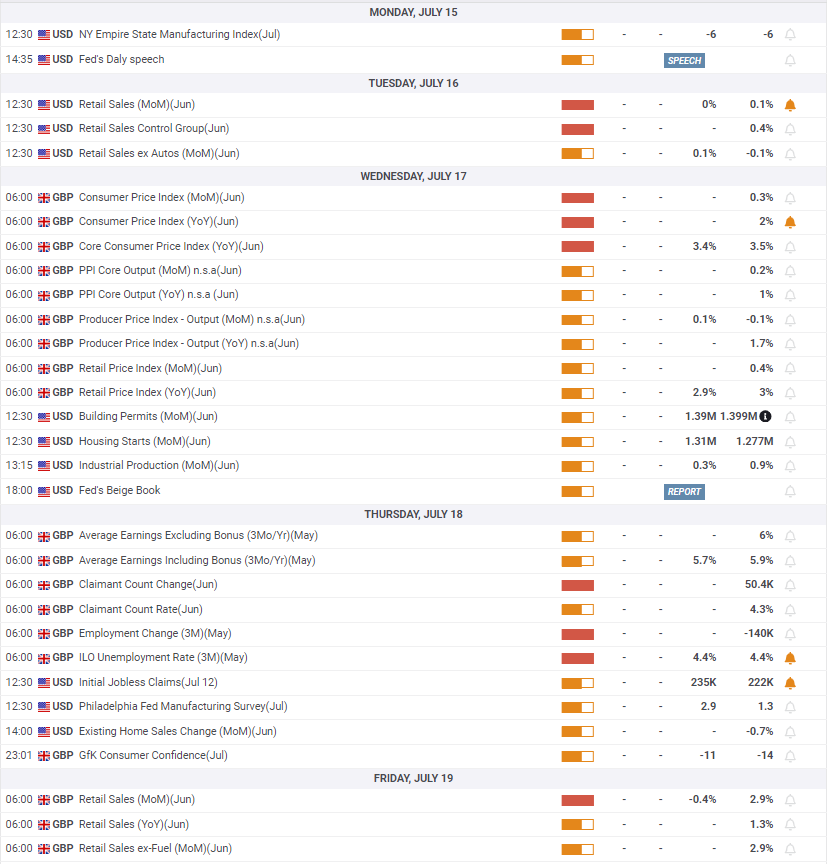

Following a US events-centric week, Pound Sterling traders eagerly look forward to the top-tier economic data releases from the UK, with the inflation data likely to hog the spotlight on Wednesday.

In the early part of the week, however, the UK docket is relatively light, and therefore, the focus will be on Fed Chair Jerome Powell’s appearance at the Economic Club of Washington DC, especially after the previous week’s key CPI data.

Traders will also look forward to China’s second-quarter GDP report, which could set the tone for markets at the start of the week.

The US Retail Sales data for June will feature on Tuesday but is unlikely to have any big market reaction, barring any major deviation from the consensus. Next of note will be Wednesday’s UK CPI figures, followed by mid-tier US housing and industrial data.

On Thursday, the UK labor market report will see an unusual release before the weekly Jobless Claims data from the US. The European Central Bank (ECB) will also announce its monetary policy decision later in the day, which could have a EUR/GBP cross-driven ‘rub-off’ effect on the British Pound.

UK Retail Sales report and speeches from a bunch of Fed policymakers will fill up Friday’s docket, wrapping up a mediocre week.

Apart from the economic statistics, traders will continue to analyze the speeches from the Fed policymakers and their implications on the path forward on interest rates.

GBP/USD: Technical Outlook

Pound Sterling looks like a ‘buy-dips’ trade in the week ahead, as the GBP/USD daily chart portrays.

The 14-day Relative Strength Index (RSI) prods the overbought region, suggesting that there is more room for the upside.

However, if GBP/USD extends the pullback from 2024 highs, Thursday’s low of 1.2848 could be tested.

A sustained move below the latter will challenge the bullish commitments at the previous key resistance near 1.2800.

Further south, the confluence support zone at around 1.2715 will be on sellers’ radars. The 21-day Simple Moving Average (SMA) and the 50-day SMA are looking to converge around that level.

On the upside, daily closing above the year-to-date highs of 1.2949 is needed to initiate a meaningful uptrend toward the 1.3000 psychological level, where the July 27 2023 high aligns.

The last line of defense for sellers is seen at around 1.3050 static resistance.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.