- GBP/USD hit a 14-month high above the 1.2800 level, as the US Dollar extended losses.

- Weak United States economic data outweighed Fed’s hawkish pause.

- GBP/USD has limited room to rise ahead of key top-tier US and UK events.

GBP/USD recorded a hat trick – three straight weekly gains, hitting its highest level in fourteen months. Pound Sterling bulls flexed their muscles amid an extended US Dollar pullback that came despite the US Federal Reserve (Fed) hawkish pause. With the Fed meeting out of the way, UK inflation data, Fed Chair Jerome Powell’s testimony and policy announcements from the Bank of England (BoE) will drive GBP/USD’s price action in the week ahead.

GBP/USD: What happened last week?

The pair moves were all about the US Dollar dynamics in the past week. Traders eagerly awaited the United States Consumer Price Index (CPI) data and a pause in the Federal Reserve interest-rate hiking cycle, which was fully baked in following the recent series of dismal US economic data. In the lead-up to these events, the US Dollar showed some signs of life, sending GBP/USD below the 1.2500 level at the start of the week. However, soft US CPI data triggered a sharp sell-off in the US Dollar across the board, although losses were capped by rebounding US Treasury bond yields.

The Bureau of Labor Statistics (BLS) reported the United States Consumer Price Index on Tuesday, which increased just 0.1% in May on month, bringing the annual inflation level down sharply to 4.0% from 4.9% in April. Meanwhile, the Core CPI rose 0.4% on the month and was still up 5.3% from a year ago, meeting the consensus forecasts for both the on-month and the on-year readings. The core figures remained sticky, but overall data suggested that the US Federal Reserve could skip a rate hike in June and at the same time keep expectations of further tightening alive and kicking.

Fed’s hawkish pause on Wednesday saved the day for the US Dollar bulls. The Greenback continued to find demand at lower levels, which limited the upside in the GBP/USD pair at 1.2700. The Federal Reserve maintained the Fed funds rate at 5.0%-5.25%, bringing a halt to its interest-rate hiking cycle for the first time since early 2022. However, the Fed’s Statement of Economic Projections, the so-called Dot Plot chart, portrayed a hawkish picture as it reflected the possibility of two more rate increases ahead by the end of the year. The hawkish Dot Plot helped stage an impressive rebound in the US Dollar along with US Treasury bond yields across the curve.

However, this bullish momentum around the US Dollar remained short-lived as sellers returned with a bang following the release of concerning United States economic data releases on Thursday. The US Dollar sell-off drove the GBP/USD pair to the highest level since April last year, testing the 1.2800 round level. Initial Jobless Claims were unchanged at 262K in the week ending June 9, higher than expectations of 249K. US Retail Sales rose 0.3% in May on month, beating the 0.1% decline expected, suggesting resiliency in consumer spending, the main driver of US economic growth. However, an unexpected 0.2% drop in US Industrial Production spelt doom for the US currency.

The resurgent US Dollar supply was also driven by the EUR/USD rally following the hawkish European Central Bank (ECB) 25 basis points (bps) rate hike. The ECB’s upward revisions to inflation projections combined with President Christine Lagarde’s comments about more tightening ahead while dismissing any expectations of a rate pause were viewed as hawkish. Meanwhile, investors also opted for profit-taking on their US longs after the Fed-inspired rebound.

On the UK side of the story, the Pound Sterling drew support from a strong UK labor market report even though the Gross Domestic Product (GDP) and Industrial Production data failed to impress. The UK Unemployment Rate unexpectedly dropped to 3.8% in the three months to April. The Claimant Count Change for Britain, a measure of unemployment, declined by 13.6K in May while Average Earnings excluding bonuses rose 7.2% in the three months to April YoY, higher than the 6.9% increase expected. Meanwhile, the British economy grew 0.2% in April, matching expectations and following a 0.3% contraction in March. Manufacturing output shrank 0.3% MoM in April, sharper than the 0.2% decline expected and swinging from a 0.7% expansion seen in March. Total industrial output contracted0.3% MoM, worse than the 0.1% expected decline and also swinging from a 0.7% increase a month earlier.

In the American session on Friday, the University of Michigan reported that the Consumer Confidence improved to 63.9 in June's flash estimate from 59.2 in May. This data failed to trigger a noticeable market reaction, allowing GBP/USD to consolidate its gains heading into the weekend.

Big three events ahead: UK CPI, Powell and BoE

There is no breather for GBP/USD traders following a blockbuster Fed week. A slew of high-impact economic events is due on the cards from both sides of the Atlantic in the week ahead.

Although it’s a holiday-shortened week, with the United States markets closed on Monday in observance of Juneteenth, the post-Fed market adjustments across the FX board are likely to extend ahead of Wednesday’s key event risks.

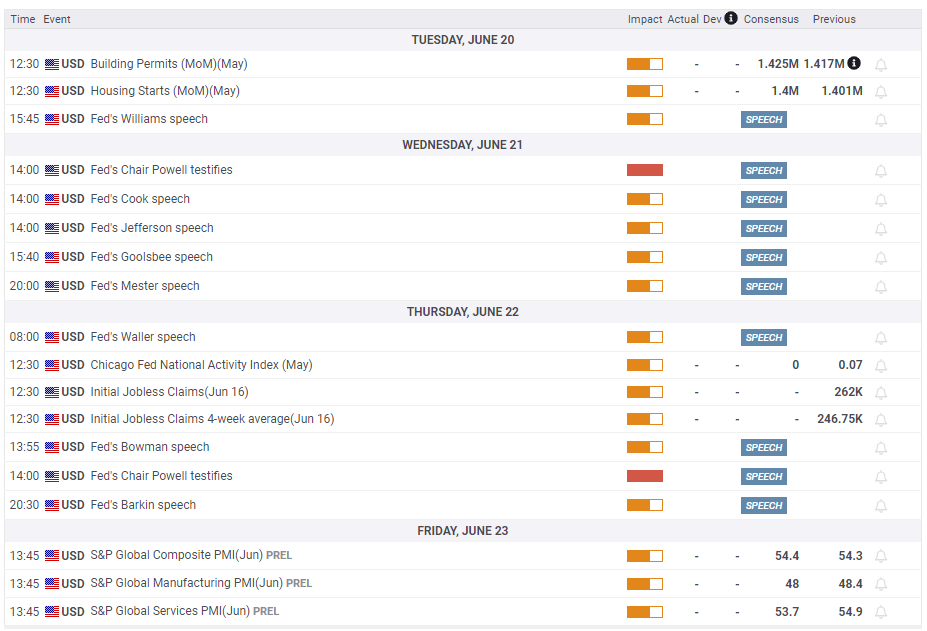

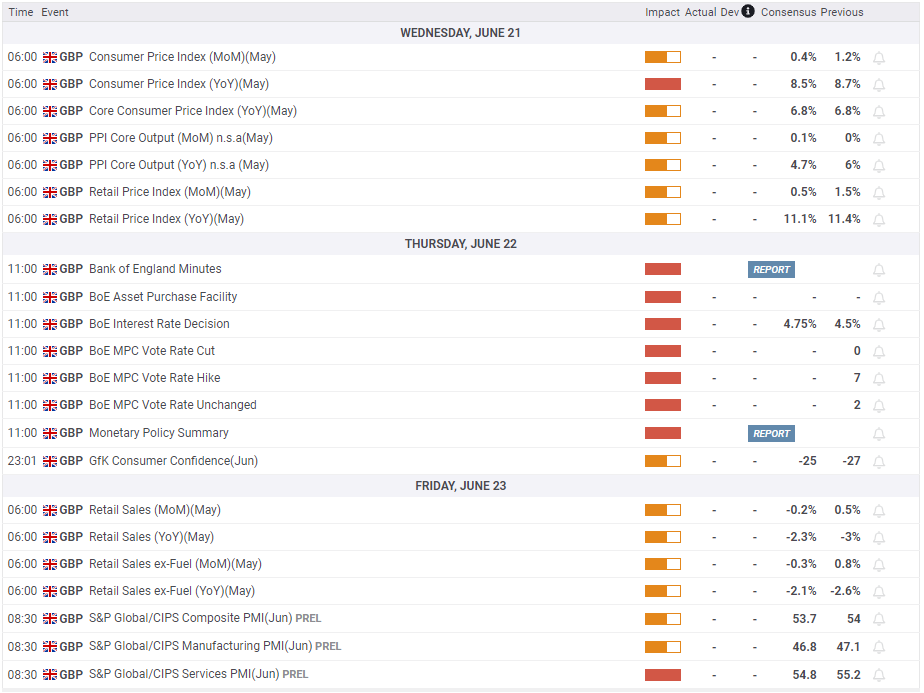

The first two trading days of the week are relatively quiet data-wise, except for the United States Housing Starts and Building Permits data on Tuesday. Wednesday will feature the United Kingdom Consumer Price Index (CPI) inflation data, which dropped to 8.7% YoY in April. The inflation report could throw fresh light on the BoE policy outlook.

From the US docket, Fed Chair Jerome Powell’s testimony will stand out on Wednesday. Powell will testify about the Semi-Annual Monetary Policy Report before the House Financial Services Committee.

The Bank of England will likely announce a 25 bps rate hike, as widely expected, on Thursday. However, the central bank’s outlook on interest rates will be key for the Pound Sterling. It’s not a ‘Super Thursday’, therefore, there will be no press conference from BoE Governor Andrew Bailey.

Later in the day, the US weekly Jobless Claims, Current Account and Existing Home Sales data will be reported. Also, Powell will testify about Semi-Annual Monetary Policy Report before the Senate Banking Committee on Thursday.

Friday will be a busy day as Preliminary Manufacturing and Services PMIs will be reported from both the UK and the US. Retail Sales data will also drop in the UK calendar. Apart from the economic data and events, speeches from Fed policymakers will be closely eyed for fresh hints on the central bank’s rate hike outlook.

GBP/USD: Technical outlook

As observed on the daily candlesticks, GBP/USD’s symmetrical triangle breakout remained in play and powered bulls to take on the 1.2800 hurdle.

In doing so, Pound Sterling buyers cleared all the major resistance levels and also achieved the triangle target measured at 1.2799.

It remains to be seen if Cable can extend its bullish momentum in the upcoming week, as the 14-day Relative Strength Index (RSI) is peeping into the overbought territory.

However, GBP/USD could have some additional room to the upside, challenging the next critical resistance at around the 1.2870 level on acceptance above the 1.2800 level.

Adding credence to a potential leg higher, the 21-daily moving average (DMA) is on the verge of cutting the 50-DMA from below, which if materialized will confirm a Bull Cross.

Any retracement in the major from higher levels will meet initial support at the May 10 high of 1.2680, below which the 1.2600 mark will be tested.

If the correction gathers strength, then GBP/USD sellers could challenge the previous key resistance now turned support near 1.2545.

Further south, the confluence of the 21- and 50-DMAs at 1.2491 will emerge as the next powerful support.

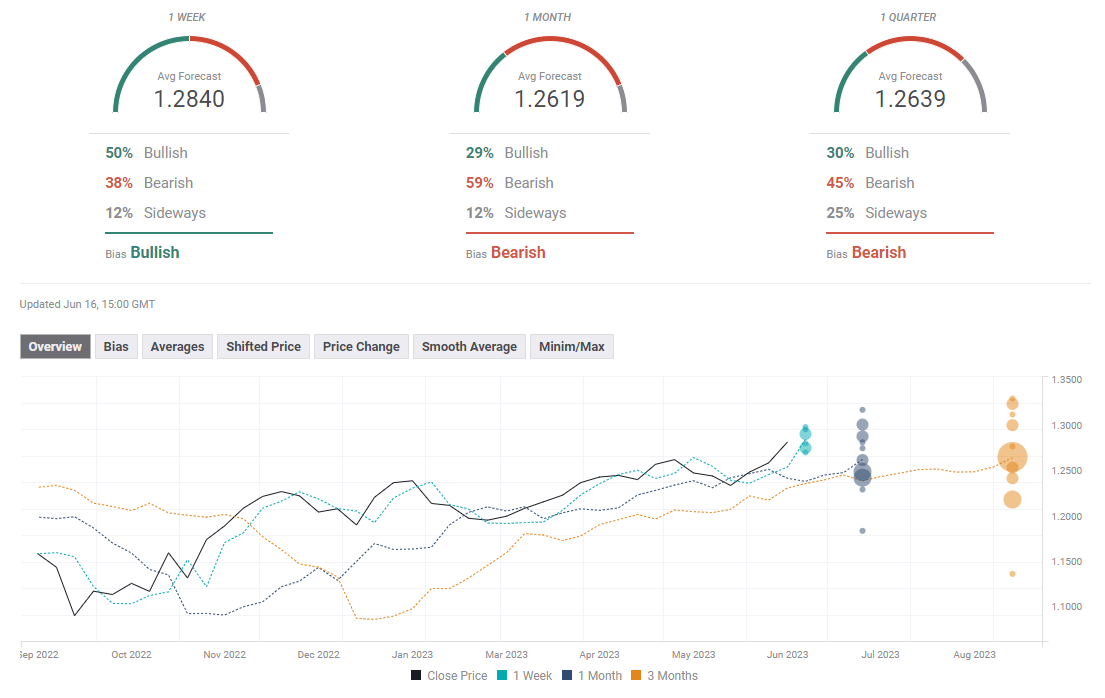

GBP/USD: Forecast poll

FXStreet Forecast Poll highlights a slightly bullish bias in the near term with the one-week average target aligning near mid-1.2800s. The one-month outlook, however, remains overwhelmingly bearish with a large portion of polled experts expecting the pair to decline at least to 1.2500 in that time frame.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0400 as mood sours

EUR/USD loses its traction and retreats to the 1.0400 area in the second half of the day on Monday. The negative shift seen in risk mood, as reflected by Wall Street's bearish opening, supports the US Dollar and makes it difficult for the pair to hold its ground.

GBP/USD drops below 1.2600 on renewed USD strength

GBP/USD turns south and drops toward 1.2550 after reaching a 10-day-high above 1.2600 earlier in the day. In the absence of high-tier macroeconomic data releases, the US Dollar benefits from the souring risk mood and weighs on the pair.

Gold holds steady above $2,600 following previous week's choppy action

Gold fluctuates in a tight range above $2,600 in the American session on Monday. The benchmark 10-year US Treasury bond yield is down more than 1% on the day, helping XAU/USD find support despite the renewed US Dollar (USD) strength.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.